A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

For us, lower timeframe confirmation starts on the M15 and finishes up on the H1, since most of our higher timeframe areas begin with the H4. Stops usually placed 5-10 pips beyond your confirming structures.

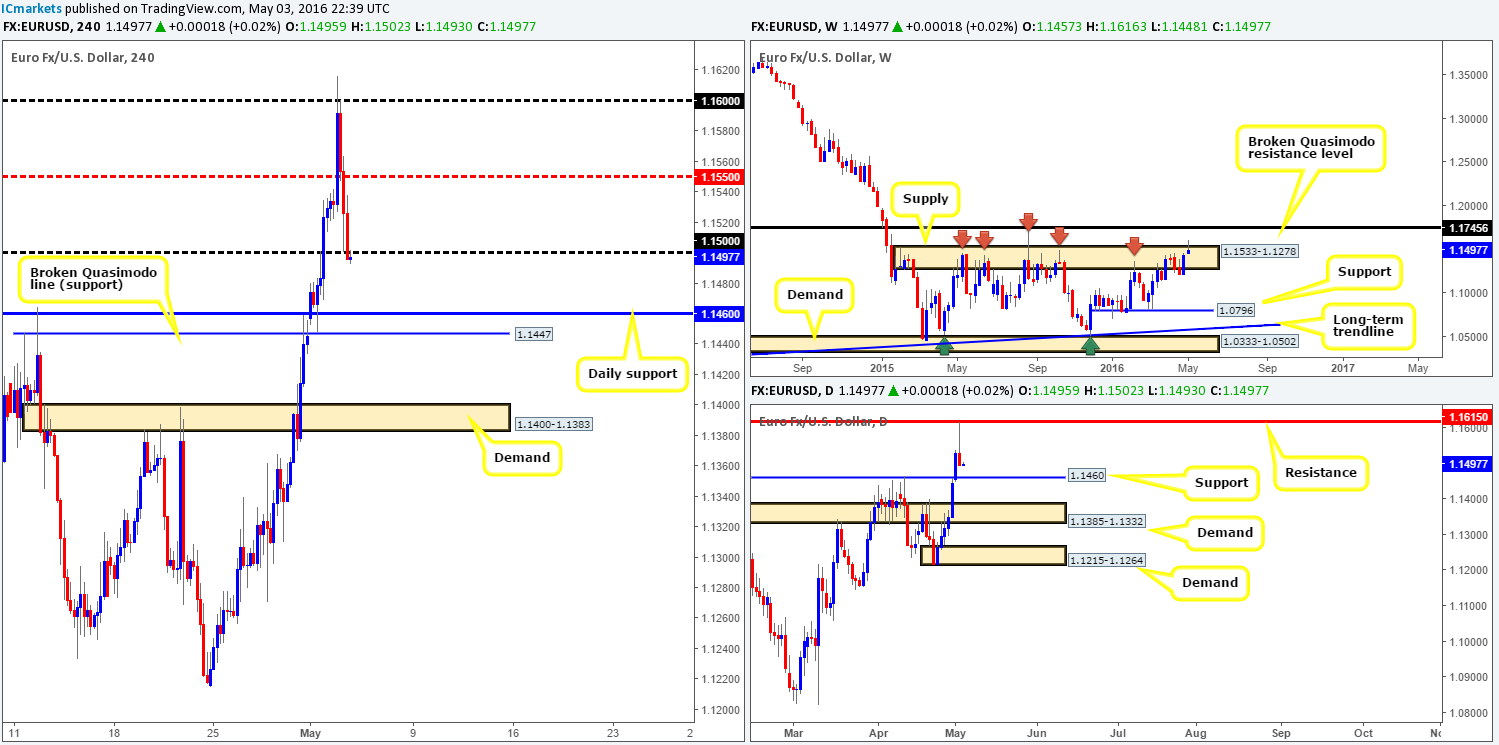

EUR/USD:

Using a top/down approach this morning, we can see that weekly action whipsawed through the top-side of a major area of supply seen at 1.1533-1.1278 yesterday. One could, as we have done in the past, now say that this zone is not on solid footing. However, let’s be mindful to the fact that price has already whipsawed through this zone once before back in late Aug 2015 at 1.1714, which followed through with a beautiful sell-off.

Casting our lines down into the daily chart, nevertheless, it’s clear to see that the EUR collided with daily resistance at 1.1615 during yesterday’s trading. An almost to-the-pip reaction from here forced this pair to chalk up a rather aggressive selling wick, which closed the day on its lows (1.1495) just ahead of daily support drawn from 1.1460. Anyone getting the feeling the EUR wants a little lower today?!?!

Stepping across to the H4 chart, yesterday’s decline from the 1.1600 handle took out the H4 mid-way support 1.1550, and ended the day closing just below the 1.1500 line. What is also shown is that if the sellers can hold this market below this number, we could possibly see a decline in value down to the daily support mentioned above at 1.1460, followed closely by a H4 broken Quasimodo support line at 1.1447. To that end, there is a relatively clear forty-pip void to sell into today!

On account of the above, today’s objective entails watching for price to retest 1.1500 as resistance together with a lower timeframe confirming signal. If this comes to fruition, we’ll take 70% of our position off the table around the 1.1460 region and reduce risk to breakeven. The remaining 30% will be left in the market to run since there is a possibility (due to where price is positioned on the weekly chart – see above) that price could continue to drop down to H4 demand at 1.1400-1.1383, which sits on top of a daily demand coming in at 1.1385-1.1332.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.1500 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

GBP/USD:

During the course of yesterday’s sessions Cable made a quick run to highs of 1.4769 going into London trading, before dropping like a rock for the remainder of the day! Sparked by lower-than-expected U.K. manufacturing data, price declined around 140 pips (open/close), which ended with the unit closing just below H4 mid-way support 1.4550.

From the weekly chart, a sell-off should not have really come as much of a surprise considering that the market is currently trading around a weekly broken Quasimodo resistance line at 1.4633 (BQRL). What this also did, if one looks down to the daily chart, was form a beautiful-looking daily bearish engulfing candle. According to this timeframe, however, support is sitting nearby at 1.1447, which can be seen as demand on the H4 chart at 1.4514-1.4475.

The distance from the current H4 mid-way resistance 1.4550 to the top-side of the H4 demand is, as you can probably guess, a mere 35 pips! With the higher-timeframe position (see above) in mind, nevertheless, a short on any retest of 1.4550 will very likely achieve its neighboring H4 demand. Therefore, if one manages to pin down a lower timeframe setup around 1.4550 today with a small enough stop, a short from this region is worthwhile in our opinion. Furthermore, in the event that price breaks below the oncoming H4 demand zone, the path could potentially be free down to the 1.4400 support, which is essentially the top-side of daily demand seen below the aforementioned daily support at 1.4514-1.4475. Good luck!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.4550 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

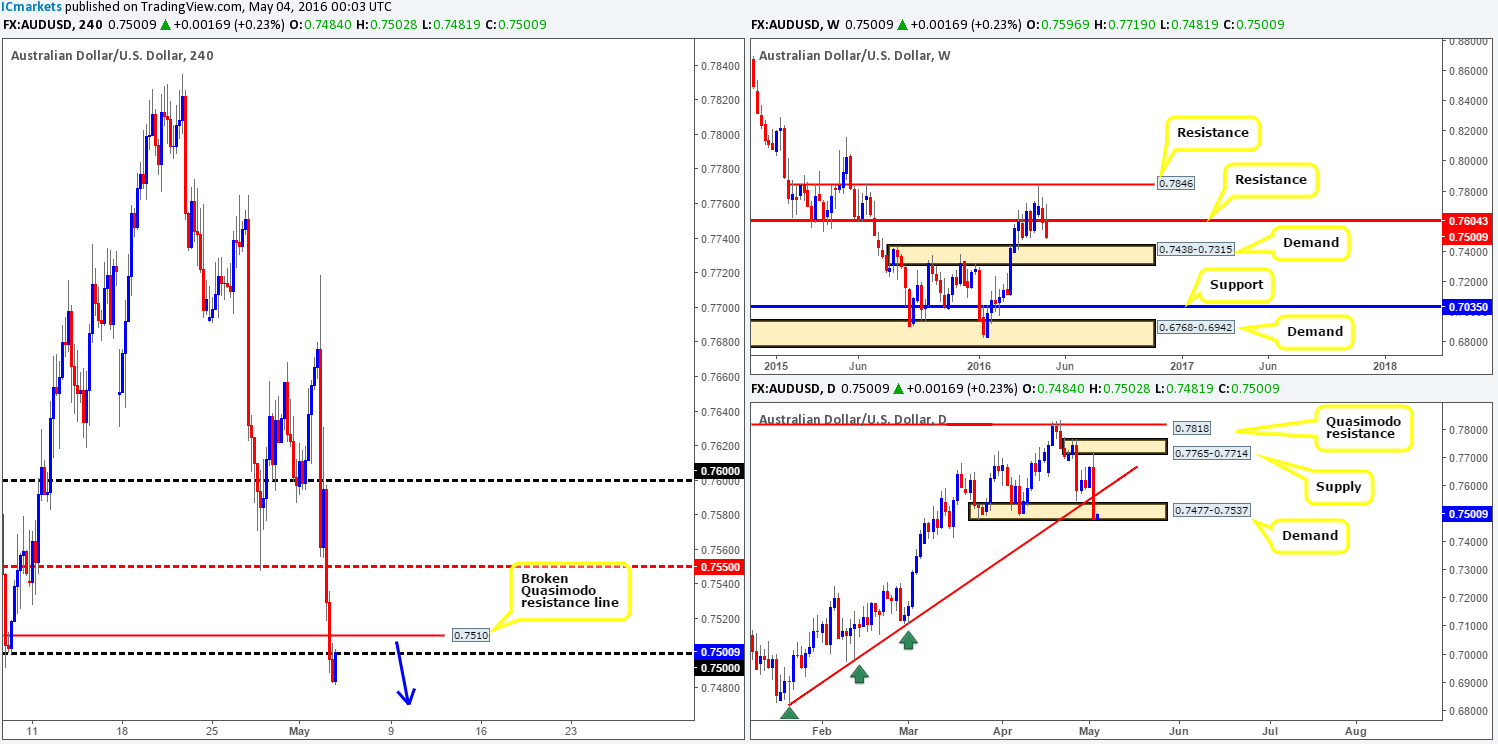

AUD/USD:

It was certainly not a good day for anyone long this currency yesterday! The Aussie dollar aggressively drove lower after the Reserve Bank of Australia cut its interest rates to 1.75%, losing over 180 pips on the day (open/close). As can be seen from the H4 chart, several technical supports were taken out during this bearish onslaught. The one that catches our eye though is the H4 broken Quasimodo support at 0.7510 (now acting resistance). Assuming that price retests the underside of this barrier today and holds; do we look for shorts, or expect a break higher?

To answer this let’s take a look at the bigger picture. Over on the weekly chart, support at 0.7604 was taken out yesterday (now acting resistance) which may have opened the door to further downside towards weekly demand coming in at 0.7438-0.7315. Down on the daily chart, however, the commodity currency wiped out daily trendline support (0.6827) and slam dunked itself into the extremes of daily demand at 0.7477-0.7537.

In answer to the above question in bold, we feel price has a better chance of finding resistance around the H4 broken Quasimodo perimeter today, due to both what the weekly picture is telling us (see above) and that it’s also located nearby the 0.7500 handle. In addition to this, the downside target from here falls in at 0.7437 – a H4 Quasimodo support that fuses with the top-side of weekly demand at 0.7438.

Taking a short trade from the 0.7500 region today would, at least for us, require lower timeframe confirmation. This could be in the form of an engulf of demand and subsequent retest as supply, a break/retest of a trendline or simply a collection of selling wicks around a lower-timeframe resistance.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7500 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

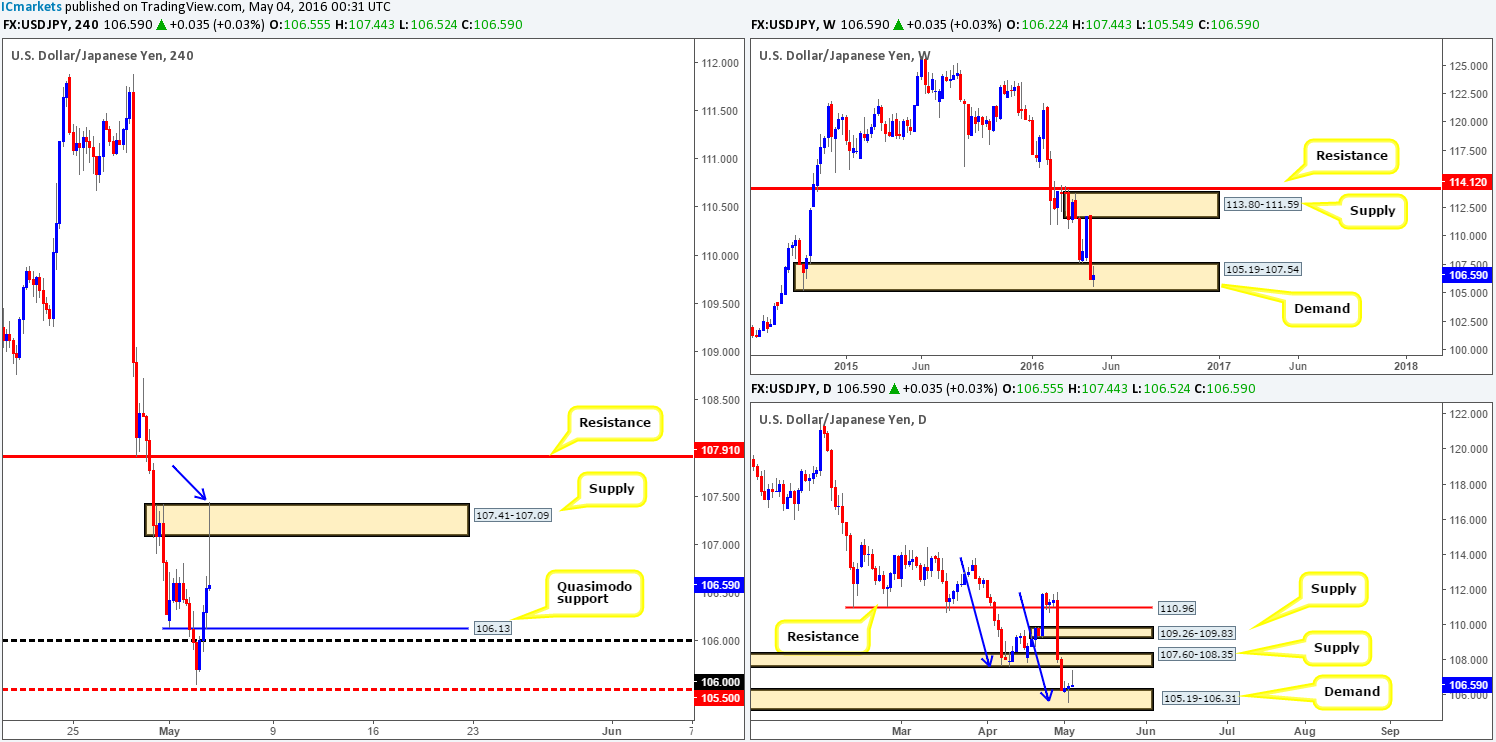

USD/JPY:

Kicking-off this morning’s report with a look at the weekly chart, we can see that the buyers and sellers remain battling for position within weekly demand coming in at 105.19-107.54. On the assumption that the buyers defend this zone there’s potential for a rally back up to weekly supply drawn from 113.80-111.59.

Yesterday’s session on the daily chart printed a beautiful-looking buying tail from within the confines of a daily demand base at 105.19-106.31 (positioned within the extremes of the aforementioned weekly demand). Recent action this morning, nevertheless, saw price aggressively spike north, just missing the underside of daily supply at 107.60-108.35 by around fifteen pips.

Stepping across to the H4 chart, Tuesday’s trading saw price come within a few pips of connecting with H4 mid-way support 105.50 before advancing north. To our way of seeing things at the moment, we feel this pair wants higher prices. The break above H4 supply at 107.41-107.09 (blue arrow) may have consumed enough stops to allow the unit to reach H4 resistance at 107.19 (positioned within daily supply mentioned above at 107.60-108.35). With that, and the higher-timeframe picture in mind (see above), the H4 Quasimodo support line at 106.13 together with the 106.00 support handle could provide a nice platform in which to buy from today. Of course, it is down to the individual trader if he/she wants to enter from here at market or wait for some sort of confirmation signal. We would much prefer waiting for some strength to form on the lower timeframes before risking capital (for confirmation techniques, please see the top of this report), as price could drop lower to shake hands with H4 mid-way support 105.50 region again before rallying higher.

Levels to watch/live orders:

- Buys: 106.00/106.13 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

USD/CAD:

With Oil finding H4 resistance on Friday at 46.76, it was not until yesterday did we see the USD/CAD rally, and rally it did! From 1.2500 the Loonie advanced over 200 pips, surpassing 1.2700 and reaching highs of 1.2731 on the day. In light of this recent movement, what direction do we see this pair heading today? Well, with Oil now approaching H4 demand at 42.48-43.07, and the USD/CAD trading just ahead of H4 resistance coming in at 1.2743, this market could sell-off today. In support of this, we also see that daily action is currently trading within the jaws of daily supply chalked up at 1.2653-1.2753. The only downside to a short trade from the H4 resistance 1.2743 is that the first take-profit level sits very close at 1.2700. Moreover, there is also a chance that this H4 line could be ignored owing to price targeting weekly resistance located just above at 1.2833.

Due to the above, we will only be taking a short from 1.2743 today if and only if there is some sort of lower timeframe sell signal seen around this barrier (for confirmation techniques, please see the top of this report). Furthermore, do keep a close eye on the weekly resistance level mentioned above at 1.2833, as between here and the 1.2900 daily resistance (broken Quasimodo barrier), this area looks incredibly strong for a reversal!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.2743 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area). 1.2900/1.2833. Keep an eye on this area as a reversal from here is high probability.

USD/CHF:

Starting from the top this morning, weekly sellers recently attempted to push below weekly support at 0.9508. As you can see though, this attack failed as price quickly bottomed out around the 0.9443 mark, forcing the Swissy to trade back above the aforementioned support line. Looking down to the daily chart, we can see that yesterday’s whipsaw action pushed through a daily support area at 0.9512-0.9464 and formed a very nice-looking buying tail, which will no doubt excite a lot of candlestick traders. From this angle, however, there is limited upside potential with daily supply lurking just above at 0.9584-0.9640. Over on the H4 chart, the Swissy is now seen nibbling at the underside of H4 mid-way resistance 0.9550. Given the higher-timeframe picture (see above) this line will not likely be able to suppress buying pressure for long. Beyond this level, we see a H4 supply zone coming in at 0.9584-0.9600.

With all three timeframes in view, our approach to this market today will be as follows:

- Watch for price to break above and retest the H4 mid-way resistance line 0.9550 as support.

- Hunt for a lower timeframe entry long following a successful retest (for confirmation techniques, please see the top of this report).

- Target the underside of H4 supply at 0.9584 as a first take-profit zone and reduce risk to breakeven.

- In the event that price engulfs this zone, trail the action up to H4 resistance at 0.9652 and liquidate a further 25% of your position.

- From there on, the ultimate target would be the underside of daily supply seen at 0.9755.

Levels to watch/live orders:

- Buys: Watch for price to close above 0.9550 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

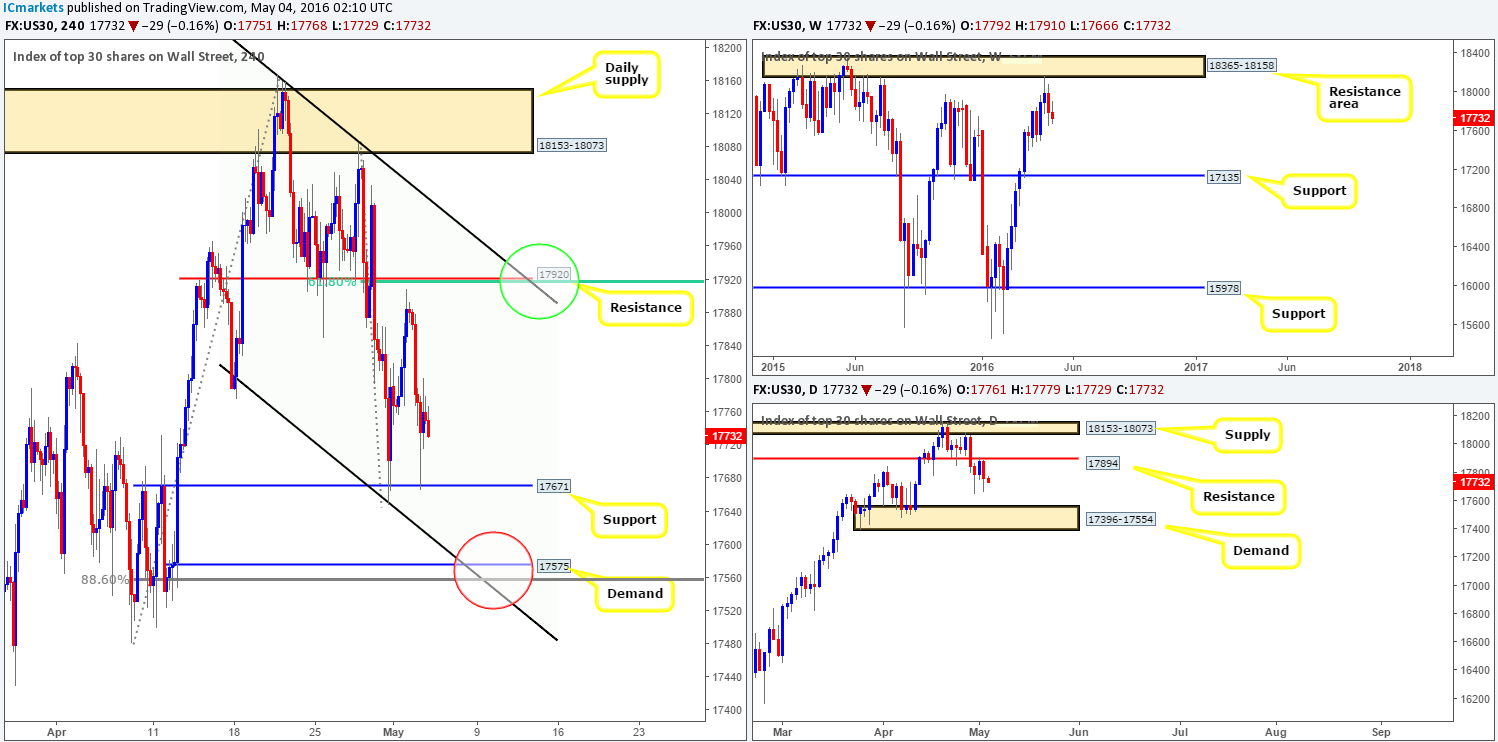

DOW 30:

In recent sessions, U.S. stocks declined in value allowing price to test H4 support chalked in at 17671. The rebound from here was quite strong considering that weekly action is trading from a resistance area at 18365-18158, and daily price is currently teasing resistance from 17894.

As of now, we have two points of interest. The first comes in at a H4 resistance drawn from 17920 (green circle). This level offers H4 channel resistance extended from the high 18167 as well as a 61.8% Fibonacci resistance level at 17916. The second can be seen lower down on the curve at H4 support carved from 17575 (red circle), which also boasts H4 channel support extended from the 17790 region, together with a deep 88.6% Fibonacci support band at 17557.

In our book, both of the above said levels are high-probability reversal zones. Nevertheless, the upper H4 resistance is strong enough to condone a trade without confirmation. The lower, however, will require confirmation. Our reasoning lies within the higher-timeframe structure. The upper H4 resistance has the backing of weekly flow as well as daily resistance (see above). The lower H4 support on the other hand only has the daily demand at 17396-17554 in its corner.

Levels to watch/live orders:

- Buys: 17575 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 17920 [Pending order] (Stop loss: should be placed above the H4 descending channel limit).

GOLD:

In view of weekly support seen around the 92.621 region on the U.S. dollar index, and weekly supply on Gold beginning to show some life at 1307.4-1280.0, the yellow metal may continue to weaken from here. Before we all start clicking the sell button, however, both daily support at 1283.4, as well as the H4 broken Quasimodo support at 1279.7 have been brought into play. Therefore, even with the weekly chart suggesting selling to be the more favorable approach right now, it is too risky considering lower-timeframe structure.

In light of the above points, the more logical path to this market today might be to wait for a H4 close below the current H4 support at 1279.7 This would likely achieve two things. Firstly, it could set the stage for a continuation move down to H4 support at 1269.6 which sits just within daily demand at 1270.8-1257.5 (seen below daily support at 1283.4). Secondly, a short trade could materialize should price retest the underside of the recently broken H4 support as resistance, together with a lower timeframe confirmation signal (optional – for confirmation techniques, please see the top of this report).

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to close below 1279.7 and look to trade any retest seen thereafter (lower timeframe confirmation required).