Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

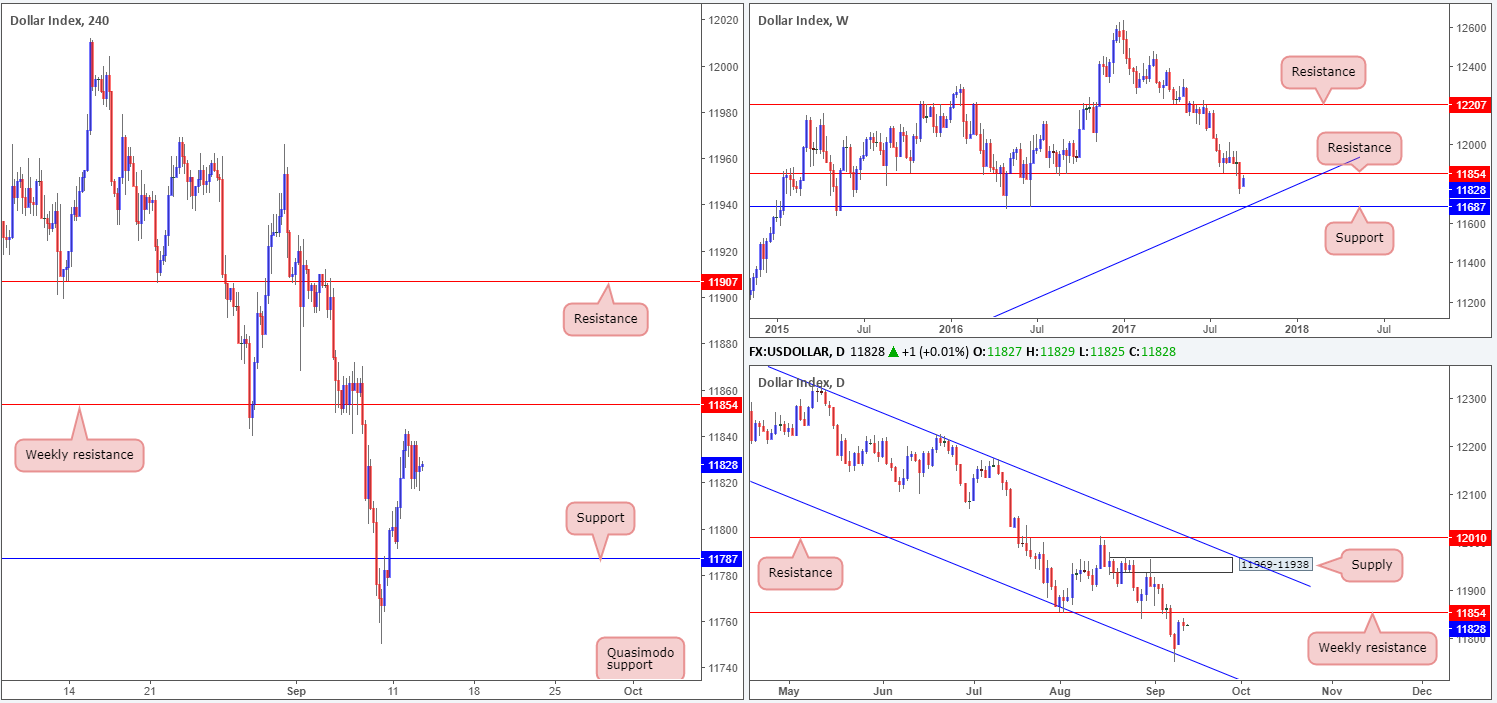

US dollar index (USDX):

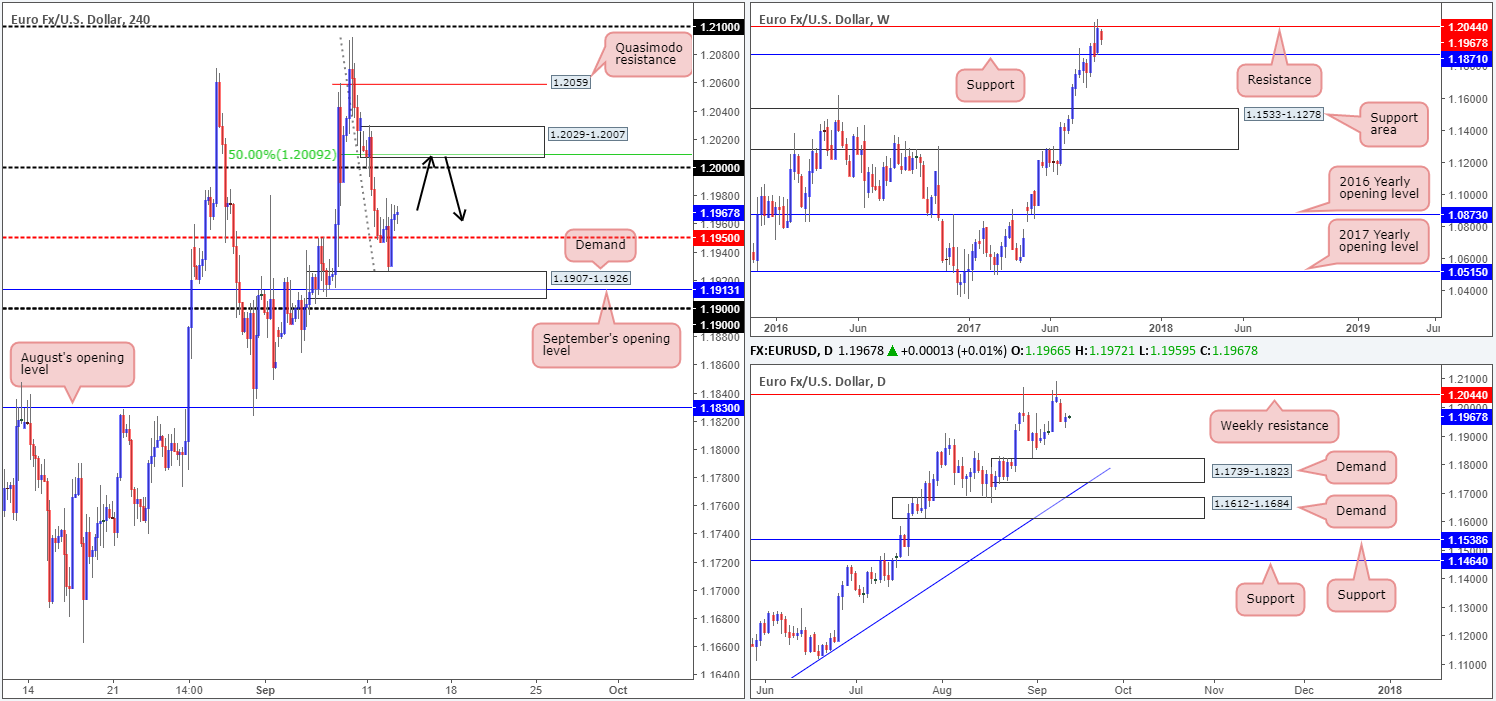

EUR/USD:

Following a breakdown through the H4 mid-level support at 1.1950, the single currency lost steam on Tuesday as price managed to find a fresh pocket of bids just ahead of H4 demand at 1.1907-1.1926. This saw the unit springboard itself back above 1.1950 to a high of 1.1973 on the day.

Looking at the weekly chart, we can clearly see that since the beginning of 2017 the EUR has been trading with a reasonably strong bias to the upside. Over the past few weeks, nevertheless, the pair finds itself tackling a resistance level pegged at 1.2044. Seeing as how weekly movement over on the USDX chart (see above) is also seen trading nearby a resistance at 11854, this may eventually translate into a dollar selloff and a bid EUR. Still, should the unit continue to decline from current price, the next support target in the firing range can be seen at 1.1871, followed closely by daily demand plotted at 1.1739-1.1823.

Suggestions: Although H4 price looks poised to extend north to shake hands with the key 1.20 level, we are wary of buying at this time given weekly selling from resistance at 1.2044. Instead, we have our beady little eye on the 1.20 region for shorts. Yes, this would mean selling against the grain, but seeing that we have a H4 supply lodged just above 1.20 at 1.2029-1.2007, coupled with a 50.0% retracement value at 1.2009 drawn from the high 1.2092, this is a relatively high-probability trade, in our humble opinion.

A pending order has been set at 1.2005, with a stop-loss order positioned at 1.2031 (will only be removed in the event of a high-impacting news event). The first area of concern, should the trade move into favor, is 1.1950, shadowed closely by the aforesaid H4 demand.

Data points to consider: US PPI data m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2005 ([pending order] stop loss: 1.2031).

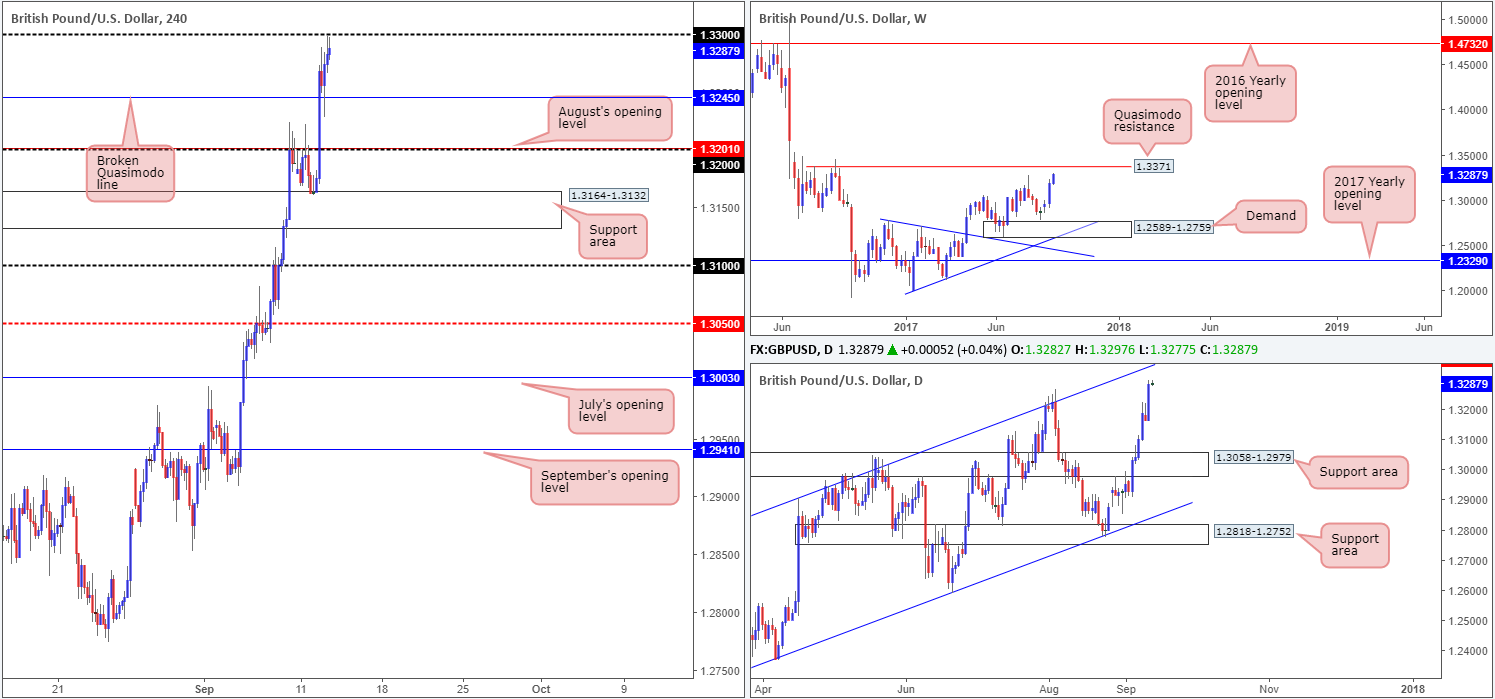

GBP/USD:

UK inflation data came in hotter than expected on Tuesday, sparking another wave of buying. Price ran through offers at the H4 Quasimodo resistance level plotted from 1.3245, and ended the day extending to a high of 1.3299. With the 1.33 handle lurking within touching distance at the moment, could this number be enough to halt further buying today? Through the lens of a simple technical trader, this is very unlikely. Why? Well, over on the daily timeframe, we have a reasonably clear run north up to a channel resistance extended from the high 1.2903. Furthermore, a little higher up on the curve, weekly price appears poised to challenge a Quasimodo resistance at 1.3371.

Basically, there is little overhead resistance seen on the bigger picture right now.

Suggestions: With both weekly and daily price showing promise to the upside, taking a short on the basis of a round number on the H4 scale would not be something we’d label high probability.

Apart from the option of selling from 1.3371, one could, however, also look to buy up to this region AFTER a H4 close has been seen beyond 1.33. A retest of this number as support, followed up with a reasonably sized H4 bull candle, preferably in the shape of a full, or near-full-bodied candle, would be ideal.

Selling from 1.3371 on the other hand, given that it is a weekly level that converges with a daily channel resistance, would not require additional confirmation, in our view. Simply set a pending sell order at 1.3371, with a stop plotted above the Quasimodo apex high at 1.3447. Yes, it is a rather large stop, but let’s remember at that point we would be dealing with higher-timeframe structures and therefore targeting higher-timeframe structures.

Data points to consider: UK Employment figures at 9.30am. US PPI data m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Watch for price to engulf 1.33 and then look to trade any retest seen thereafter ([waiting for a H4 bull candle to form following the retest is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

AUD/USD:

For those who read Tuesday’s report you may recall that the desk took a short position at 0.8038 and placed a stop at 0.8060 (22 pips). This was a simple setup that allowed us to take partial profits at the key 0.80 level (38 pips), before price reversed and took out our breakeven stop. Well done to any of our readers who also benefitted from this intraday move.

Going forward, we can see that despite H4 price bouncing from 0.80, the commodity currency ended the segment printing another loss. This, in our book, is likely due to weekly price trading from resistance at 0.8075, which shows room to extend as far down as the support area pegged at 0.7849-0.7752.

Suggestions: In light of the weekly picture, 0.80 may come under attack again today. Only this time it may end with price sawing its way through this level and heading down to the H4 mid-level point at 0.7950, shadowed closely by September’s opening line at 0.7939. Why we believe H4 price could trade as low as the 0.7940 neighborhood is simply because there’s a high probability that H4 demand painted in yellow at 0.7965-0.7988 has already had its orders taken by the H4 tail seen marked with a black arrow at 0.7974.

Therefore, a decisive close below 0.80, coupled with a retest as resistance would, in our technical opinion, be sufficient enough to warrant an intraday short, targeting the 0.7950/40 neighborhood.

Data points to consider: US PPI data m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 0.80 and then look to trade any retest seen thereafter ([waiting for a H4 bearish candle to form following the retest – preferably in the shape of a full, or near full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

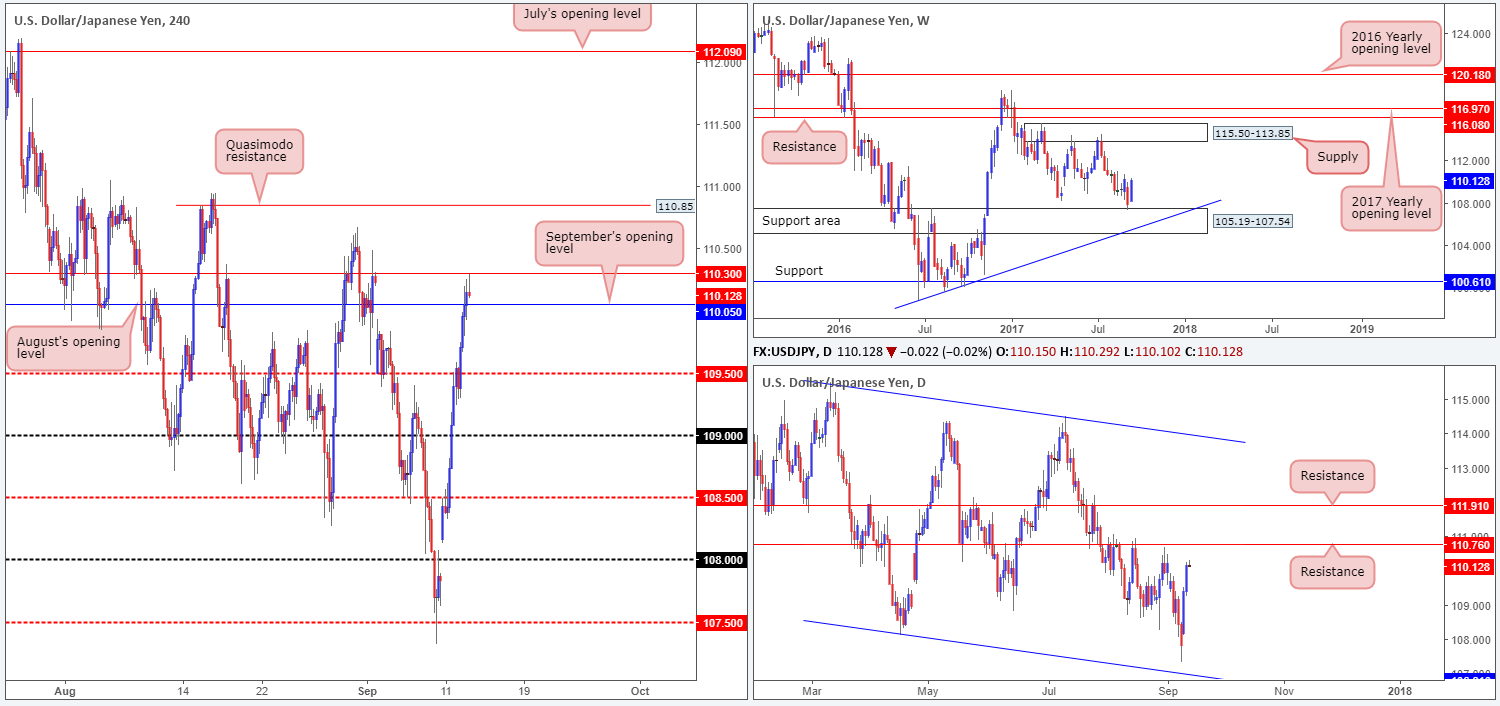

USD/JPY:

The USD/JPY, alongside US equities, continued to print recovery candles on Tuesday. This, according to our weekly drawings, should not really come as much of a surprise since the pair recently clashed with a support area penciled in at 105.19-107.54. In spite of this, the recent bull run may be tested today as daily price approaches a key resistance level sited at 110.76.

As you can see on the H4 timeframe, price concluded the session engulfing September’s opening line at 110.05 and challenged August’s opening level at 110.30, which, for now, is holding ground. Despite this, we are not keen sellers here. Both weekly and daily price show room to extend up to at least the 110.76 neighborhood, and also we have to take into account that directly below current price there sits September’s opening line which may very well act as support now.

Suggestions: Watch the H4 Quasimodo resistance at 110.85 for a potential sell trade. We like this level because it sits just above daily resistance at 110.76. However, in view of weekly bulls trading from a support area, additional candle confirmation would be required before a trade can be initiated from here. Should this trade come to realization, however, we would likely be looking to trail the position down to 110.30 as an initial take-profit zone.

Data points to consider: US PPI data m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 110.85 region ([waiting for a H4 bearish candle to form – preferably in the shape of a full, or near full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

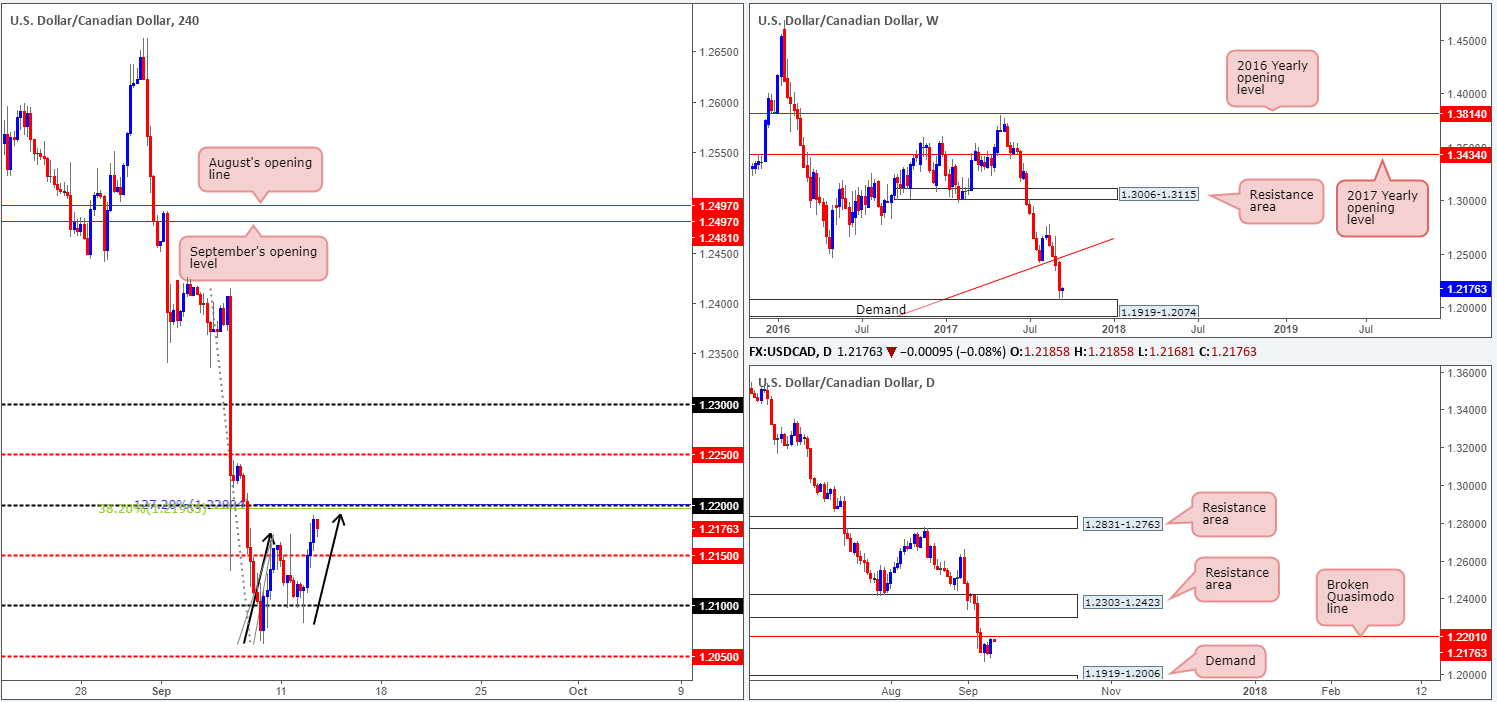

USD/CAD:

In recent activity, the US dollar pressed higher against its Canadian counterpart. Offers at the H4 mid-level resistance 1.2150 were consumed, allowing the unit to tap a high of 1.2189 into the closing bell. The important thing to consider here, however, is the H4 AB=CD bearish formation topping at 1.22 (H4 Fib ext. point at 127.2%), which boasts a H4 38.2% Fib resistance also at 1.22. This – coupled with a daily broken Quasimodo line at 1.2201, makes 1.22 a very interesting sell zone.

The only grumble we see is the fact that weekly price recently connected with demand printed at 1.1919-1.2074. While this is obviously a concern and could potentially damage a 1.22 sell, we remain biased to the downside due to the pair’s strong downtrend in play since May. In addition to this, we have a nearby weekly resistance plotted on the USDX weekly chart at 11854, which could help in pushing the dollar lower.

Suggestions: Despite weekly demand in play, we are going to sell 1.22 with a stop planted 20 pips above at 1.2220. Should this come to fruition before our EUR pending sell is triggered at 1.2005, we will cancel this order and focus on the CAD. The first area of interest, should the trade move into favor, is 1.2150.

Data points to consider: US PPI data m/m at 1.30pm. US Crude oil inventories at 3.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.22 (stop loss: 1.2220).

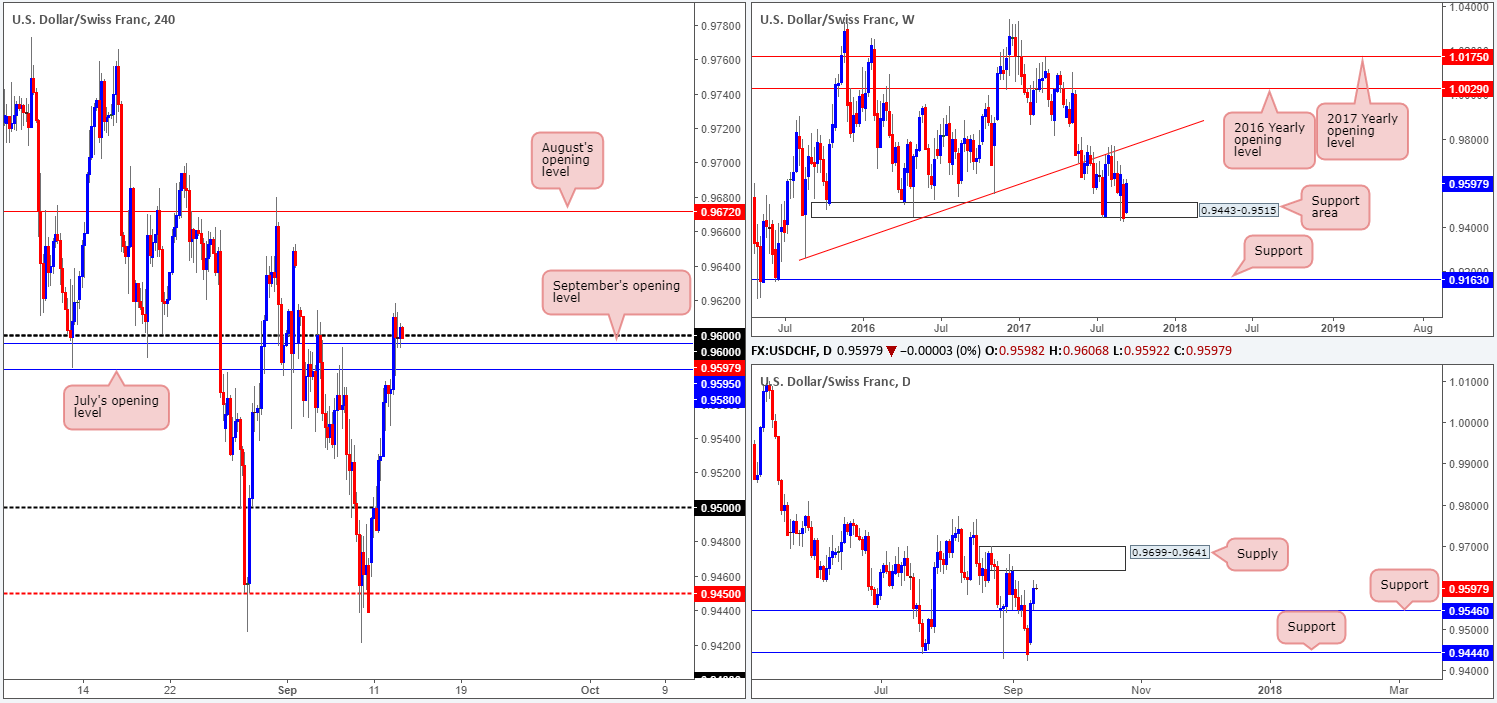

USD/CHF:

Another strong session for the USD/CHF yesterday dragged H4 price above both July and September’s opening levels at 0.9580/0.9595, as well as the 0.95 handle. Shortly after this, as you can see, the candles made a play to retest 0.96/0.9595 as support. Providing that the buyers create a floor here, the previous weekend gap will likely be filled with the possibility of price testing August’s opening level coming in at 0.9672.

From the weekly timeframe, bulls continue to reflect a bullish stance from the support area drawn in at 0.9443-0.9515. With daily resistance at 0.9546 (now acting support) out of the picture, traders likely have the daily supply at 0.9699-0.9641 in their crosshairs.

Suggestions: Traders who only focus on the H4 timeframe and below have very likely missed the nearing daily supply. So, while a long may look attractive according to the H4 scale, it is potentially quite dangerous from a daily perspective, since you really only have 40 pips (probably less once you factor in confirmation) of room to play with before possible sellers enter the equation.

Although longs could possibly work out beautifully from 0.95, our team has opted to remain on bench today and will look to reassess structure going into tomorrow’s open.

Data points to consider: US PPI data m/m at 1.30pm. CHF PPI m/m at 8.15am GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

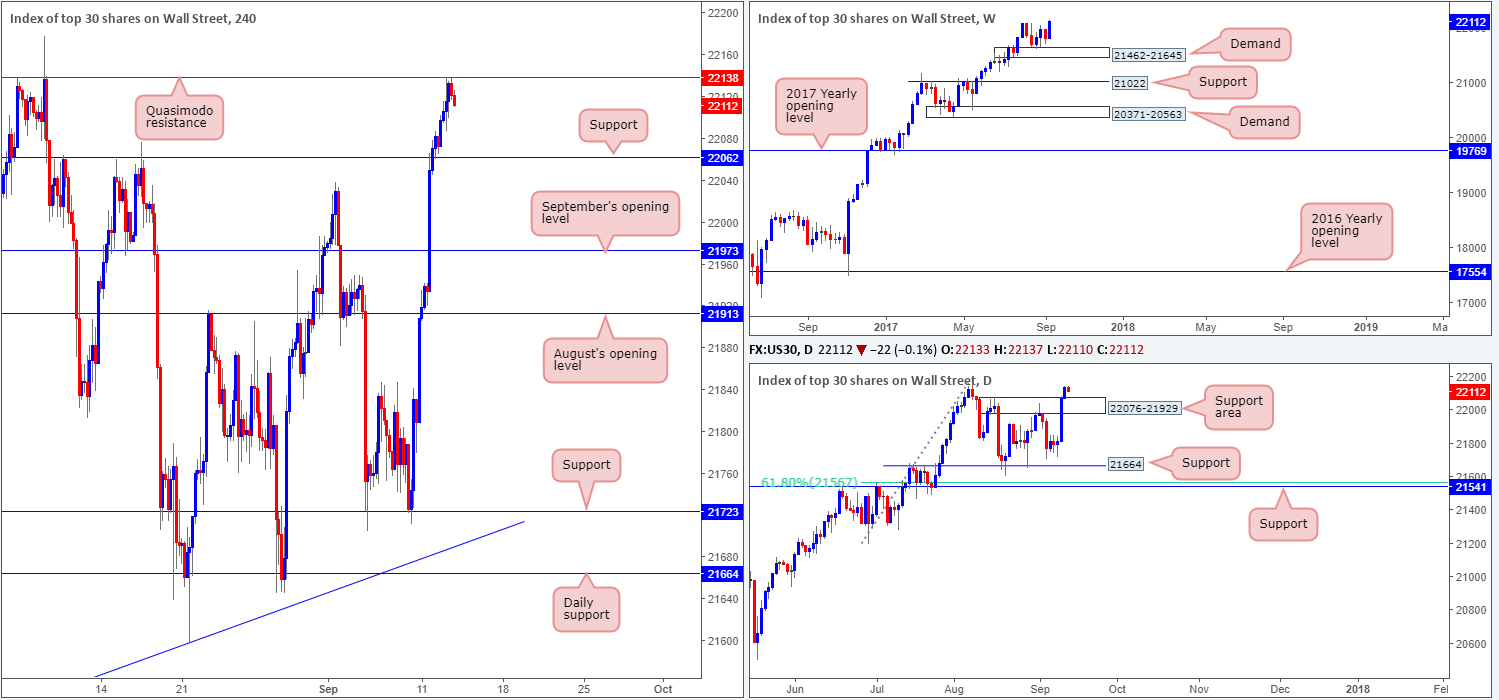

DOW 30:

US equities extended Monday’s advance yesterday, sealing a concrete break above daily supply at 22076-21929. What this recent push higher also accomplished was bringing the H4 candles up to a Quasimodo resistance linked at 22138. This, if you ask us, is the last remaining barrier of resistance stopping the index from achieving fresh record highs. Before the bulls muster enough strength to run through this area though, it is likely that a retest of the recently broken daily supply (now acting support area) will be seen (H4 support at 22062 also seen within).

Suggestions: Keeping it Simple Simon today, we see two possible scenarios on offer:

- In the event that H4 price closes above the current Quasimodo resistance, a retest of this level as support is a high-probability long trade given the lack of overhead higher-timeframe resistance in view.

- A selloff from the current Quasimodo resistance will, as mentioned above, likely end with price retesting the daily support area registered at 22076-21929. Should H4 candle action tap the support level at 22062 today and hold ground (preferably printing a full, or near-full-bodied candle), then this, in our opinion, is also another strong signal to buy, targeting 22138 as an initial take-profit level.

Data points to consider: US PPI data m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 22138 and then look to trade any retest seen thereafter ([waiting for a H4 bullish candle to form following the retest – preferably in the shape of a full, or near full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail). 22062 region ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

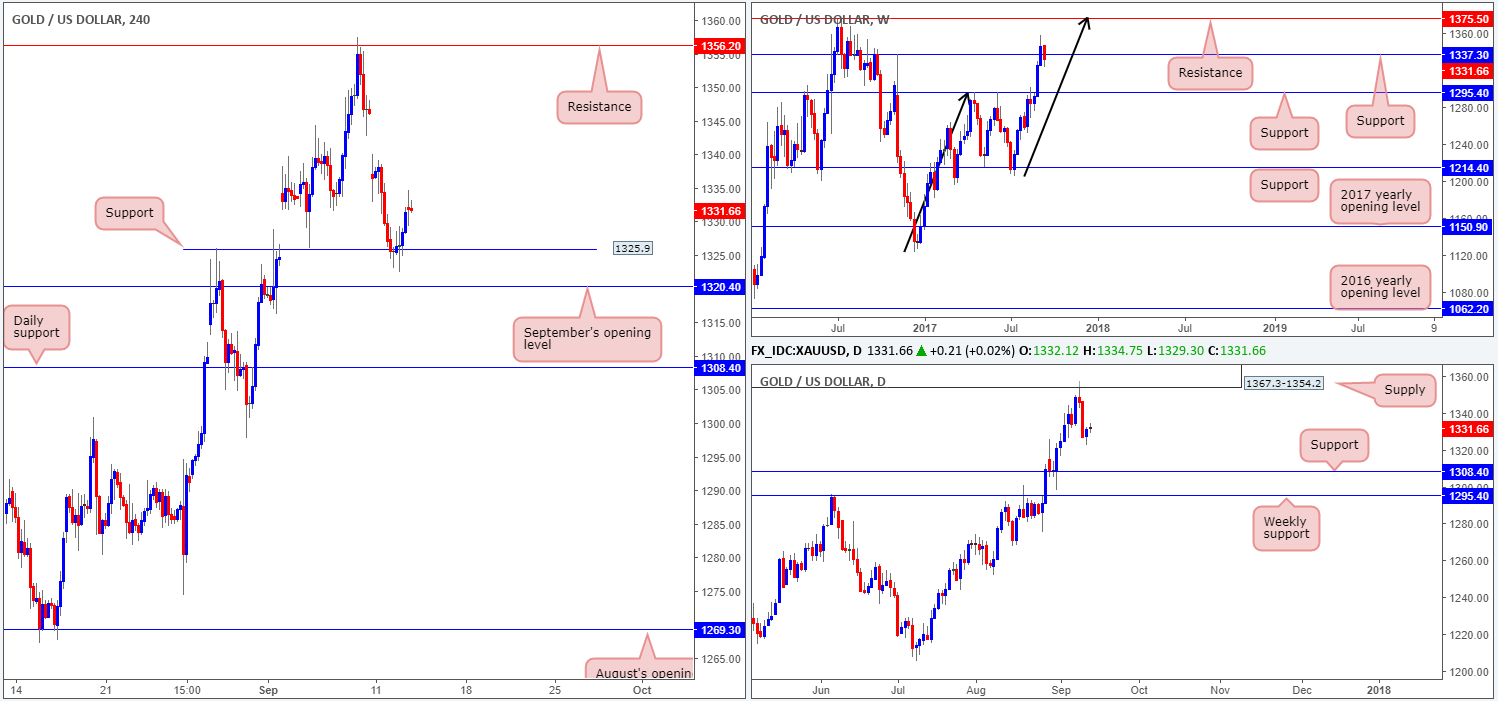

GOLD:

After a few earnest attempts from the sellers to push below H4 support at 1325.9 on Tuesday, the bulls finally took the wheel going into the US open and pushed north. Although price advanced to a high of 1332.1, it’s very difficult to judge how strong the buyers really are at the moment! We say this for few reasons. First, weekly price recently edged its way through support at 1337.3. Secondly, daily price shows room to stretch as far south as support lurking at 1308.4. This gives the pair a somewhat bearish tone. Bolstering the yellow metal from here, however, is weekly price on the USDX chart seen nearing resistance at 11854. As highlighted in Tuesday’s report, a dollar move up to this weekly level could see the dollar collapse and therefore push the yellow metal higher!

Suggestions: Right now, we’re not keen on this market since we clearly have conflicting signals in play right now, and feel it’s best to remain on the sidelines.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).