Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

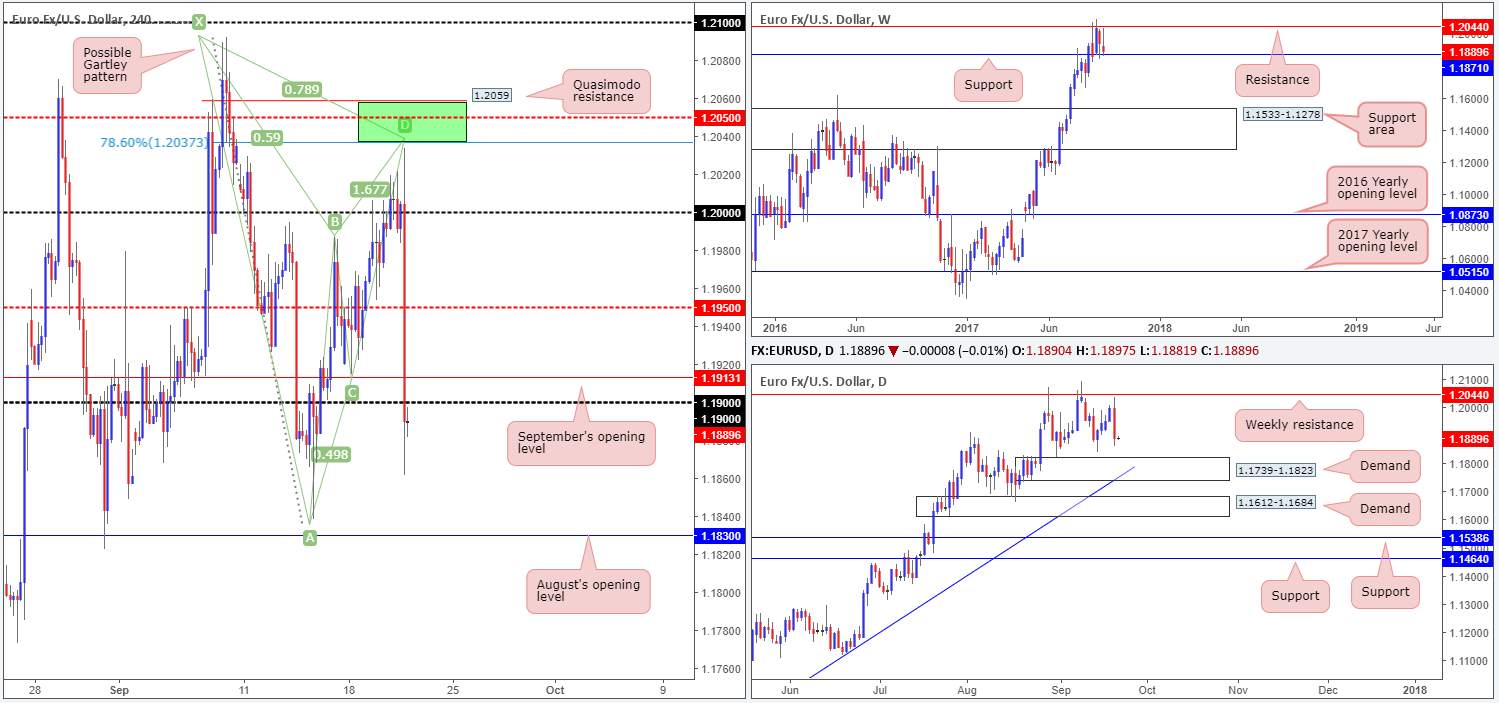

EUR/USD:

The aftermath of Wednesday’s FOMC meeting saw the single currency aggressively drive over 100 pips south. H4 price reached a high of 1.2034, falling 4 pips short of our green sell zone (comprised of a H4 Quasimodo resistance at 1.2059, a H4 mid-level resistance at 1.2050, a H4 Harmonic bearish Gartley pattern completion at 1.2038, weekly resistance at 1.2044), before pressing lower. Very frustrating indeed!

As you can see, yesterday’s move lower brought H4 candles below the 1.19 handle, which on this scale has potentially opened up the path south down to August’s opening level at 1.1830. Daily action now appears poised to challenge nearby demand marked at 1.1739-1.1823, and weekly flow is currently testing support fixed at 1.1871 (USDX weekly flow trading beneath resistance at 11854).

Suggestions: Although H4 looks good for a sell down to the 1.1830 region, this would entail selling into potential weekly buyers, which is not really something we would label a high-probability setup. And likewise, a long in this market, while in-line with the overall trend and corresponding with current weekly structure, faces potential opposition from 1.19, followed closely by September’s opening level at 1.1913.

A long on a H4 close back above the 1.1913 neighborhood would, in our opinion, be a safer approach. However, you’d need to pin down a reasonably tight setup beyond here as potential resistance lies just ahead at 1.1950.

Data points to consider: ECB President Draghi takes to the stage at 2.30pm. US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

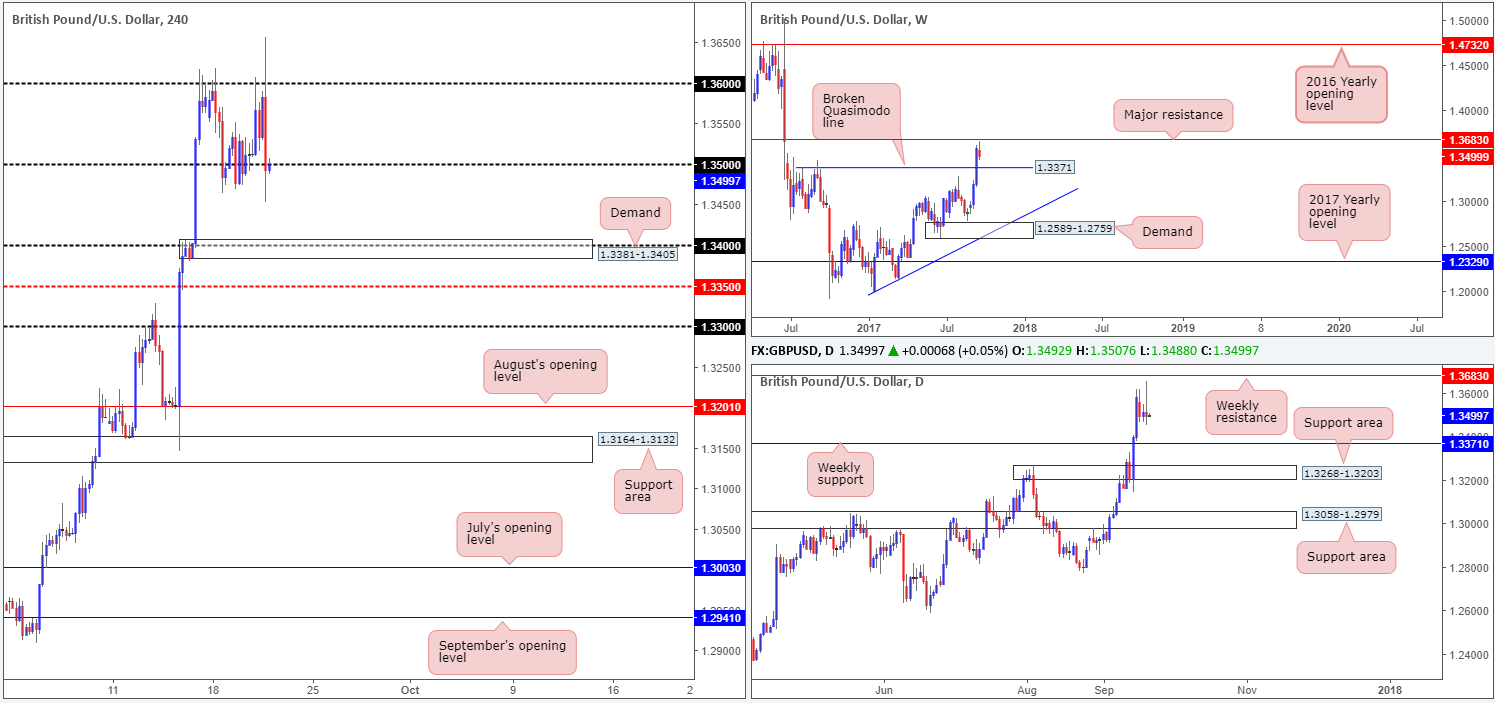

GBP/USD:

The British pound pushed higher against its US counterpart during London on Wednesday, but failed to muster enough strength to breach the 1.36 handle. Thanks to FOMC shenanigans, the pair put in a high of 1.3659 and drove marginally beyond the 1.35 mark going into the closing bell.

As is clear from the H4 chart this morning, price is currently retesting the underside of 1.35 as we write. Although weekly price failed to connect with resistance at 1.3683, yesterday’s move could be enough to encourage further selling today. Below 1.35, we see little stopping the unit from reaching the 1.34 boundary, which intersects with nice-looking H4 demand at 1.3381-1.3405 and sits just above a weekly broken Quasimodo level at 1.3371.

Suggestions: In view of the above notes, looking for short trades around 1.35 today could be an option (waiting for lower-timeframe confirmation is advised – see the top of the report). Should this come to fruition, we’d look to take full profits around 1.34 and likely switch over to longs given how close the aforesaid weekly support is located.

Data points to consider: US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.35 region ([waiting for a lower-timeframe sell signal to form is advised] stop loss: dependent on where one confirms this area).

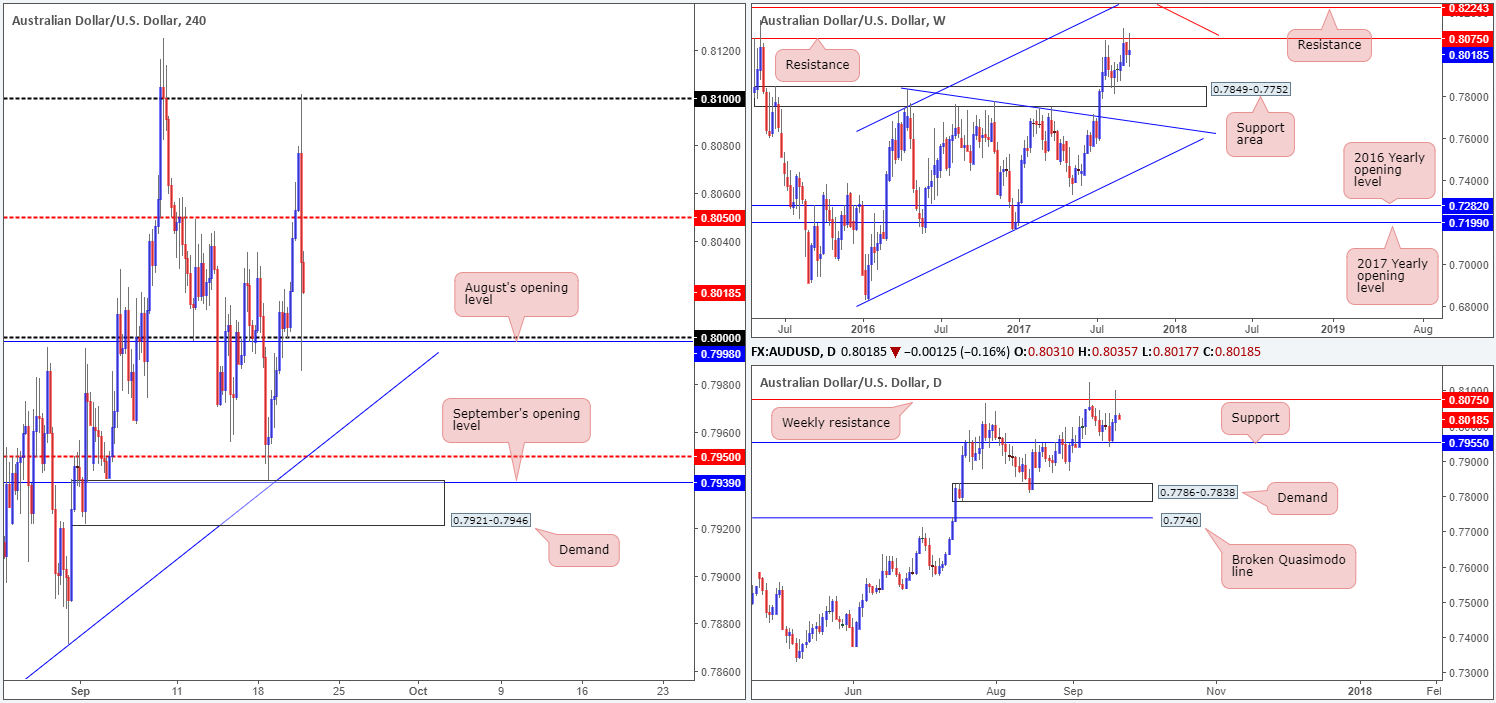

AUD/USD:

From the weekly timeframe this morning, price action shows that the commodity currency continues to reflect a bearish stance below resistance at 0.8075. Daily price on the other hand indicates that the unit has now entered into a phase of consolidation between the aforesaid weekly resistance barrier and a support level drawn from 0.7955.

Across on the H4 timeframe, the Aussie came under considerable pressure once it shook hands with the 0.80 boundary, following Wednesday’s FOMC meet. Post-Fed momentum, however, eased after connecting with the large psychological number 0.80, shadowed closely by August’s opening level at 0.7998.

Suggestions: Neither a long nor short seems attractive at this point. Yes, weekly price is trading beneath resistance, but with H4 bulls defending 0.80 it would be a dangerous sell right now, in our view. And clearly, trying to buy this market when weekly price is teasing resistance would be just as risky, even though the pair’s overall trend is facing north.

Data points to consider: RBA Gov. Lowe speaks at 6.10am. US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

USD/JPY:

Trade update: stopped out at breakeven.

Kicking this morning’s report off with a look at the weekly timeframe, we can clearly see the bulls look poised to challenge the supply area at 115.50-113.85. In conjunction with the weekly timeframe, daily action recently crossed above resistance coming in at 111.91 and shows little resistance stopping price from reaching trendline resistance extended from the high 115.50 (intersects with the aforementioned weekly supply area).

Leaving the 111 handle unchallenged, H4 price aggressively advanced north after yesterday’s FOMC meeting. The move, as you can see, took out offers from supply at 112.19-111.75, the 112 handle and July’s opening level at 112.09, consequently allowing price to cross paths with supply at 112.86-112.55.

Suggestions: With the dollar showing remarkable strength at the moment, and both weekly and daily timeframes offering little nearby resistance, a short from the H4 supply is not a trade we’ll be taking. A break above this area would, as far as we can see, immediately open up the door to 113, and another supply seen at 113.57-113.38 (not seen on the screen). So, although we’re expecting further upside in this market, buying beyond the current supply is somewhat restricted for the time being.

Data points to consider: BoJ interest-rate decision and policy statement (tentative); BoJ Press conference at 7.30am. US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

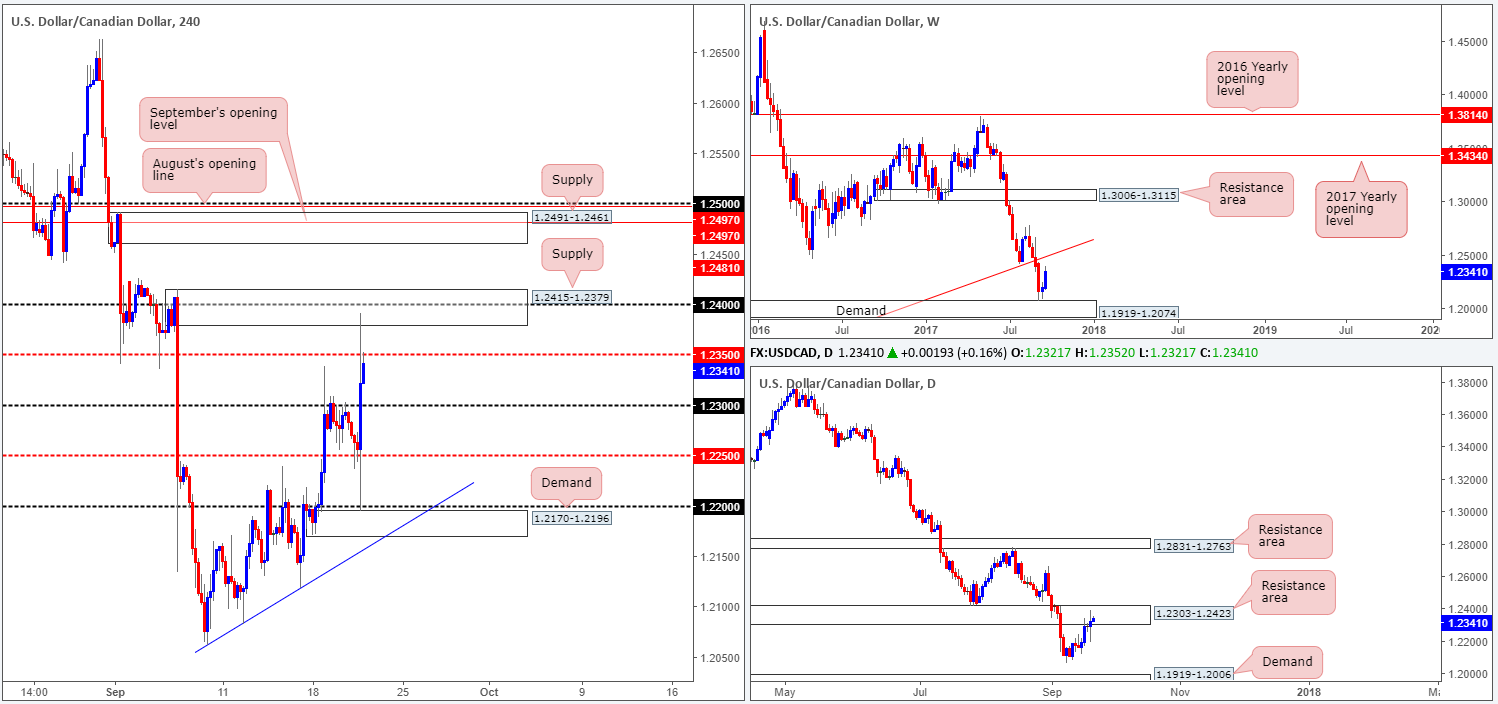

USD/CAD:

The USD/CAD pair rose sharply following Wednesday’s FOMC meet, consequently running through the 1.23 handle. It was only once H4 price whipsawed through mid-level resistance at 1.2350 and brought supply at 1.2415-1.2379 into the picture, nevertheless, did we see the unit pullback.

The noted H4 supply, as you can probably see, is positioned within the walls of a daily resistance area coming in at 1.2303-1.2423. Before we all get too excited and punch the sell button though, it might be worth noting that weekly price shows room to extend above the daily area to tap a long-term weekly trendline resistance extended from the low 0.9633.

Suggestions: Given the threat of further upside on the weekly scale, the team is reluctant to sell from current prices. An area we would be interested in selling, however, is the H4 supply seen at 1.2491-1.2461. Not only is it surrounded by both September/August’s opening levels at 1.2497/1.2481, as well as the 1.25 handle, it also intersects nicely with the noted weekly trendline resistance.

As H4 price could potentially fake above 1.2491-1.2461 to attack offers at 1.25, we would advise waiting for a reasonably sized H4 bear candle to take shape from here (preferably a full, or near-full-bodied candle), before pulling the trigger.

Data points to consider: US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2491-1.2461 area ([waiting for a reasonably sized H4 bearish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

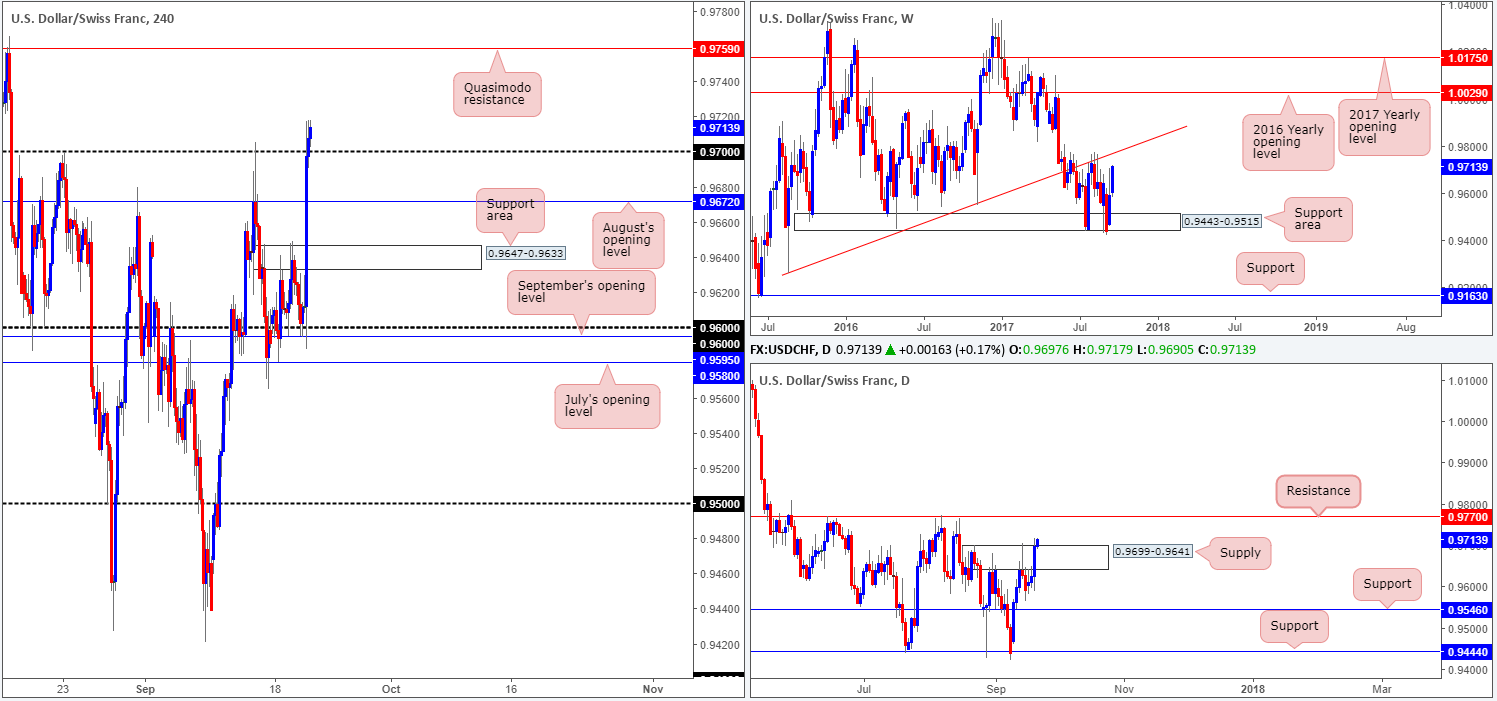

USD/CHF:

Basing our analysis from the weekly timeframe this morning, it is clear to see price closing in on the weekly trendline resistance taken from the low 0.9257 after a rather dominant push north from a support area at 0.9443-0.9515. Moving down to the daily timeframe, the unit is currently trading above supply at 0.9699-0.9641. The next upside target in view, should the bulls continue to push north, can be seen around a resistance level pegged at 0.9770 (intersects with the noted weekly trendline resistance).

A closer look at price action on the H4 timeframe shows the Swissy aggressively launched itself north after yesterday’s FOMC meet. The day ended with the unit closing above the 0.97 handle, which in turn has potentially opened up the runway north to a Quasimodo resistance at 0.9759.

Suggestions: Keeping it Simple Simon today, we see two possible scenarios playing out:

- A retest of 0.97 as support, followed by a reasonably sized H4 bull candle (preferably a full, or near-full-bodied candle). This could be good enough for a move up to the aforementioned H4 Quasimodo resistance line.

- Instead of trying to long a market which is so close to testing weekly/daily structures, you could simply wait for price to challenge the H4 Quasimodo resistance and look to sell. Positioned just 10 pips beneath daily resistance at 0.9770 and intersecting with a weekly trendline resistance this H4 level is, in our opinion, enough to warrant a sell without the need for additional confirmation.

Data points to consider: US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: 0.97 region ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: 0.9759 area (stop loss: 0.9776).

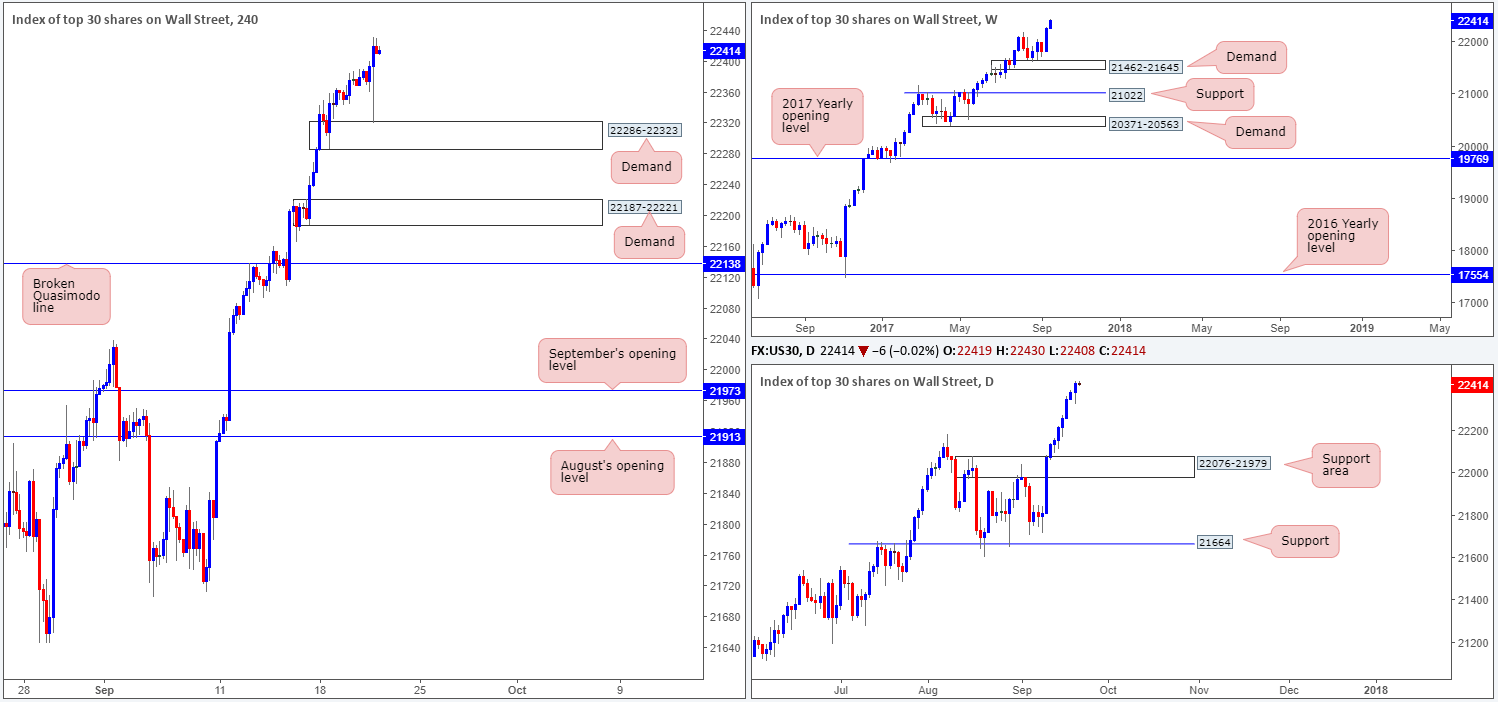

DOW 30:

US equities, as you can see, hit the brakes and pressed to a low of 22319 (the top edge of H4 demand at 22286-22323) in the immediate aftermath of Wednesday’s FOMC meet. Despite this, the index quickly pared losses and closed the day at a fresh record high of 22431. A pullback on the H4 timeframe could see price revisit the noted H4 demand. A violation of this area, however, likely opens the door for a test of the demand base coming in at 22187-22221.

Suggestions: With absolutely no resistances seen on the horizon, this remains a buyers’ market right now as far as we’re concerned. As such, we’ll continue to watch both the above said H4 demands for possible buying opportunities should the index dip lower.

Data points to consider: US Weekly unemployment claims at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: 22286-22323 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail). 22187-22221 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

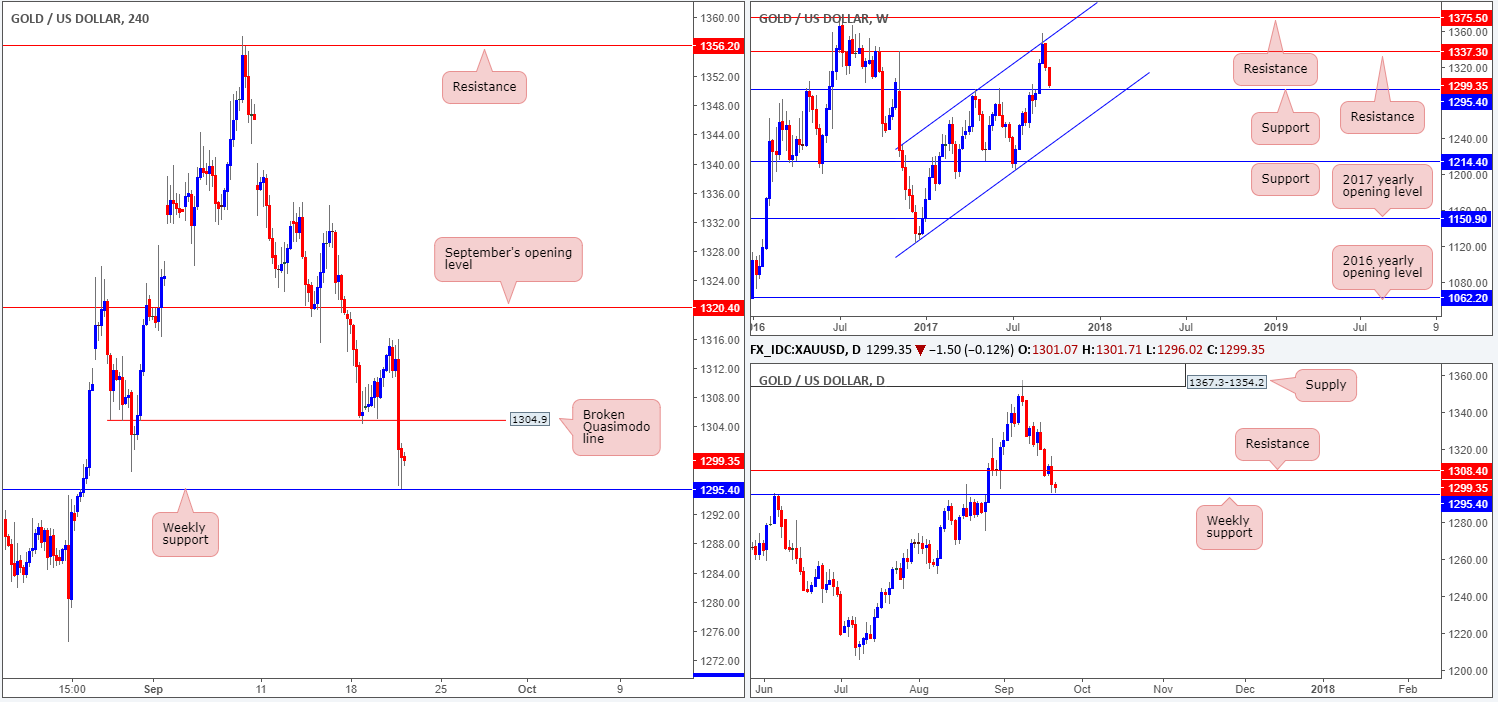

GOLD:

Across the board, the US dollar rallied after yesterday’s FOMC meet, thus pushing the price of gold lower. This not only saw price storm through the H4 Quasimodo support at 1304.9 (now acting resistance), it also saw daily price close below support at 1308.4 (now acting resistance) and place weekly price within touching distance of support at 1295.4.

With the recent H4 buying tails printed just ahead of weekly support, this could lead to a short-term bounce back up to the recently broken H4 Quasimodo line. The reason behind believing that this bounce may only be short term simply comes down to daily resistance seen plotted just above the H4 resistance at 1308.4.

Suggestions: Right now, we do not see much to hang our hat on. Granted, a long from weekly support could be an option, but with H4/daily resistance structures positioned nearby, we’re wary of buying at the moment.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).