A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

Weekly gain/loss: – 88 pips

Weekly closing price: 1.0882

Weekly view: As you can see, the shared currency continued to push lower last week, consequently breaking through support at 1.0970 (now acting resistance) and closing nearby a major support barrier drawn from 1.0819. With this level having been a considerable support since mid-May 2015, a bounce from this neighborhood is likely. However, the other key thing to note here is that just below it we see a long-term trendline support taken from the low 0.8231 and an AB=CD completion point around the 1.0667ish area (black arrows). Therefore, a whipsaw through 1.0819 is something we should all be prepared for prior to serious buyers step in.

Daily view: The daily chart does not seem to be throwing up any red flags as the path south appears clear for price to shake hands with the above said weekly support hurdle. Should the sellers hit the brakes here and reverse without striking the weekly support, nonetheless, we would consider the supply zone seen at 1.1039-1.0998 to be a viable area for price to rebound from, since it merges with the key figure 1.10.

H4 view: A quick recap of Friday’s trading on the H4 shows just how dominant the sellers were! The only relief the EUR saw was during the US session where price found a pocket of bids just ahead of the mid-way support 1.0850, pushing price to highs of 1.0888 by the day’s end.

Direction for the week: Until the pair touches gloves with the weekly support level mentioned above at 1.0819, we strongly feel price will continue to lose ground this week.

Direction for today: The opening candles will likely want to cross swords with the nearby broken H4 Quasimodo resistance at 1.0903, which fuses beautifully with psychological resistance 1.09. Personally, we don’t imagine price making much headway beyond this point. If it does, however, we’d then be looking for the candles to connect with the aforementioned daily supply base.

Our suggestions: A retest of the 1.09 region followed by a reasonably sized H4 bearish close is, at least in our book, worthy of attention. A short could be taken from here, targeting the mid-way support 1.0850 and then the weekly support at 1.0819 as your final take-profit zone.

Data points to consider today are mainly speeches from Fed officials at 1pm and 6pm. In addition, there’s also European manufacturing data scheduled for release between 7-8am GMT, which, in our opinion, should not be ignored.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.09 region ([H4 bearish close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

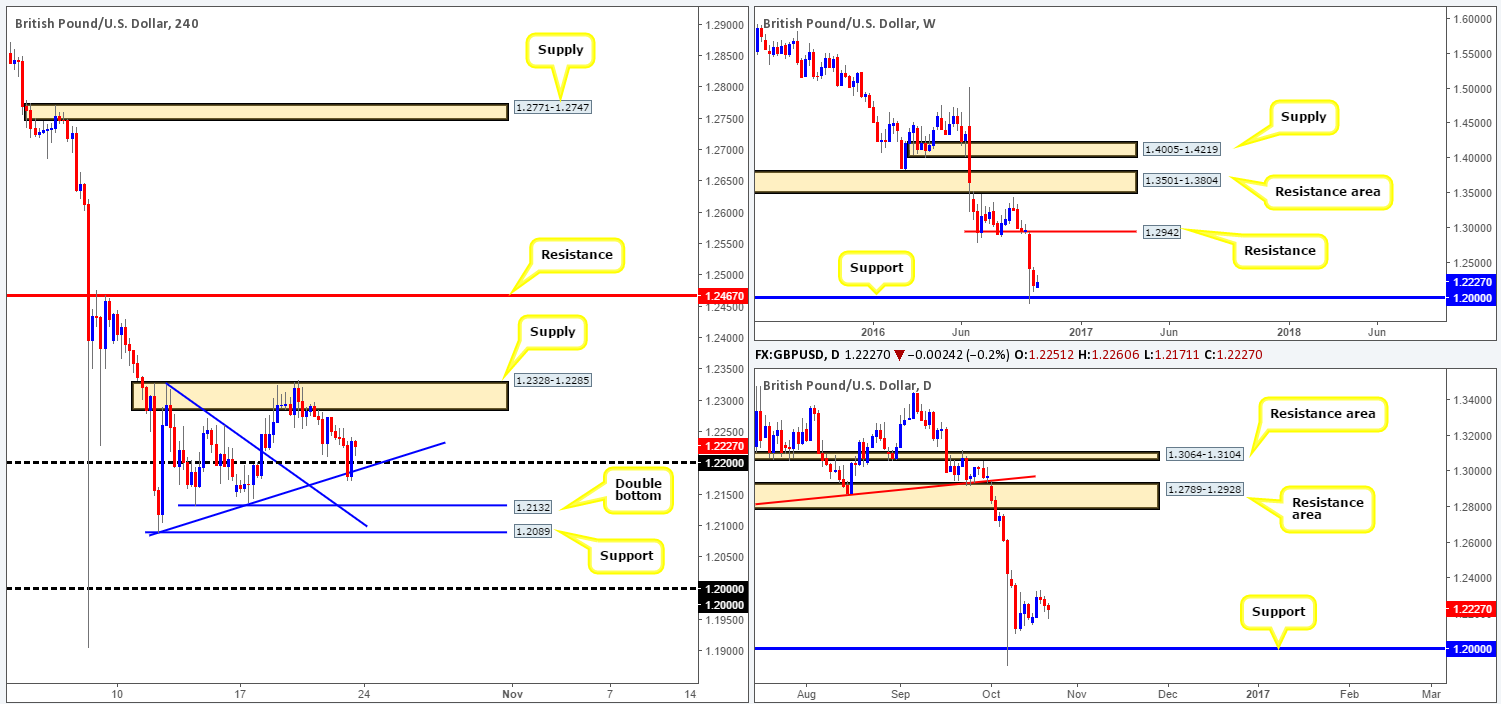

GBP/USD:

Weekly gain/loss: – 48 pips

Weekly closing price: 1.2227

Weekly view: There was little development seen on the weekly chart last week, as price was unable to break beyond the prior week’s high/low, resulting in the market printing an inside candle formation by the close. While the majority of market players believe the pound could head further south in the future, and we’re not saying it couldn’t, let’s keep in mind that on the monthly chart price has touched base with a major demand, with 1.20 representing the top edge (http://fxtop.com/en/historical-exchange-rates-graph-zoom.php?C1=GBP&C2=USD&A=1&DD1=07&MM1=10&YYYY1=1960&DD2=14&MM2=10&YYYY2=2016&LARGE=1&LANG=en&VAR=0&MM1M=0&MM3M=0&MM1Y=0).

Daily view: Besides cable bottoming out around the 1.2089 region two weeks ago, there is not much difference seen between this chart and the weekly. To the upside, the next barrier of interest comes in at 1.2789-1.2928: a resistance area that sits directly below a weekly resistance at 1.2942. Meanwhile, to the downside, 1.20 is also the next available support.

H4 view: Since price topped out around supply at 1.2328-1.2285 on Tuesday, we saw cable grind lower and eventually surpass the 1.22 handle and tag in bids from a trendline support drawn from the low 1.2089.

Direction for the week: In view of the clear downtrend the pair is in, along with the uncertainty surrounding the British economy right now, it is likely 1.20 will be visited again in the near future. Be that as it may, let’s remind ourselves that monthly action shows price in demand!

Direction for today: With little resistance seen ahead of current price until the unit reaches the above said H4 supply, a move north will likely take place today.

Our suggestions: In a similar fashion to Friday’s outlook, here’s what logged so far:

- A long could be considered on the close above the current H4 supply area. For us personally, we’d also require a retest followed up by a reasonably sized H4 bullish close, before we’d look to pull the trigger.

- Supposing the market breaches the 1.22 handle, the runway south looks relatively free down to a H4 double-bottom support at 1.2132, followed closely by support at 1.2089. Again though, our team would require a retest to the underside of 1.22 along with a reasonably sized H4 bearish close. This is a trade we would deem valid, given that there is room seen on both the weekly and daily charts for price to retest the 1.20 band.

On the data front, we have MPC member Shafik taking the stage at 6.30am today, along with speeches from Fed officials at 1pm and 6pm GMT.

Levels to watch/live orders:

- Buys: Watch for a close above the H4 supply at 1.2328-1.2285 and then look to trade any retest seen thereafter (H4 bullish close required prior to pulling the trigger).

- Sells: Watch for a close below the 1.22 region and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

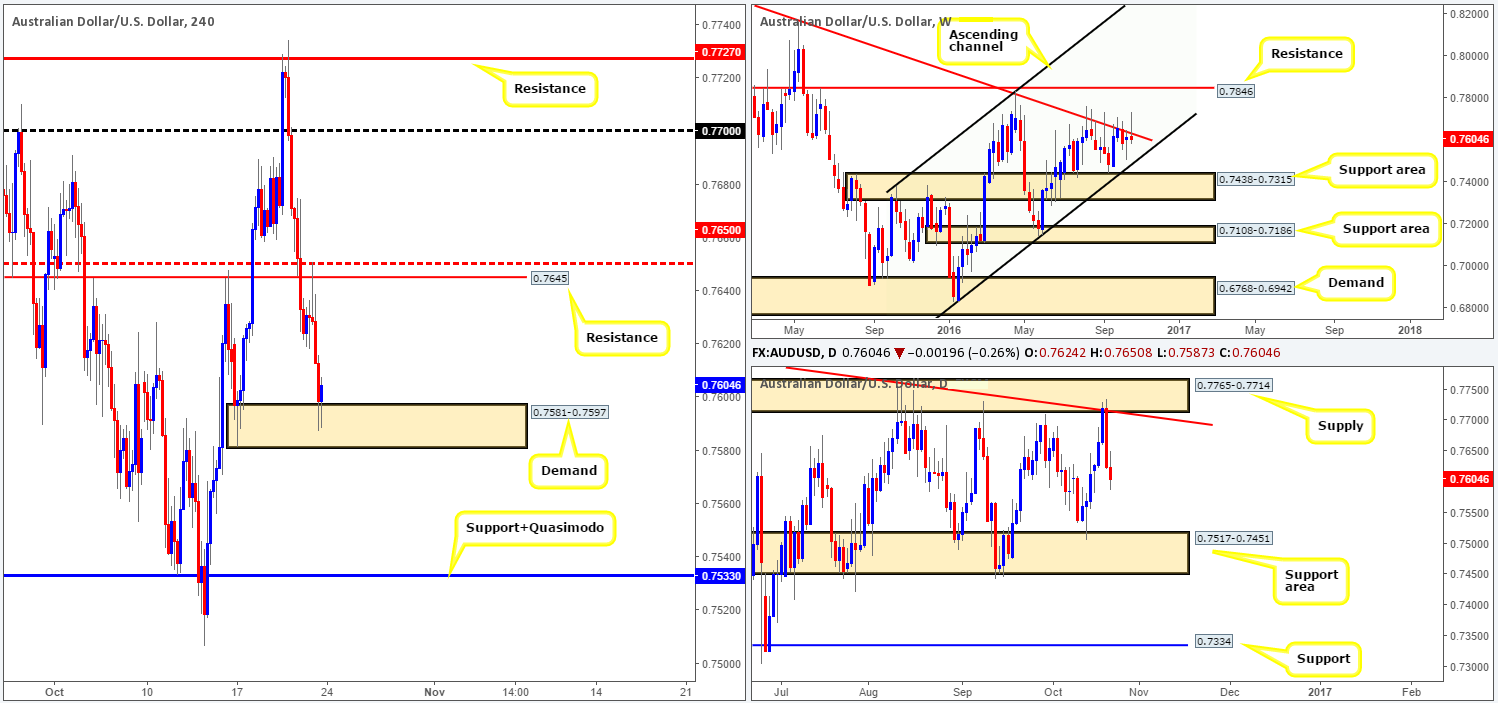

AUD/USD:

Weekly gain/loss: – 9 pips

Weekly closing price: 0.7604

Weekly view: Although the pair closed the week relatively unchanged, what the candles did provide us with was a beautiful-looking bearish selling wick that pierced through a trendline resistance extended from the high 0.8295. As a result of this, the bears may look to head down to an ascending channel support line this week drawn from the low 0.6827.

Daily view: Turning our attention to the daily candles, Thursday’s action responded beautifully to the supply zone at 0.7765-0.7714 and its corresponding trendline resistance taken from the high 0.7835. From this angle, the next area in the firing range is seen at 0.7517-0.7451: a support area that merges with the above said weekly ascending channel support.

H4 view: For those who read Friday’s report you may recall that we were looking to short between the H4 mid-way resistance 0.7650 and H4 resistance 0.7645. As you can see from the chart, price stabbed this area beautifully going into the London open and proceeded to fall sharply down to a fresh H4 demand base coming in at 0.7581-0.7597. Unfortunately, we were unable to pin down a lower timeframe sell setup from the 0.7650/0.7645 region, thus missing the trade. Well done to any of our readers who managed to net some green pips from this move!

Direction for the week: Until the commodity currency connects with the daily support area seen at 0.7517-0.7451, the pair is likely to weaken in the coming days.

Direction for today: While price has steadied itself around the aforementioned fresh H4 demand area, we feel that the bulls will struggle to find a foothold here since there is little corresponding support coming in from the higher-timeframe structures. Therefore, we feel a move lower may take place today.

Our suggestions: Put simply, we have no interest in buying from the current H4 fresh demand base today. With that being the case, our team has noted that they’re watching for price to CLOSE below this zone, as this would not only confirm bearish strength on the higher-timeframe picture, but also open up the path south for price to challenge the combined H4 support/Quasimodo level at 0.7533, which is conveniently positioned just ahead of the aforementioned daily support area.

Should a close below the fresh H4 demand take place, and price follows up with a retest to the underside of this area as supply, we would look to short on the close of any reasonably sized H4 bearish candle.

As there’s no Aussie economic data scheduled for release today, focus will likely shift to the speeches from Fed officials at 1pm and 6pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for a close below the H4 demand at 0.7581-0.7597 and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

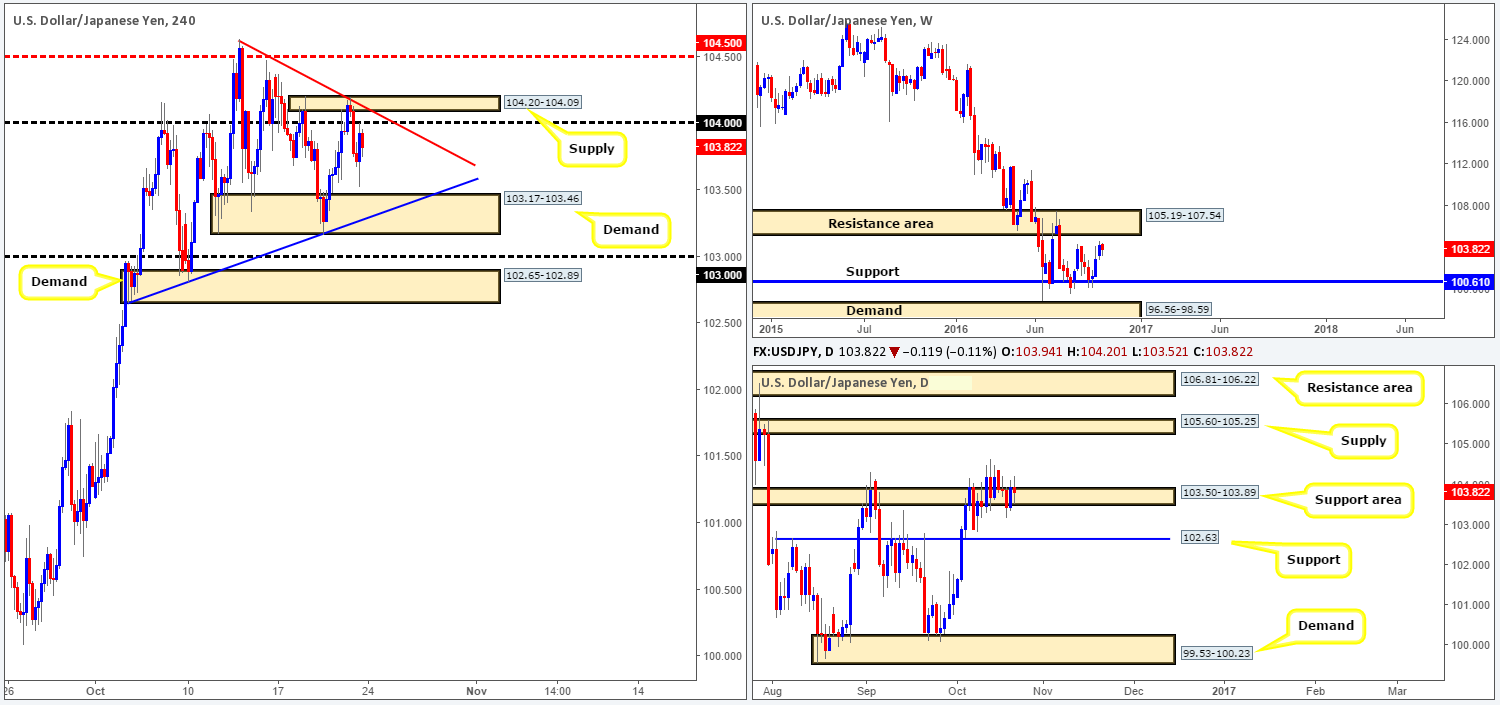

USD/JPY:

Weekly gain/loss: – 36 pips

Weekly closing price: 103.82

Weekly view: After chalking up three consecutive bullish candles, the market closed last week in the red. Despite this, weekly action, at least in our opinion, still remains in a good position to continue north this week, due to price recently taking out highs chalked up on the 29/08 around the 104.32ish region. The next upside barrier currently in our sights comes in at 105.19-107.54: a resistance area that stretches back as far as the year 2013.

Daily view: The story on the daily chart shows that price remains bolstered by the support area seen at 103.50-103.89, but given Friday’s indecision candle, the buyers appear uncertain here. This is not to say this area will give way, it’s just we expect more energy to be seen from the bulls. To the upside, the next area of interest above this zone falls in at 105.60-105.25: a supply zone that is housed within the lower limits of the aforementioned weekly resistance area.

H4 view: Through the lens of a technical trader, the first thing that is glaringly obvious on the H4 chart is that price has, since mid-Oct, been compressing between two converging trendlines (102.65/104.63): a possible bullish pennant formation. Another key thing to note is there’s little room seen for price to move as far as structure is concerned. Directly above current price stands a psychological resistance at 104 and a nearby supply at 104.20-104.09, while to the downside a demand barrier sits close by at 103.17-103.46.

Direction for the week: In view of the higher-timeframe structures, a push north is likely going to develop in the days ahead, at least until price retests the underside of the aforementioned weekly resistance area.

Direction for today: Seeing as how the potential H4 pennant formation has not really shown any signs of weakening as of yet, we don’t picture price breaking beyond these lines today. However, we do have speeches from key Fed officials at 1pm and 6pm GMT today so this could cause an abrupt move in this market.

Our suggestions: Ultimately, we have no interest in trading the edges of the above said H4 pennant. A break above the upper edge and its corresponding H4 supply at 104.20-104.09, on the other hand, is interesting. As long as price retests the top edge of the broken areas and prints a lower timeframe buy setup (see the top of this report for ideas on entering using the lower timeframes) this would be enough to condone a long entry, targeting the H4 mid-way resistance 104.50, followed by the 105 handle. Looking for longs beyond 105 is NOT something we’d recommend as by that point price would be trading within touching distance of both the weekly resistance area and also the daily supply. In fact, this would be an ideal place to be looking to short from!

Levels to watch/live orders:

- Buys: Watch for a close above the H4 trendline resistance (104.63) and H4 supply at 104.20-104.09 and then look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

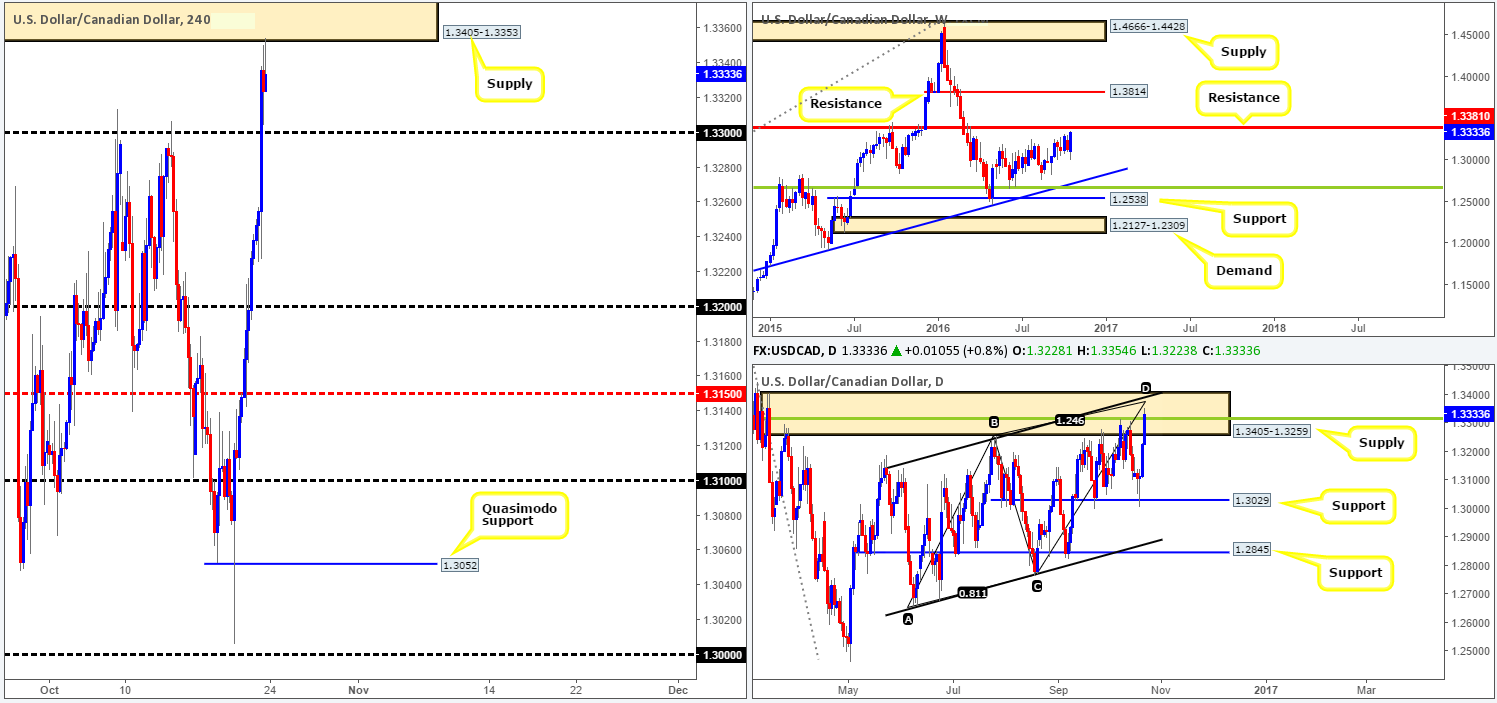

USD/CAD:

Weekly gain/loss: + 196 pips

Weekly closing price: 1.3333

Weekly view: Across the board, we saw the US dollar appreciate last week, consequently bringing the USD/CAD up to within shouting distance of a resistance level drawn from 1.3381. This barrier has provided the pair significant support/resistance going back to the 1990s, thus, the buyers will likely struggle to advance beyond here this week.

Daily view: Thanks to the recent bout of buying, the daily candles are also seen trading deep within a supply zone penciled in at 1.3405-1.3259. In addition to this, price is currently getting to grips with, what we like to call, a daily convergence point. This area is made up of: a 38.2% Fib resistance level at 1.3315 (green line), the weekly resistance level at 1.3381, a channel resistance taken from the high 1.3241 and an AB=CD completion point around the 1.3376ish range.

H4 view: As we explained in Friday’s report, our team placed a pending sell order at 1.3315 and set a stop-loss order above the current daily supply at 1.3407. This was simply due to the truckload of daily/weekly confluence. Although the market closed the week above our entry, meaning we ended in drawdown, our team is confident that the H4 supply at 1.3405-1.3353 (located within the extremes of the above said daily supply) will force prices to trade lower this week.

Direction for the week: According to higher-timeframe structure, the pair is now in overbought territory. As a result, price will likely decline in value this week, possibly bringing the candles back down to daily support coming in at 1.3029.

Direction for today: The H4 candles will likely look to attack the 1.33 handle this morning. Ideally, we’re looking for a decisive push beyond this number today, as this will likely seal the deal for lower prices down to at least the 1.32 handle, which of course, would be fantastic for our current short position in this market!

Our suggestions: Wait for a close below 1.33 to confirm downside. Following this, a retest to the underside of this number along with a reasonably sized H4 bearish candle would, in our view, make for a beautiful shorting opportunity down to 1.32. Should this come to fruition, we will also likely look to pyramid our current position.

From a fundamental standpoint, nevertheless, we not only have Fed officials speaking at 1pm and 6pm today, we also have the BoC Gov. Poloz taking the spotlight at 7.30pm GMT. As such, trade with caution during these times guys!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.3315 ([live] Stop loss: 1.3407). Watch for a close below the 1.33 handle and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

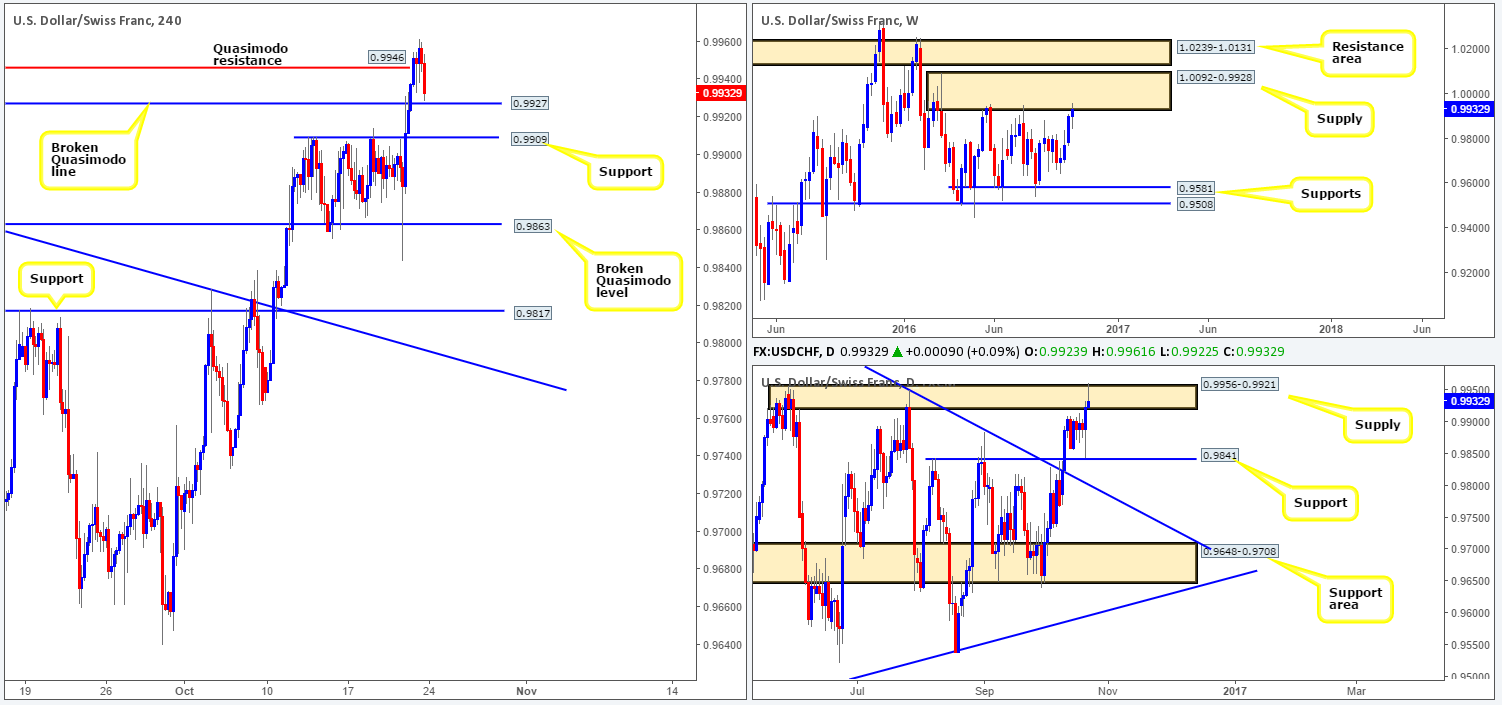

USD/CHF:

Weekly gain/loss: + 31 pips

Weekly closing price: 0.9932

Weekly view: Since the beginning of May, the pair has been consolidating between a supply zone painted at 1.0092-0.9928 and a support band drawn from 0.9581. As you can see from the chart, however, the recently closed weekly candle is now seen kissing the underside of the above said supply zone. Therefore, looking to enter long on this pair may not be the best path to take this week!

Daily view: In conjunction with weekly price, the daily chart also shows the Swissy recently attacked a supply zone coming in at 0.9956-0.9921. Although Friday’s candle did slightly surpass this barrier, it did, however, chalk up a nice-looking bearish selling wick, suggesting further downside could be seen to support at 0.9841.

H4 view: (Removed pending sell order at 0.9945 due to already being short the USD/CAD)

Following Friday’s push above the Quasimodo resistance level at 0.9946, price eventually topped out going into US trading and went on to close the day just ahead of a broken Quasimodo line at 0.9927. Looking at this chart with the higher-timeframe picture in mind, a break below both the broken Quasimodo line and the support seen just below it at 0.9909 is likely going to take place.

Direction for the week: Given where price is positioned on the higher timeframes right now, we favor a selloff this week down to at least the daily support boundary at 0.9841.

Direction for today: While the H4 broken Quasimodo line at 0.9927 and the H4 support positioned below it at 0.9909 may bounce price today, the market will, as already mentioned, eventually likely consume these barriers, thus allowing price to challenge the H4 broken Quasimodo line at 0.9863 – located just above the daily support mentioned above at 0.9841.

Our suggestions: Watch for a decisive close below the H4 support at 0.9909. On account of this, a retest to the underside of 0.9909 is required followed by a H4 bearish close. Only then would our team look to go about entering short, targeting 0.9863.

As far as economic data goes today, there’s no CHF news scheduled for release today, so attention will likely be focused on the Fed officials speaking at 1pm and 6pm GMT.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for a close below the H4 support at 0.9909 and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

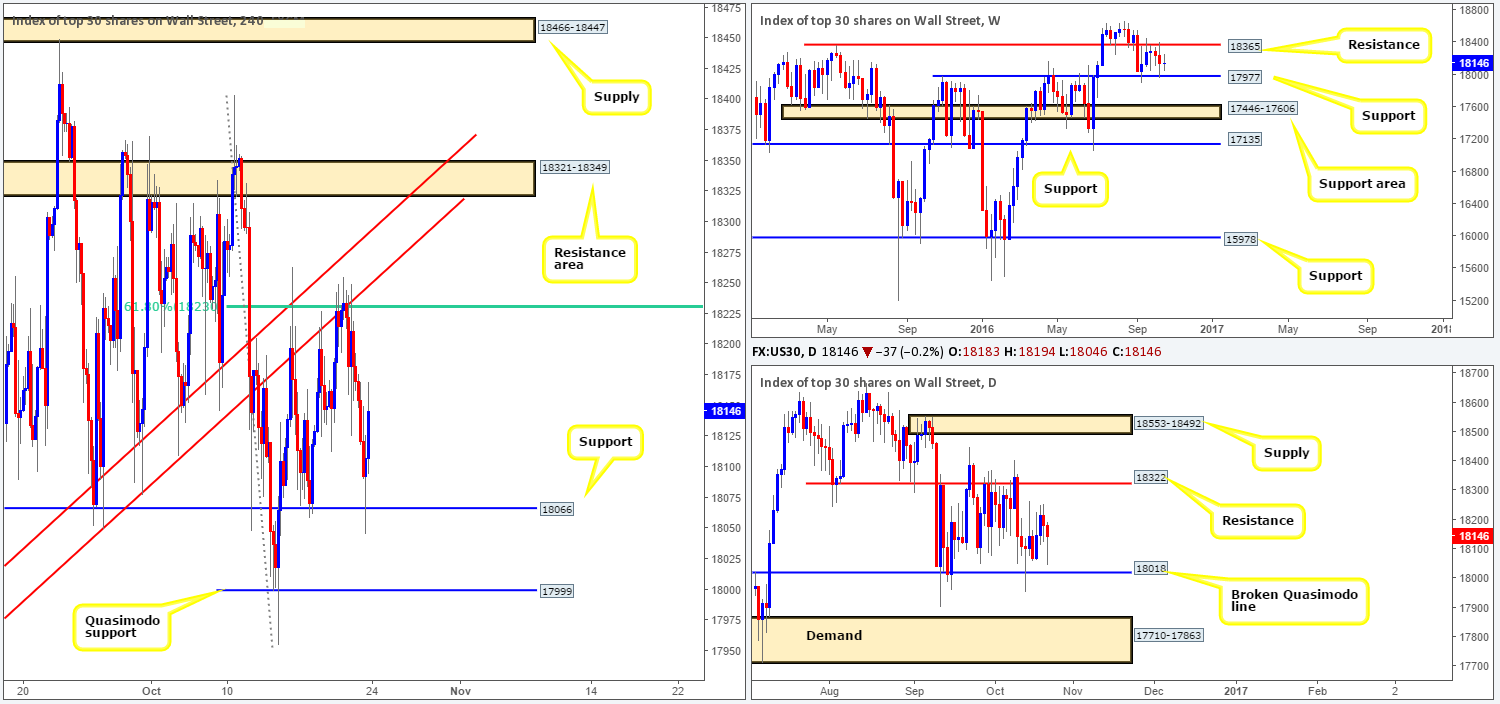

DOW 30:

Weekly gain/loss: + 3 points

Weekly closing price: 18146

Weekly view: Equities, as you can see, remained pretty much unchanged by the week’s closing point, recording a mere 3-point gain. Since September 12, the weekly candles have been sandwiched between a resistance drawn from 18365 and a support level coming in at 17977. If this support is consumed, the support area at 17446-17606 would likely be the next objective to reach. A push above the resistance level on the other hand, could signal that the bulls are ready to strike fresh highs and continue trading northbound.

Daily view: In a similar fashion to the weekly chart, the daily candles are seen consolidating between a resistance at 18322 and a broken Quasimodo line penciled in at 18018. A violation of this Quasimodo boundary would likely lead to a test of the demand base seen at 17710-17863, whereas a break above the resistance could force price to connect with supply carved from 18553-18492.

H4 view: Stepping across to the H4 chart, the buyers and sellers are seen locked between a 61.8% Fib resistance level at 18230 (bolstered by a trendline resistance chalked up from the low 17959) and a support registered at 18066. Taking into account that this H4 consolidation has very little higher-timeframe confluence, our team has absolutely no interest in trading within these walls. Instead, as we have mentioned several times in previous reports, the only areas we have interest in at the moment is the H4 Quasimodo support at 17999 and the H4 resistance area at 18321-18349. The Quasimodo is attractive because it fuses with nearby weekly support at 17977 and also the daily broken Quasimodo line at 18018.The resistance zone, however, is equally attractive since it houses the daily resistance level at 18322 and is located just below weekly resistance at 18365.

Direction for the week: Movement, as we have shown on the weekly and daily charts, is somewhat restricted for the time being. Therefore, weekly direction is rather limited.

Direction for today: Monday’s are notoriously slow, so it’s unlikely the unit will break beyond the current H4 consolidation today. Nevertheless, we do have a number of Fed officials speaking today at 1pm and 6pm GMT; therefore a break is certainly not out of the question!

Our suggestions: As we have stated above, we only have interest in the H4 Quasimodo support at 17999 and the H4 resistance area at 18321-18349. However, to avoid being stopped out by one of those dreaded whipsaws; we’d recommend waiting for a H4 close prior to risking capital at these areas.

Levels to watch/live orders:

- Buys: 17999 ([H4 bullish close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

- Sells: 18321-18349 ([H4 bearish close required prior to pulling the trigger] Stop loss: ideally beyond the trigger candle).

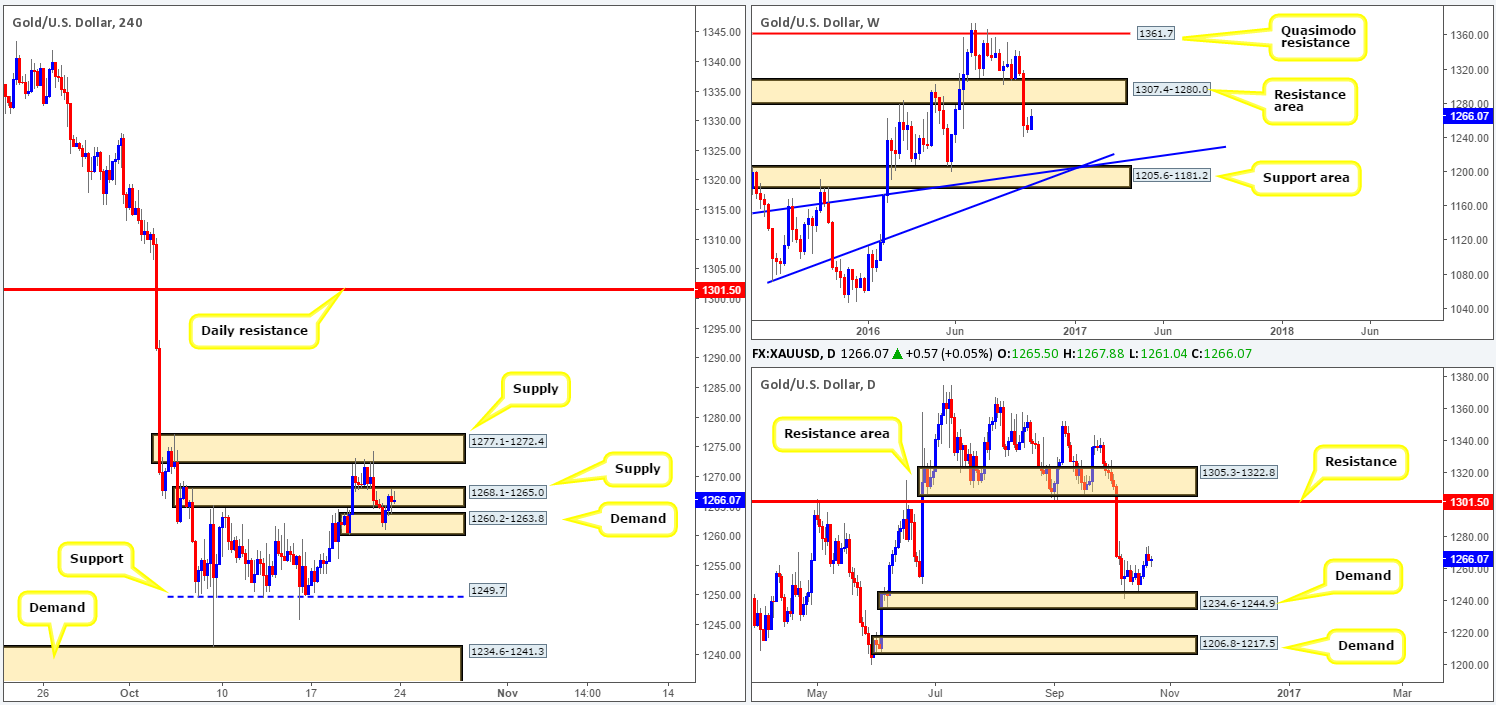

GOLD:

Weekly gain/loss: + $15.8

Weekly closing price: 1266.0

Weekly view: Following the rather aggressive break below the support area seen at 1307.4-1280.0 three weeks ago, the metal bottomed out around the 1241.2 neighborhood, and now looks to be on course to retest the underside of this recently broken zone as resistance. Should this come into view, there’s potential for another voracious leg down from here to a support area formed from 1205.6-1181.2 (fuses with two weekly trendline support [1071.2/1130.1]).

Daily view: Our read on the daily chart shows that demand at 1234.6-1244.9 is currently providing this market with support. In the event that bullion continues to be favored here, we may see price shake hands with resistance at 1301.5, seen located relatively deep within the above mentioned weekly resistance area. Given the strength shown so far from this daily demand zone, the yellow metal may be bid up to the aforementioned daily resistance level before we see the sellers make any noteworthy appearance.

H4 view: The current situation on the H4 chart is an interesting one. The unit closed the week in between a supply zone at 1268.1-1265.0 and a demand coming in at 1260.2-1263.8. Now, directly above this supply, there’s another supply planted at 1277.1-1272.4, which did a superb job in suppressing buying on Wednesday last week. Meanwhile, below the current demand, space to run down to a support level at 1249.7 is seen.

Direction for the week: Going by what we’ve noted on the higher-timeframe picture, the upside is more favorable this week, in our opinion, at least until the weekly resistance area at 1307.4-1280.0 is in view.

Direction for today: With a number of key Fed officials speaking today at 1pm and 6pm GMT this may inject some volatility into this market today. However, in that Monday’s are usually slow; we do not think price will breach H4 demand at 1260.2-1263.8 or the H4 supply at 1277.1-1272.4.

Our suggestions: A break beyond the current H4 demand base could be considered a bearish cue to either sell the breakout, or conservatively wait for price to retest the underside of the demand as supply. However, we would not feel comfortable selling beyond here knowing where we are positioned in the bigger picture at the moment.

A break above the H4 supply at 1277.1-1272.4, nevertheless, is something our team is interested in seeing. The reason being is that beyond this barrier, the pathway north from here is clear up to the aforementioned daily resistance. As such, should price retest this boundary as demand (after a close higher) followed by a reasonably sized H4 bull candle, one could look to go long from here targeting the daily level. However, do remain aware that by entering long from here, even with the confirmation of a H4 bull candle, you’re effectively buying directly into a weekly resistance area.

Levels to watch/live orders:

- Buys: Watch for a close above the H4 supply at 1277.1-1272.4 and then look to trade any retest seen thereafter (H4 bullish close required prior to pulling the trigger).

- Sells: Flat (Stop loss: N/A).