Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

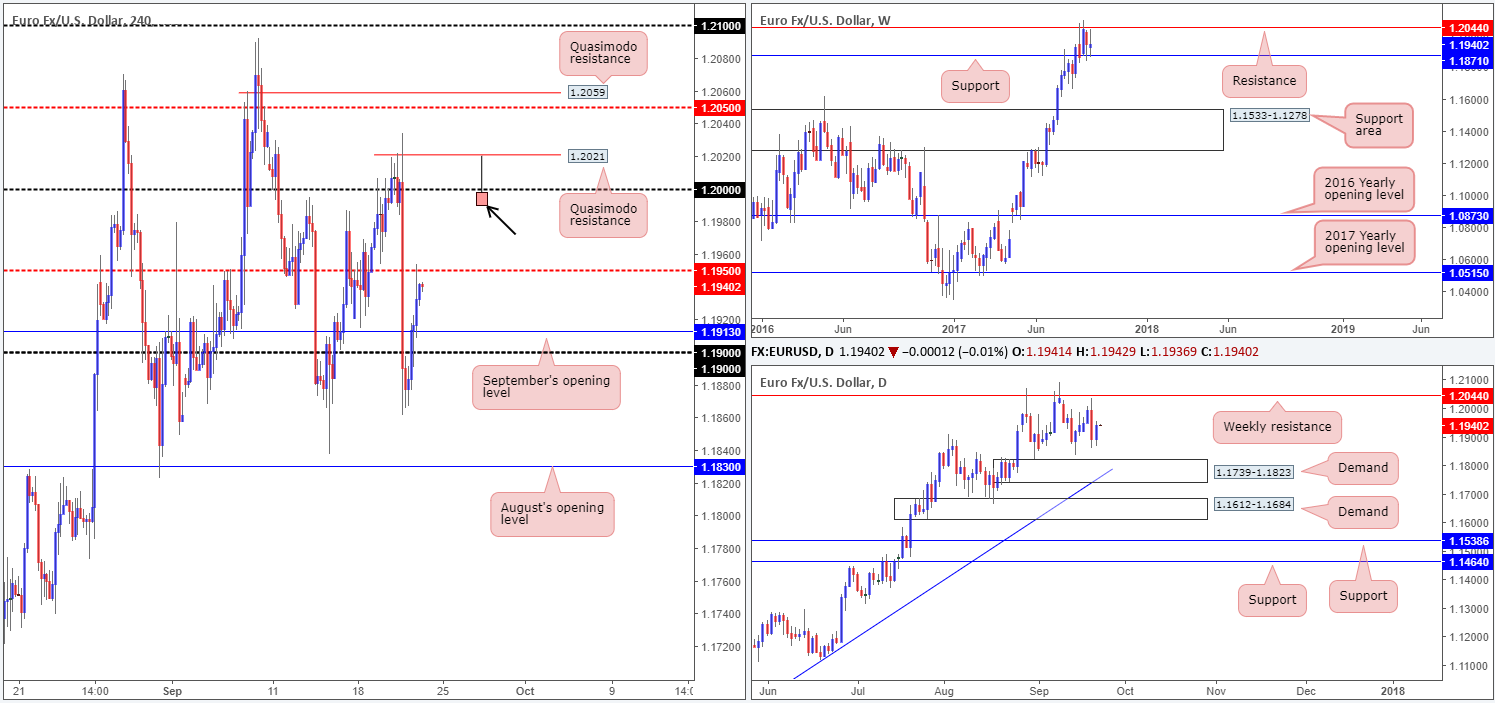

EUR/USD:

The value of the EUR strengthened on Thursday, consequently erasing 50% of Wednesday’s Fed-induced losses. As the US dollar found refuge beneath USDX weekly resistance at 11854, the single currency conquered both the 1.19 handle and September’s opening level at 1.1913, allowing H4 price to shake hands with the mid-level resistance marked at 1.1950.

Aside from dollar shorts, we also believe this recent upsurge may be a product of buyers defending weekly support at 1.1871, alongside the pair trading in-line with the overall trend. With this in mind, and assuming 1.1950 is consumed today, the unit will likely gravitate north to reconnect with the large psychological band 1.20.

For those considering shorts from 1.20, be prepared for the possibility of a fakeout. Directly above sits a H4 Quasimodo resistance at 1.2021, shadowed closely by weekly resistance at 1.2044. Both levels, in our opinion, are ideal candidates to help facilitate a fakeout above 1.20.

Suggestions: Instead of placing sell orders at 1.20, we will be looking for evidence that a fakeout has taken place before pulling the sell trigger. An ideal scenario would be for H4 price to print a bearish selling wick (as drawn on the chart) that pierces through 1.20, taps the noted H4 Quasimodo and closes lower. Should this trade come to fruition, stops are to be placed above the fakeout candle’s wick and the initial take-profit level would be 1.1950.

Data points to consider: EUR Manufacturing figures released between 8-9am; ECB President Draghi speaks at 9am GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.20 region ([waiting for a fakeout of this number is advised before selling] stop loss: ideally beyond the fakeout candle’s wick).

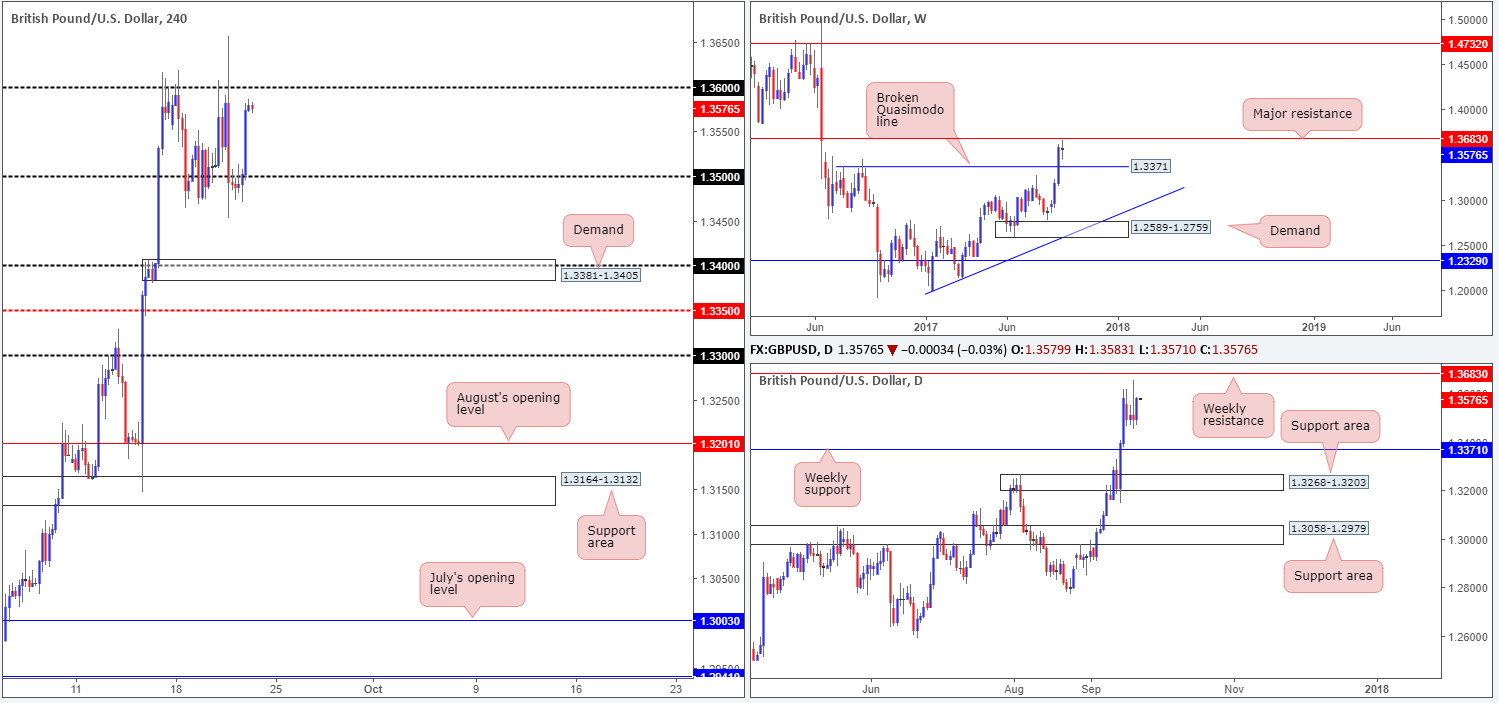

GBP/USD:

From the weekly timeframe this morning, we can clearly see that the buyers and sellers remain undecided as price trades mid-range amid resistance at 1.3683 and a broken Quasimodo line coming in at 1.3371.

Across on the H4 timeframe price briefly found refuge beneath the 1.35 handle during London’s morning segment yesterday, even printing a reasonably nice-looking bearish selling wick. That was, of course, until the US buyers entered the fray, taking price up to highs of 1.3581 in one fell swoop.

Sellers, in our humble view, are very likely weak around the nearby 1.36 handle – just take a look at the size of Wednesday’s Fed-induced whipsaw through this psychological boundary! It is doubtful any sellers here survived that move.

Suggestions: Put simply, with USDX weekly sellers trading from resistance at 11854, and GBP weekly chart showing room to advance as far as resistance at 1.3683, a long above the 1.36 handle could be an option today. To take advantage of this potential move north, one could either buy the breakout or conservatively wait to see if price retests 1.36 as support, and buy on the condition that H4 price chalks up a reasonably sized H4 bull candle in the shape of a full, or near-full-bodied candle.

Data points to consider: UK Prime Minister May speaks sometime today.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 1.36 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bullish candle to form following the retest – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

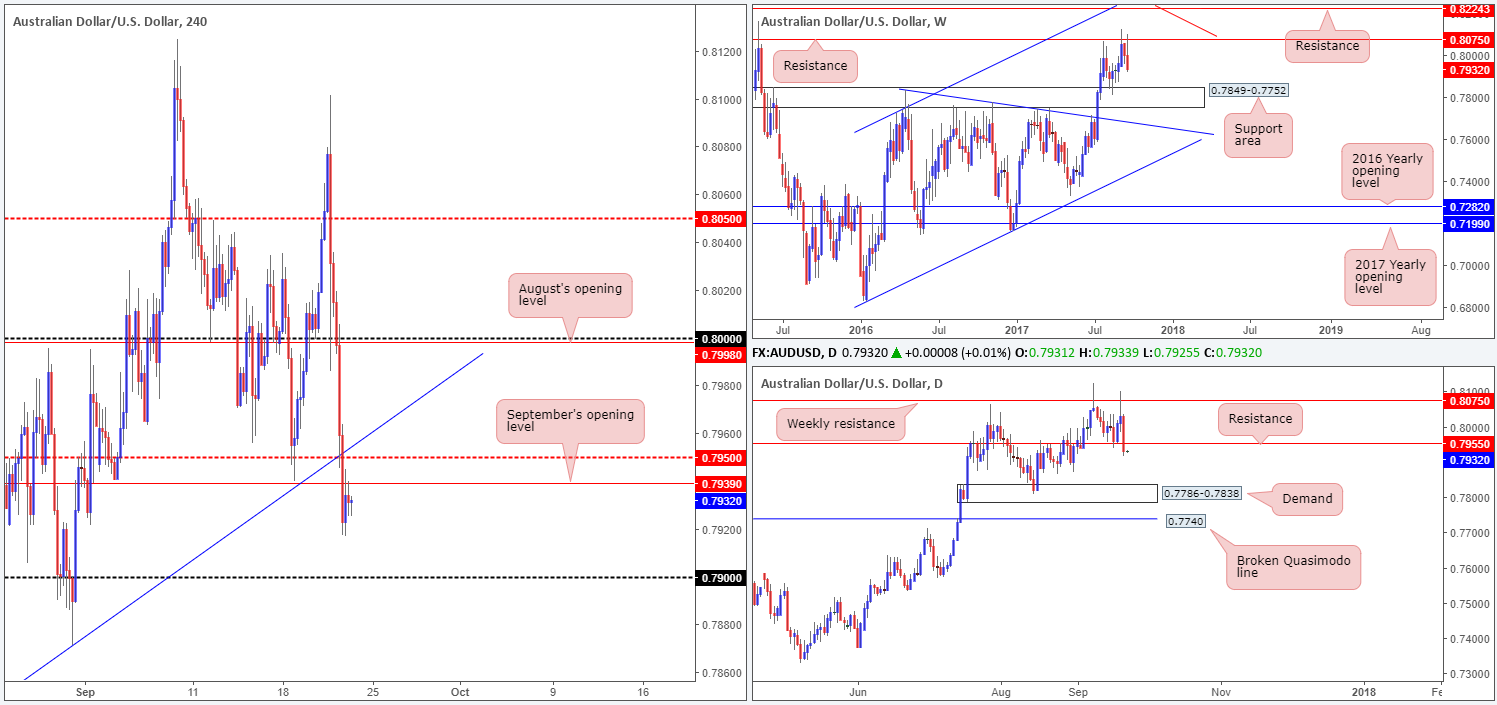

AUD/USD:

During the course of yesterday’s sessions, the commodity currency continued to sag against the US dollar following RBA’s Lowe’s speech at the American Chamber of Commerce in Australia. The move, as you can see, ended with H4 price running through bids at September’s opening level drawn from 0.7939, which is now acting resistance.

From a technical standpoint, it is highly likely that the Aussie will resume downside today at least until the pair reaches the 0.79 handle. This is largely due to weekly price showing room to extend down to a support area at 0.7849-0.7752, and daily price recently closing below support at 0.7955 (now acting resistance).

Suggestions: To trade from 0.7939, a stop not exceeding 15 pips is required should you target 0.79 to take profits. This will then provide at least two times one’s risk should the trade achieve its target. To find such a small stop from a H4 level, we would advise drilling down to the lower timeframes and looking to pin down a setup from that region (see the top of this report for ideas on how to utilize lower-timeframe action).

Data points to consider: No high-impacting news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.7939 region ([waiting for lower-timeframe confirmation to form is advised] stop loss: dependent on where one confirms the area).

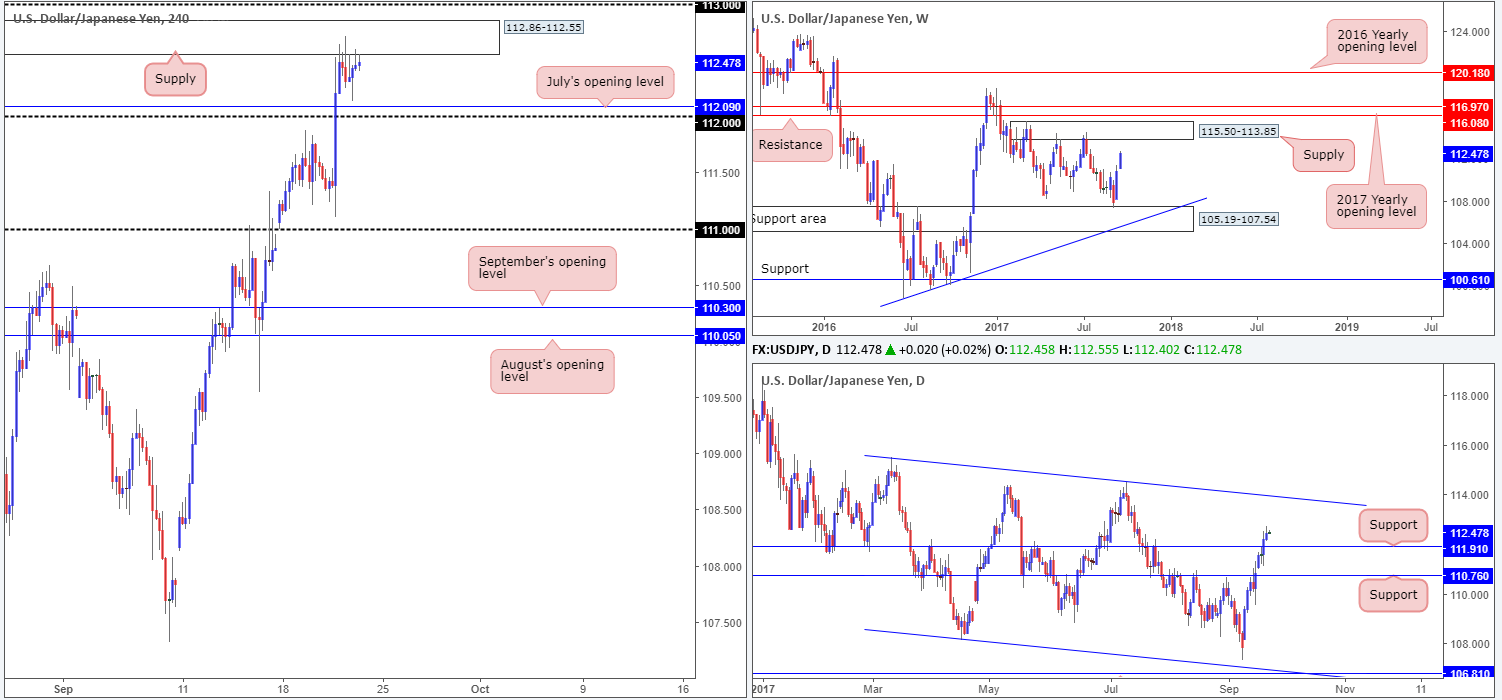

USD/JPY:

Although the USD/JPY pair posted a gain on Thursday, H4 price action was relatively subdued around the underside of supply penciled in at 112.86-112.55.The highly anticipated BoJ meeting turned out to be a non-event, after the bank decided to leave its monetary policy unchanged.

Looking over to the weekly timeframe, we can clearly see the bulls look poised to challenge the supply area at 115.50-113.85. In conjunction with the weekly timeframe, daily price recently crossed above resistance coming in at 111.91 and shows little resistance stopping price from reaching trendline resistance extended from the high 115.50 (intersects with the aforementioned weekly supply area).

Suggestions: To our way of seeing things, the only barrier bolstering the current H4 supply is the weekly USDX resistance at 11854. Both the weekly and daily charts on the USD/JPY, however, suggest further buying is likely to take place. In addition to this, we have July’s opening level at 112.09, followed closely by the 112 handle lurking just below the current supply! Therefore, we will not be taking shorts in this market right now.

A break above the current H4 supply area would, as far as we can see, immediately open up the door to 113, and another H4 supply seen at 113.57-113.38 (not seen on the screen). So, even though there’s a good chance further upside is likely in this market, buying beyond the current H4 supply is also somewhat restricted for the time being.

Data points to consider: No high-impacting news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

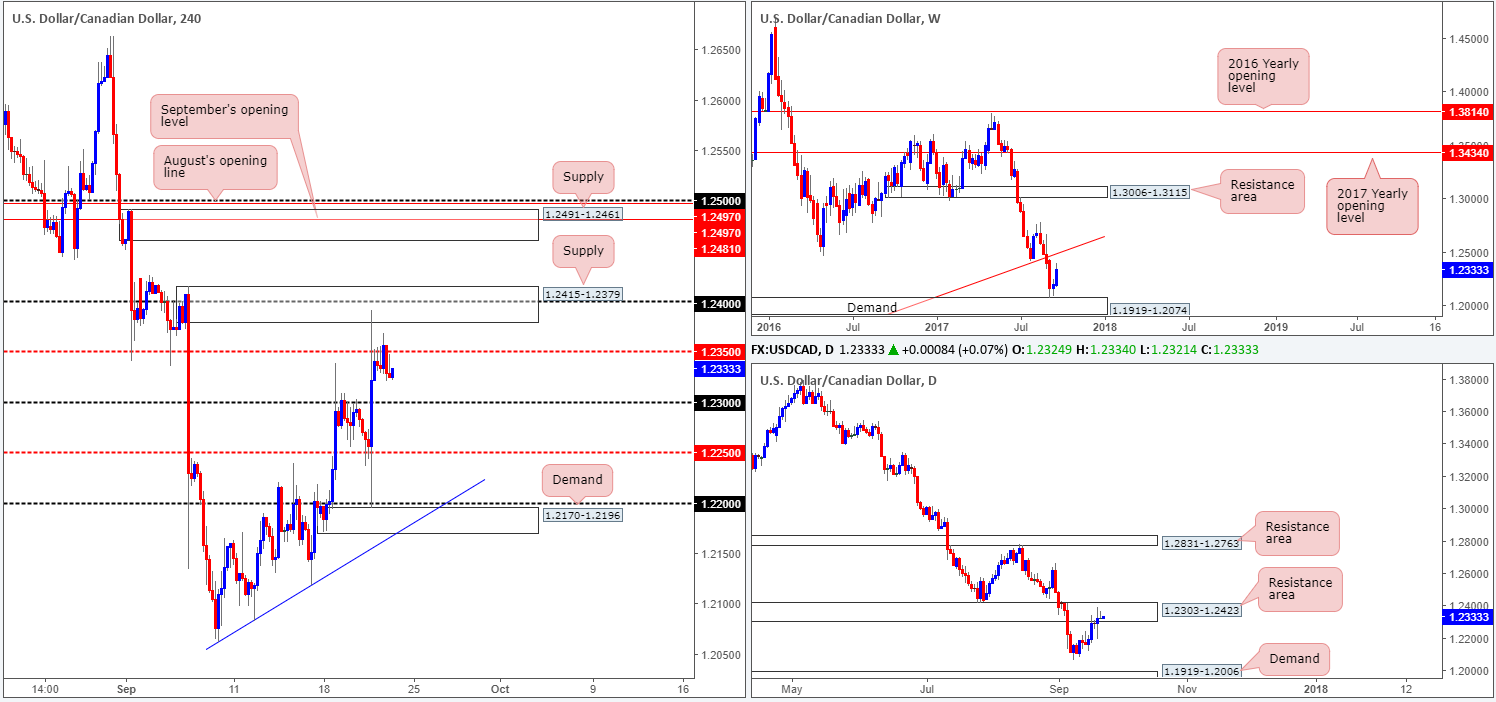

USD/CAD:

In a similar fashion to the USD/JPY, the USD/CAD saw little change on Thursday, with the unit spending the majority of the day hugging the underside of a H4 mid-level resistance at 1.2350. As we highlighted in yesterday’s report, both the H4 supply seen above at 1.2415-1.2379 and the 1.2350 barrier are located within the walls of a daily resistance area coming in at 1.2303-1.2423. However, before we all get too excited and punch the sell button, it might be worth noting that weekly price shows room to extend above the daily area to tap a long-term weekly trendline resistance extended from the low 0.9633.

Suggestions: Given the threat of further upside on the weekly scale, the team is reluctant to sell from current prices. An area we would be interested in selling, however, is the H4 supply seen at 1.2491-1.2461. Not only is it surrounded by both September/August’s opening levels at 1.2497/1.2481 and the 1.25 handle, it also intersects nicely with the noted weekly trendline resistance.

As H4 price could potentially fake above 1.2491-1.2461 to attack offers at 1.25, nevertheless, we would advise waiting for a reasonably sized H4 bear candle to take shape from here (preferably a full, or near-full-bodied candle), before pulling the trigger.

Data points to consider: Canadian inflation and retail sales figures scheduled to be released at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2491-1.2461 area ([waiting for a reasonably sized H4 bearish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

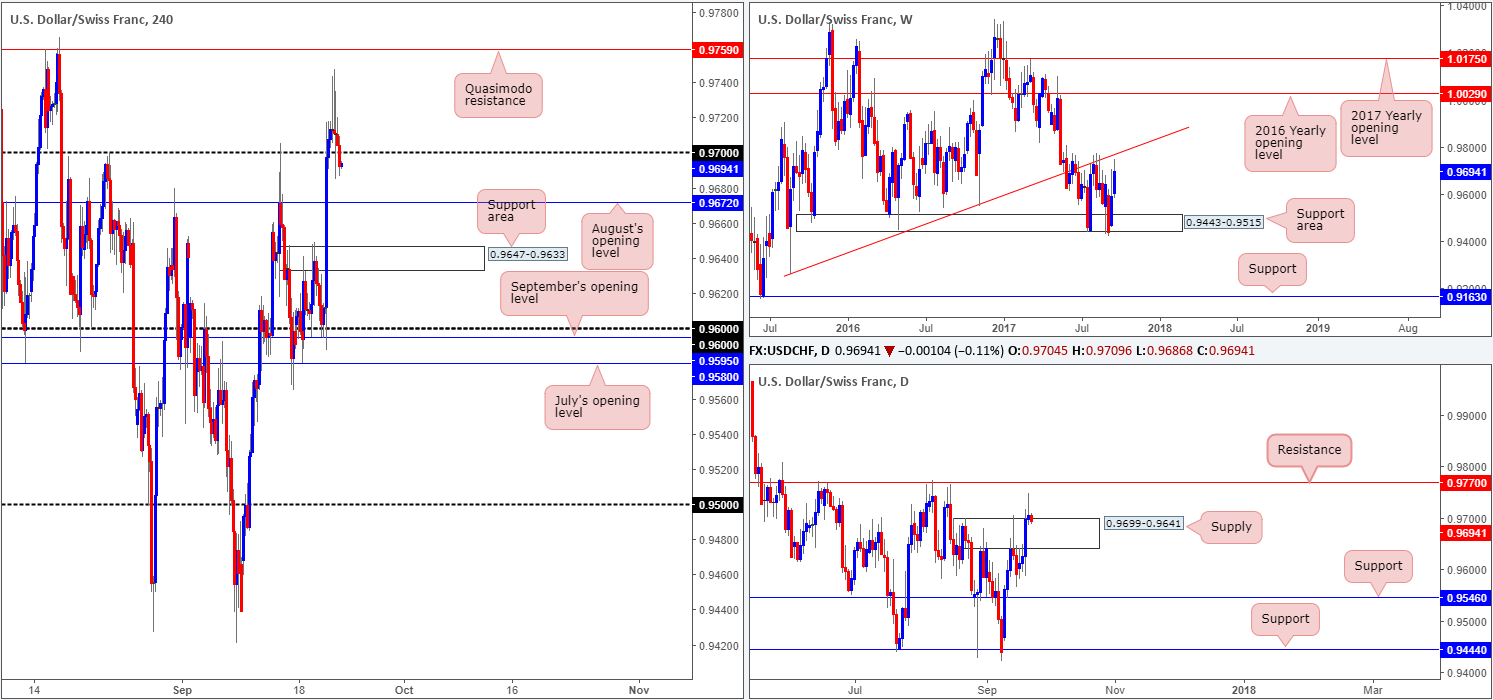

USD/CHF:

In recent dealings, H4 price put in a top at 0.9747 and shortly after collapsed back below the 0.97 boundary. Near-term, this opens up the path south down to August’s opening base line at 0.9672, followed closely by the support area coming in at 0.9647-0.9633.

Also of particular interest is daily price has aggressively punctured the top edge of supply drawn from 0.9699-0.9641 and opened up the possibility for further upside to resistance at 0.9770. What’s also interesting is that we can also see weekly price closing in on the weekly trendline resistance taken from the low 0.9257.

Suggestions: Technically speaking, although H4 action is now sub 0.97 both the weekly and daily charts show room for the market to extend north.

However, as we mentioned in Thursday’s analysis, instead of trying to long a market which is so close to testing weekly/daily structures, you could simply wait for price to challenge the H4 Quasimodo resistance at 0.9759 and look to sell. Positioned just 10 pips beneath daily resistance at 0.9770 and intersecting with a weekly trendline resistance this H4 level is, in our opinion, enough to warrant a sell without the need for additional confirmation.

Data points to consider: No high-impacting news on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.9759 area (stop loss: 0.9776).

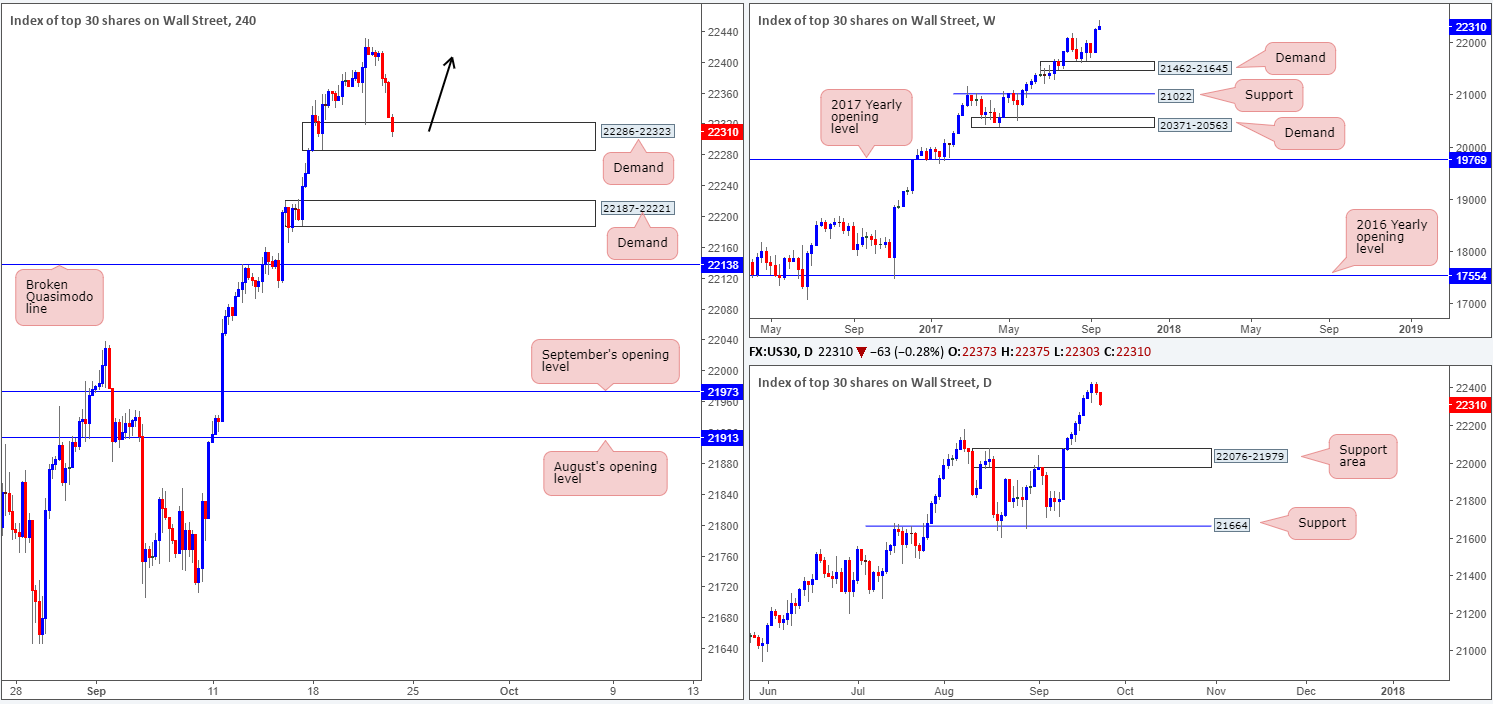

DOW 30:

Going into the early hours of Thursday’s session, US equities began paring gains. Shaped by three relatively strong H4 bearish candles, the index managed to end the day closing a few points ahead of H4 demand pegged at 22286-22323. This demand has, in our opinion, already proved its worth as it held ground in the immediate aftermath of Wednesday FOMC meet. A violation of this area, however, likely opens the door for a test of the H4 demand base coming in at 22187-22221.

Suggestions: With absolutely no resistances seen on the horizon, this remains a buyers’ market right now as far as we’re concerned. As such, we’ll be watching the current H4 demand for potential buying opportunities today. Should price chalk up a H4 bull candle in the shape of a full, or even a near-full-bodied candle, we would deem this a worthy buy signal to long this market in the hope of joining the long-term trend.

Data points to consider: No high-impacting news on the docket today.

Levels to watch/live orders:

- Buys: 22286-22323 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

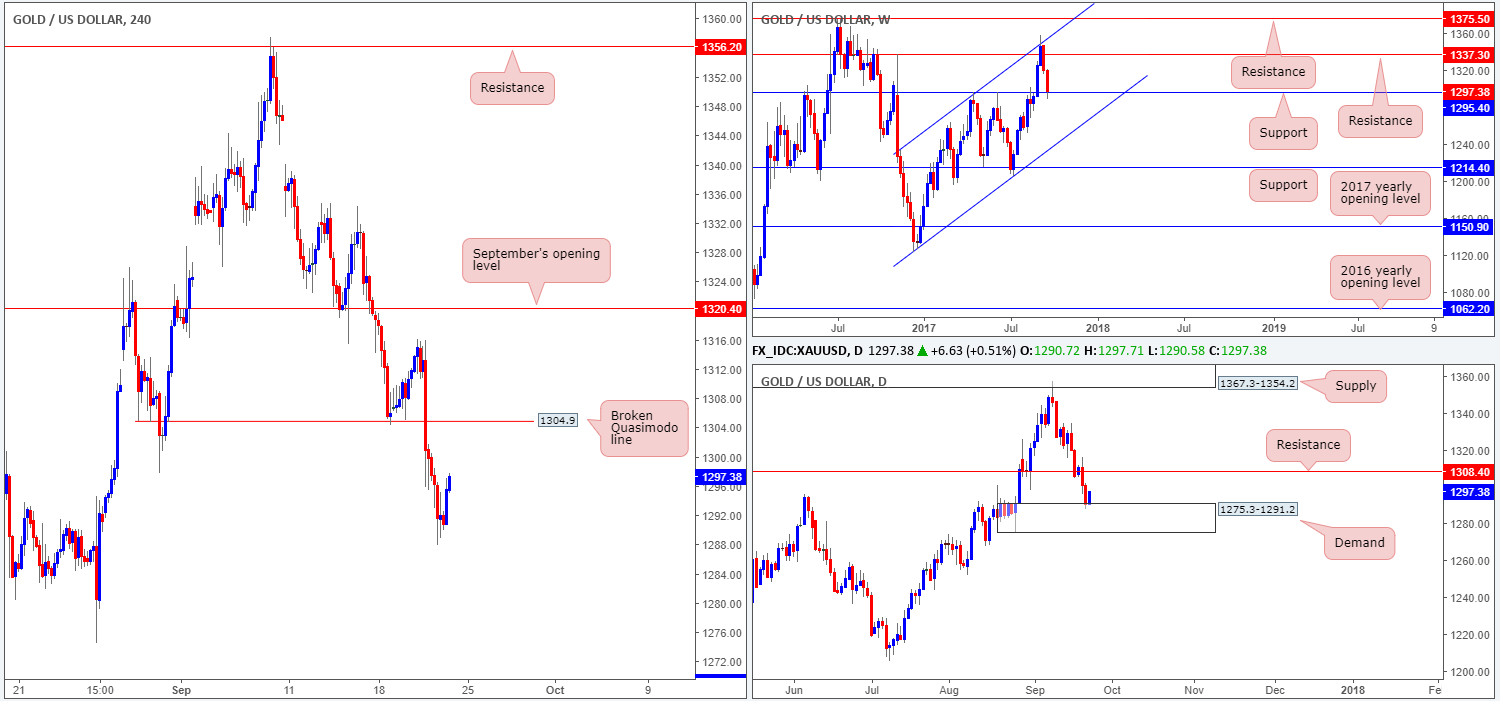

GOLD:

Kicking this morning’s report off with a quick look at the weekly timeframe shows price is currently seen crossing paths with support coming in at 1295.4. As you can see, the buyers have yet to register much interest here. Sliding down to the daily timeframe, however, the candles recently connected with the top edge of a demand base logged at 1275.3-1291.2. Should the bulls hold ground here, the next upside target can be seen at resistance drawn from 1308.4. Before price can reach this level, nonetheless, daily buyers will need to contend with the H4 broken Quasimodo line at 1304.9.

Suggestions: Although a long from weekly support looks tempting, buying into nearby H4 and daily resistances is not really our cup of tea. Along the same lines, selling at the noted H4/daily levels would, in our view, be considered

courageous given that weekly price is trading from support!

On account of the above, our desk will remain on the sidelines for the time being and reassess structure going into Monday’s open.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).