Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

US dollar index (USDX):

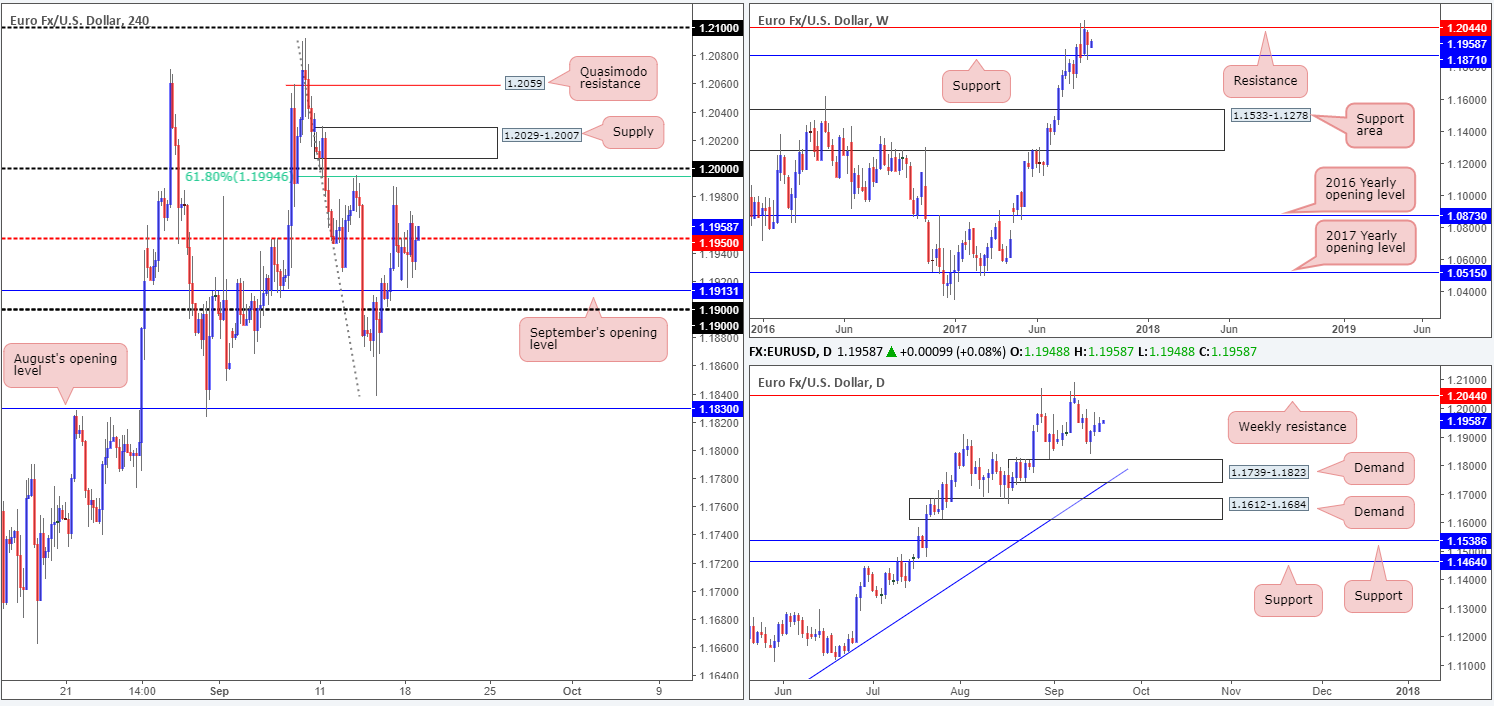

EUR/USD:

With absolutely no high-impacting news on the docket yesterday, the single currency is effectively little changed this morning. As you can see, the pair spent Monday’s sessions ranging between the H4 mid-level resistance at 1.1950 and September’s opening level at 1.1913. Therefore, much of the following report will echo similar thoughts put forward in yesterday’s analysis…

On the weekly timeframe, the unit remains confined between resistance at 1.2044 and support coming in at 1.1871. In addition to this, the weekly USDX chart shows price trading beneath resistance at 11854, with room to move down to at least support positioned at 11687 (converges with a long-term trendline support etched from the low 9322). Moving down to the daily timeframe, price has been consolidating between the noted weekly resistance level and a demand coming in at 1.1739-1.1823 since August 29.

Suggestions: Given H4 action currently trading a tad above the mid-level resistance 1.1950, traders may want to note the large psychological number 0.80 lurking ahead. Not only is this a watched level in the market, it is also bolstered by a strong-looking H4 supply just above it at 1.2029-1.2007 and a nearby H4 61.8% Fib resistance at 1.1994 taken from the high 1.2092. For that reason, price may bounce lower from here.

To trade any bounce seen from 0.80, nonetheless, we would highly recommend drilling down to the lower timeframes to secure a tighter entry (see the top of this report for information on how to do this). This will likely help secure better risk/reward should price reverse before reaching 1.1950 (first take-profit target).

Data points to consider: German ZEW economic sentiment at 10am. US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.80 region ([waiting for a lower-timeframe entry signal to form is advised] stop loss: dependent on where one confirms this area).

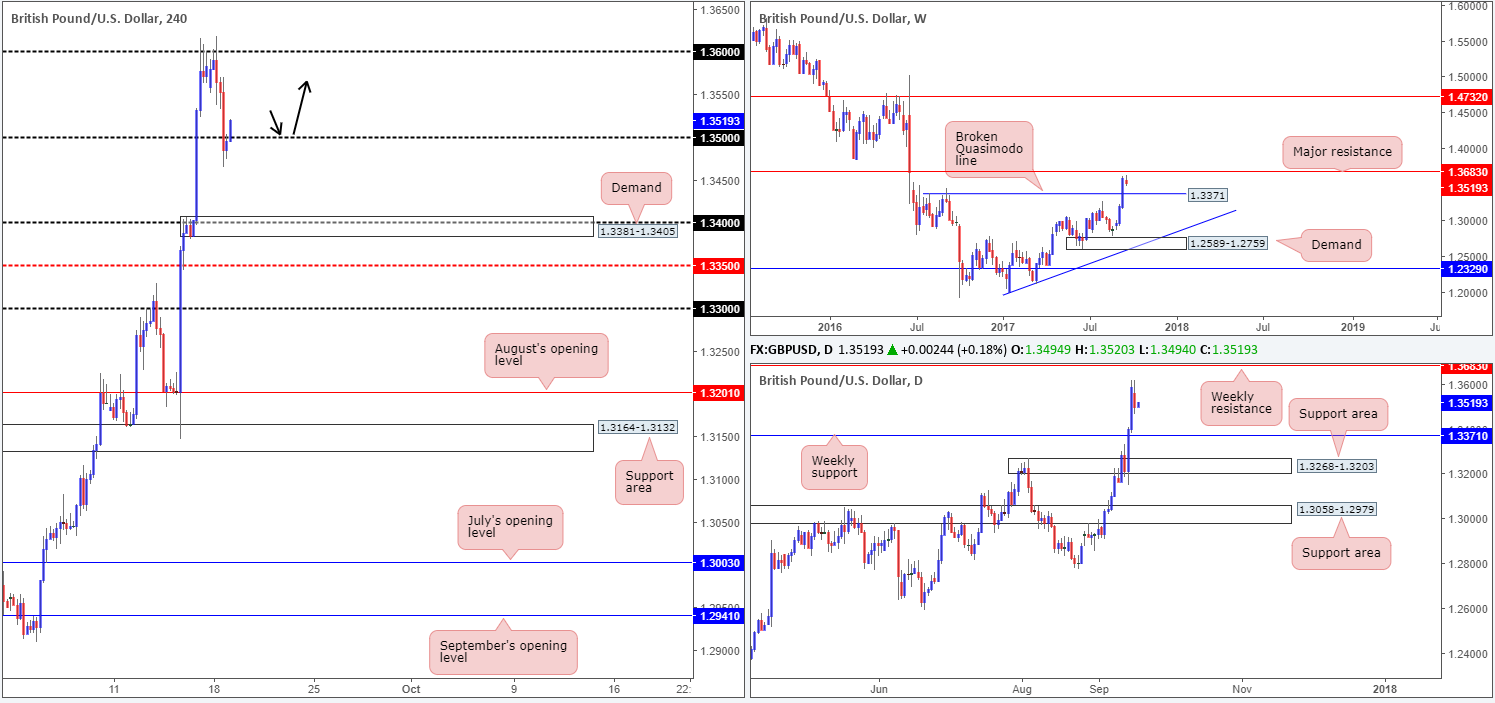

GBP/USD:

The British pound, as you can see, failed to sustain gains beyond the 1.36 handle during the early hours of London. This eventually transpired into a substantial move lower, intensified by BoE’s Gov. Carney’s recent comments, forcing the pair to trade sub 1.35 going into the closing bell. As you can see though the bears were unable to hold ground here, allowing H4 price to edge its way back above 1.35 this morning.

Looking over to the bigger picture, weekly price is seen loitering between a major resistance level drawn from 1.3683 and a broken Quasimodo line at 1.3371. With USDX weekly action trading beneath resistance at 11854, there’s a strong possibility GBP resistance will come into play sometime this week. On the daily timeframe, there’s not really much to add except that the USDX daily candles could possibly halt around demand at 11681-11749 (fuses with a channel support taken from the low 12352) should a downside (dollar) move take place.

Suggestions: Although yesterday saw a brisk 100-pip move lower, our desk is still biased to the upside for now. Aside from weekly USDX trading beneath resistance, both weekly and daily GBP charts show room to advance up to as far as 1.3683. For that reason, we will be keeping a close eye on the 1.35 handle today for possible buying opportunities. Ideally, we would like to see 1.35 retested as support (see black arrows) before pulling the trigger. Should this trade come to fruition, 1.36 will be the next port of call, followed by the major weekly resistance, thus giving us plenty of room to lock in substantial profits.

Data points to consider: US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: 1.35 region ([waiting for a H4 confirming bull candle to form following the retest is advised, preferably in the shape of a full, or near-full-bodied candle] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

AUD/USD:

Coming in from the top this morning, weekly flow shows price extending losses from resistance at 0.8075. In the event that the bears remain in the driving seat here, the next port of call will likely be the support area coming in at 0.7849-0.7752. Sliding down to the daily timeframe, nevertheless, price recently engaged with a support level seen at 0.7955. A violation of this level would likely pressure the major back down to demand coming in at 0.7786-0.7838 (seen positioned within the walls of the noted weekly support area).

Across on the H4 timeframe, the large psychological level 0.80/August’s opening level at 0.7998 held firm in early trading, lifting price back up to supply at 0.8044-0.8028. It was from here though that things turned sour for the commodity currency as price stormed lower, breaking through 0.80 and the mid-level support at 0.7950, and coming within a pip of testing September’s opening level at 0.7939.

For those who read Monday’s report you may recall that we had a pending buy order set at 0.7939 with a stop loss positioned at 0.7918, meaning we missed the move by a pip! But well done to any of our readers who managed to pin down a position from here.

Suggestions: Near term, we feel the Aussie will continue to advance today at least until we reach 0.80. Therefore, for traders already long, you might want to consider reducing risk to breakeven around this point and taking some profits off the table. Still, considering the RBA takes to the stage in a few hours, you may be forced to reduce risk sooner than expected.

Other than our recent call, we do not see much else to hang our hat on at the moment.

Data points to consider: Australian monetary policy meeting at 2.30am. US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

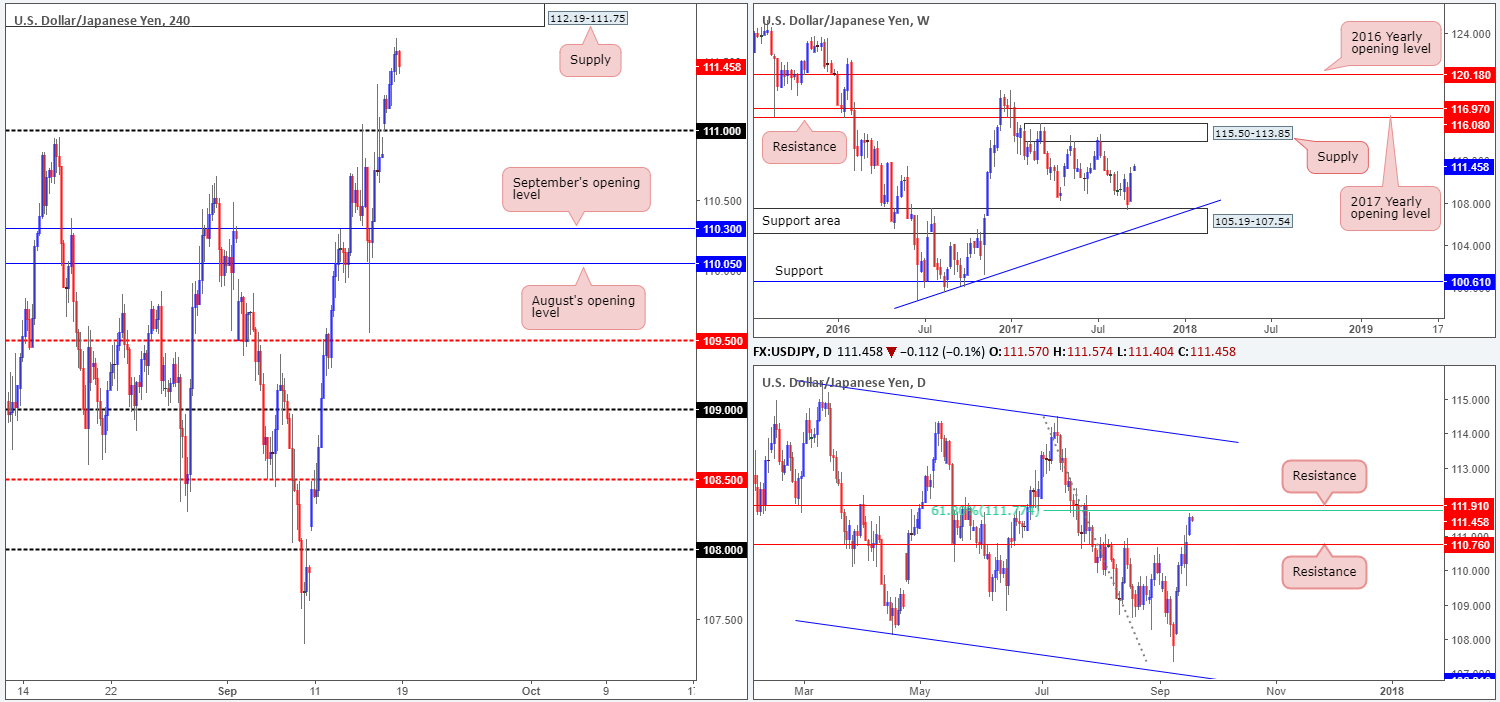

USD/JPY:

As expected, the 111 handle failed to provide resistance on Monday, consequently opening up the path north to H4 supply at 112.19-111.75.

Apart from weekly price, which is seen trading from a support area coming in at 105.19-107.54, daily and H4 price show there’s a possibility for a pullback today/this week. On the daily timeframe, we have a nearby resistances planted at 111.91/61.8% daily Fib at 111.77. Alongside this, H4 price highlights the supply mentioned above at 112.19-111.75, which holds July’s opening level at 112.09, the 112 handle and the above said daily resistances within. This – coupled with the USDX weekly chart trading beneath resistance at 11854, makes the H4 supply a very interesting area indeed.

Suggestions: Keeping it simple this morning, we have set a pending sell order around the underside of H4 supply at 111.75 and a stop-loss order two pips beyond the area at 112.21. Assuming the order fills today, we’ll be eyeing the 111 handle as an initial take-profit target.

Data points to consider: US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 111.75 ([pending order] stop loss: 112.21).

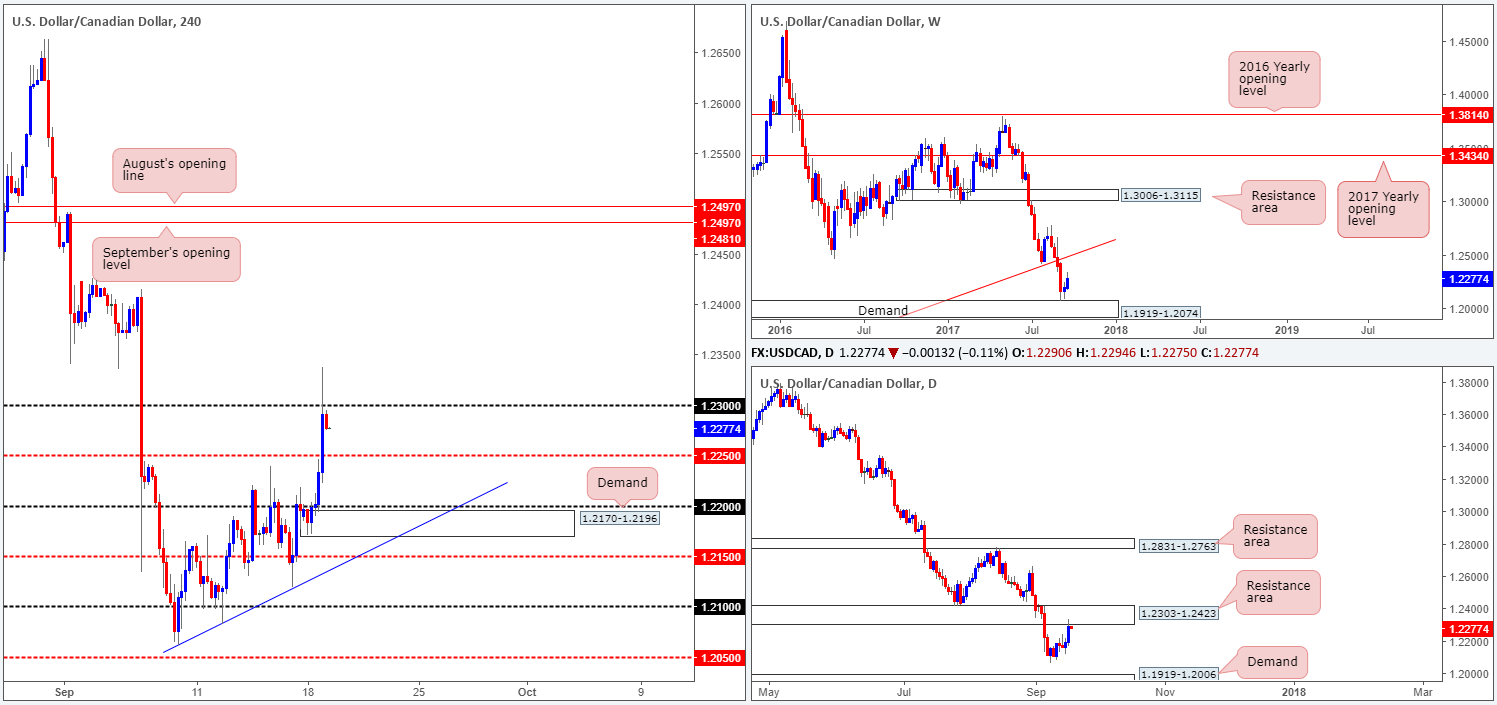

USD/CAD:

The pair rose more than 100 pips during the US afternoon segment on Monday, following BoC Deputy Governor Tim Lane’s comments.

Given weekly price is currently seen trading from demand at 1.1919-1.2074, yesterday’s move should have not really come as too much of a surprise.

Apart from the rather brutal whipsaw through the 1.23 handle, we can see the recent move north also brought daily price into the jaws of a resistance area formed at 1.2303-1.2423. With this area having been a reasonable support back in July, as well as the unit currently entrenched within a steep downtrend at the moment, price is likely to find some active sellers residing here.

Suggestions: As you can probably guess from our notes, a long in this market is great from a weekly perspective, but precarious according to the daily timeframe. Although we believe H4 price will selloff back down to at least the mid-level support at 1.2250/H4 demand at 1.2170-1.2196 today, we are just not willing to short into potential weekly buyers. As such, we will remain on the sidelines today and look to reassess price action going into tomorrow’s open.

Data points to consider: US Housing figures and Canadian manufacturing sales m/m at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

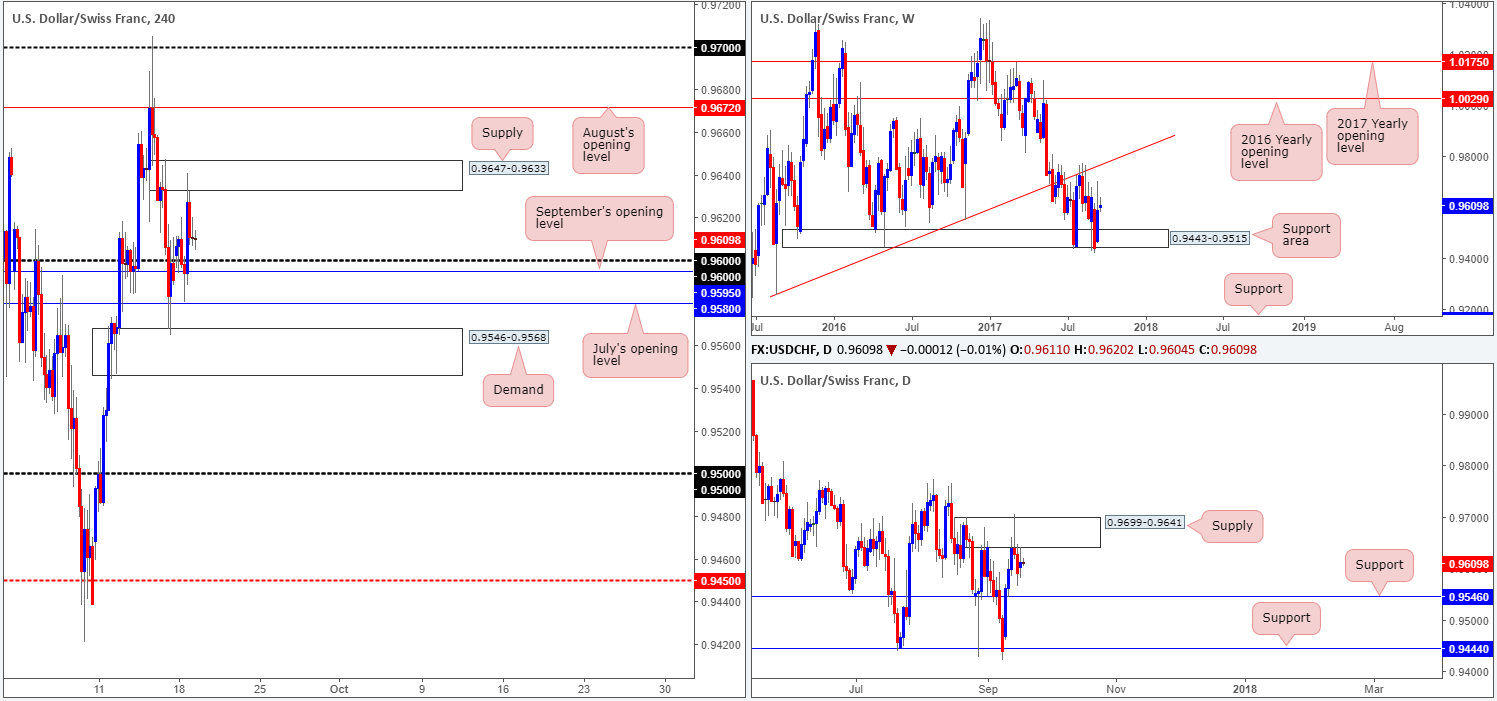

USD/CHF:

Using a top-down approach this morning, the buyers and sellers on the weekly chart remain battling for position between a support area registered at 0.9443-0.9515 and a trendline resistance etched from the low 0.9257.Also of particular interest is weekly price over on the USDX is seen trading below resistance at 11854.Turning our attention to the daily timeframe, price remains capped by supply penciled in at 0.9699-0.9641. Should the Swissy continue lower, the next area of support on tap can be seen at 0.9546.

During the course of Monday’s sessions, the candles shook hands with supply coming in at 0.9647-0.9633, after finding a floor of support around September’s opening level at 0.9595. Despite yesterday’s movement, we are sure you’ll agree with us when we say H4 action is somewhat restricted at the moment. To the upside, not only do we have the current supply to contend with, there’s also August’s opening level at 0.9672 lurking nearby. To the downside, however, there’s the 0.96 handle, two monthly opening levels (September/July – 0.9595/0.9580), shadowed closely by demand pegged at 0.9546-0.9568.

Suggestions: With little ‘wiggle’ room for H4 price to move, and not much going on over on the bigger picture, we’ll place this market on the back burner for the time being and reassess structure tomorrow.

Data points to consider: US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

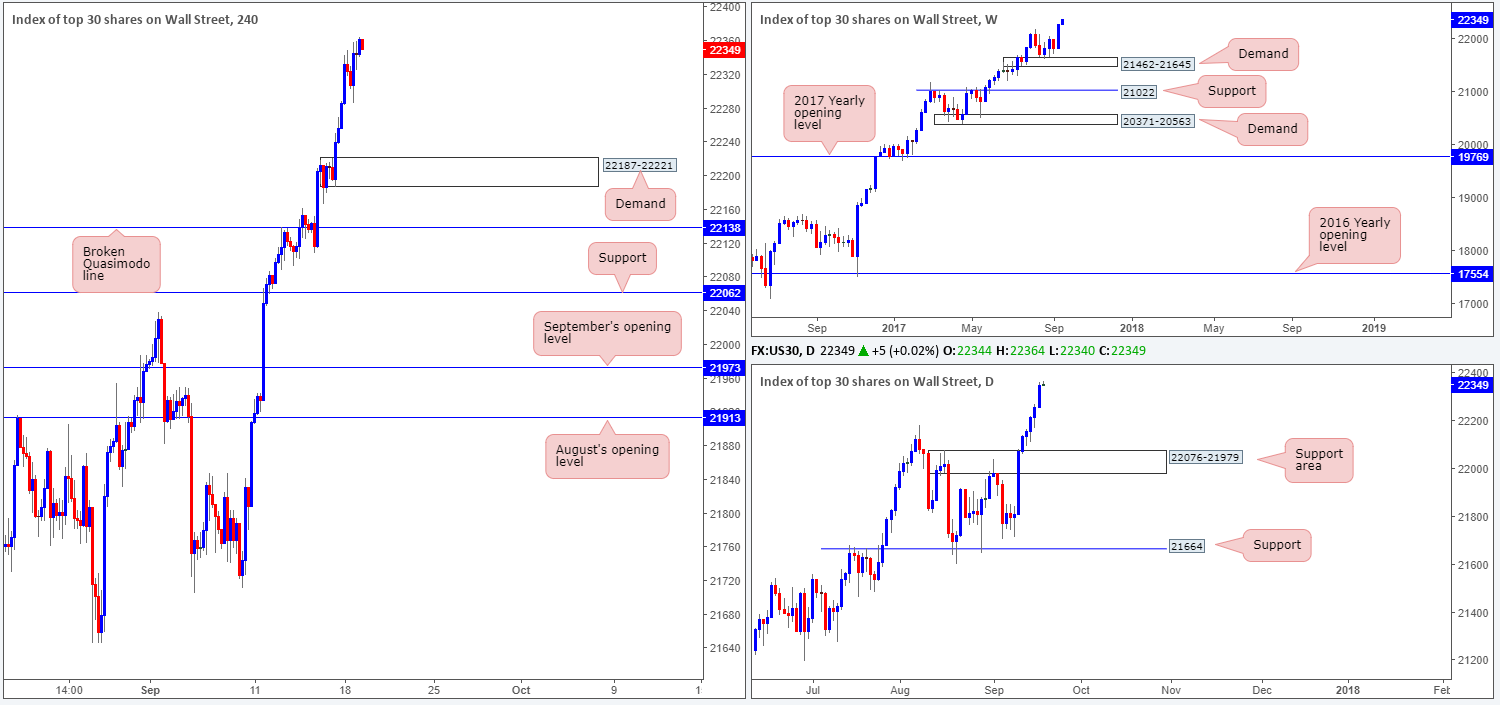

DOW 30:

US equities extended Friday’s advance on Monday, reaching a record high of 22359. As highlighted in yesterday’s report, a pullback on the H4 timeframe could see price cross swords with the demand zone at 22187-22221. A violation of this area, however, likely opens the door for a test of the broken Quasimodo line at 22138, which happens to sit just above a daily support area fixed at 22076-21979.

Suggestions: With absolutely no resistances seen on the horizon, this is a buyers’ market right now as far as we’re concerned. As such, we’ll continue to watch both the above said H4 supports for possible buying opportunities should the index dip lower.

Data points to consider: US Housing figures at 1.30pm GMT+1.

Levels to watch/live orders:

- Buys: 22187-22221 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail). 22138 ([waiting for a reasonably sized H4 bullish candle to form – preferably a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

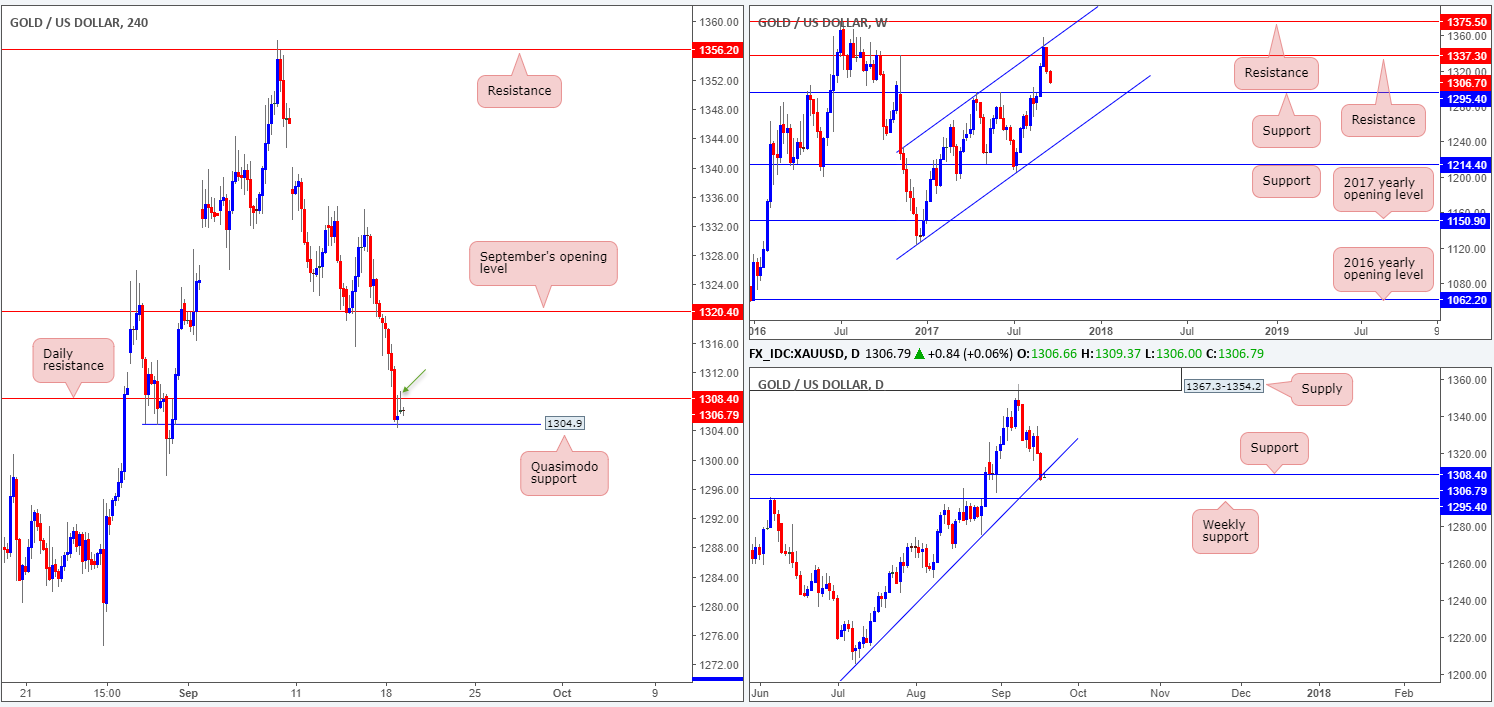

GOLD:

As demand for havens fade, the yellow metal continued to press lower on Monday after a marginal close below September’s opening level at 1320.4 last week. Daily support at 1308.4, as you can see, was taken out, leaving H4 price free to challenge a H4 Quasimodo support level pegged at 1304.9.

The bounce from this H4 boundary has so far been unable to register anything noteworthy, as the recently broken daily support is now offering the market resistance. Over on the weekly timeframe, gold looks poised to extend losses this week, at least until we reach support marked at 1295.4.

Suggestions: We would not want to be buyers in this market right now! Not only do we have space for weekly sellers to stretch their legs, but now we also have resistance forming on the daily timeframe. In fact, H4 price has just finished printing a nice-looking bearish selling wick (green arrow) at the underside of this daily resistance. This could, given the position of current price on the bigger picture, be enough to short this market and target the above said weekly support level.

Aside from the current H4 Quasimodo support, the only risk we see by selling this market is USDX weekly price trading beneath resistance at 11854 – a dollar move lower could translate to a push higher on gold.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Possible short at current price (stop loss: 1310.1).