A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

Entering into the early hours of yesterday’s European session, we saw the single currency put in a top around the 1.0479 region. Shrugging off better-than-expected German data, the pair then went on to clock lows of 1.0411 from here going into the early hours of the US segment. Following a brief pullback from this point (just ahead of the 1.04 handle), the major resumed its decline on the back of comments made by Fed Chair Janet Yellen regarding the labor market.

As we write, price is currently seen probing the 1.04 handle. While a long from this psychological base is an option given that it’s located within a major weekly support area at 1.0333-1.0502 (can be seen stretching as far back as 1997), one has to bear in mind that the daily candles show room to extend yesterday’s losses on the daily chart (which happened to form a bearish engulfing candle yesterday) down to daily support at 1.0360.

Our suggestions: Basing our analysis on the above points, the team has noted that they’re reluctant to begin hunting for longs around the 1.04 region. Of course, that does not mean the level will not hold and push prices higher today! For traders still interested in buying from here, we would recommend waiting for at least a reasonably sized H4 bull candle to form before pressing the buy button.

Data points to consider: There are no high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

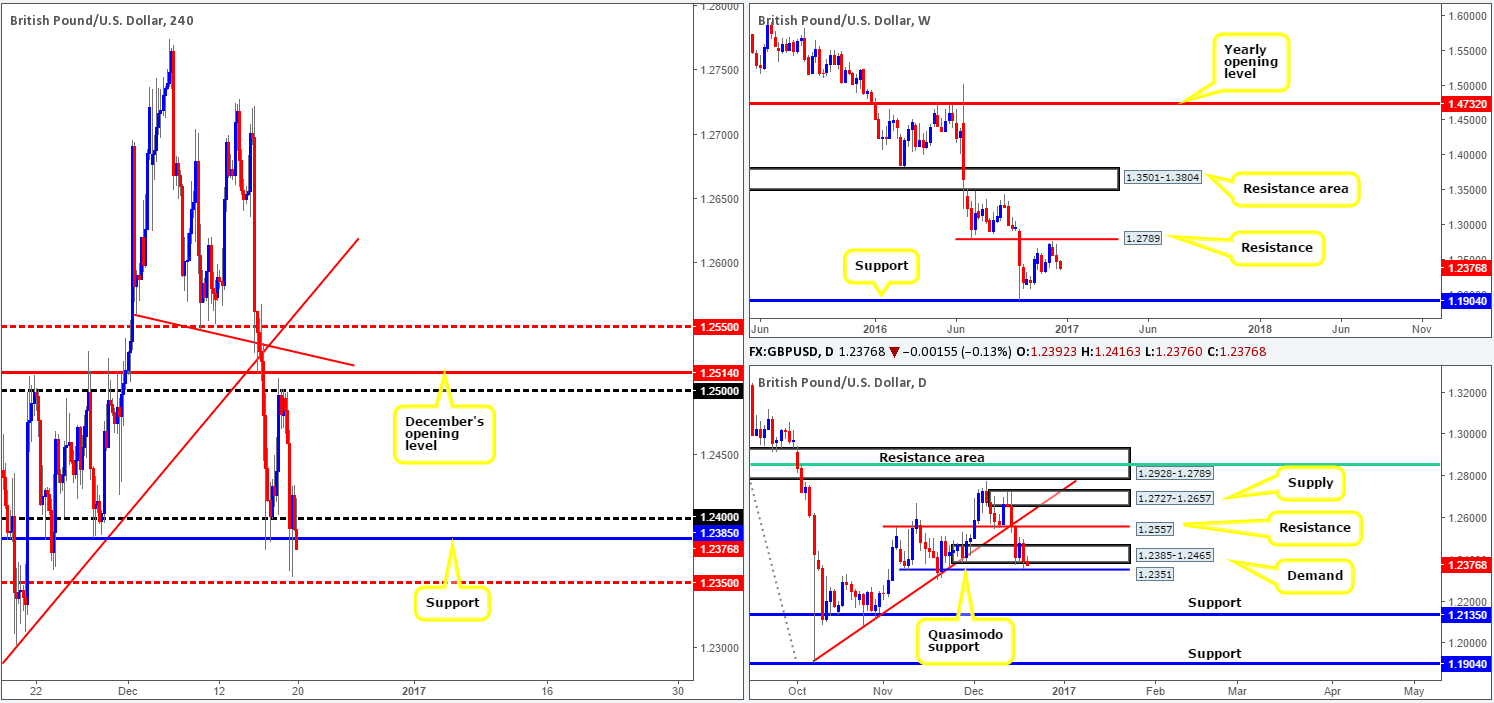

GBP/USD:

After a brief phase of consolidation around the 1.25 handle, the pair plummeted over 100 pips as London opened their doors for business. To our way of seeing things, the move came about following comments made by Scotland’s First Minister Nicola Sturgeon, concerning a new referendum on separation from the UK if the country fails to remain within the single market following Brexit.

Yesterday’s decline also saw daily action punch through demand at 1.2385-1.2465 and come within striking distance of connecting with a nearby daily Quasimodo support line at 1.2351. This line – coupled with the H4 mid-way support at 1.2350 makes for a reasonably strong base for longs.

Our suggestions: This begs the question; would our desk consider buying from the 1.2350 point today? Well, in view of how close price came to visiting the hurdle yesterday, and taking into account its reaction (two buying tails suggesting strong demand), as well as the fact that this line is reinforced by a daily Quasimodo support level, we feel a bounce from this region may be on the cards. Be that as it may, traders need to be prepared for the possibility that a whipsaw through1.2350 could be seen, as there is likely a collection of stops seen lurking beyond this region just waiting to be tapped. With this in mind, we would only recommend entering long from here if, and only if, one is able to pin down a lower-timeframe buy signal. The first take-profit target, at least for our desk, would be the current H4 support at 1.2385 (which would at that point be considered resistance).

Lower-timeframe confirmation is considered to be either of the following: a break above supply followed by a retest, a trendline break/retest or simply a collection of well-defined buying tails around the said H4 buy zone. We search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures. However, this can vary.

Data points to consider: There are no high-impacting news events on the docket today relating to these two markets.

Levels to watch/live orders:

- Buys: 1.2350 region ([lower-timeframe confirmation required prior to pulling the trigger] stop loss: dependent on where one confirms the area).

- Sells: Flat (stop loss: N/A).