A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, andhas really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

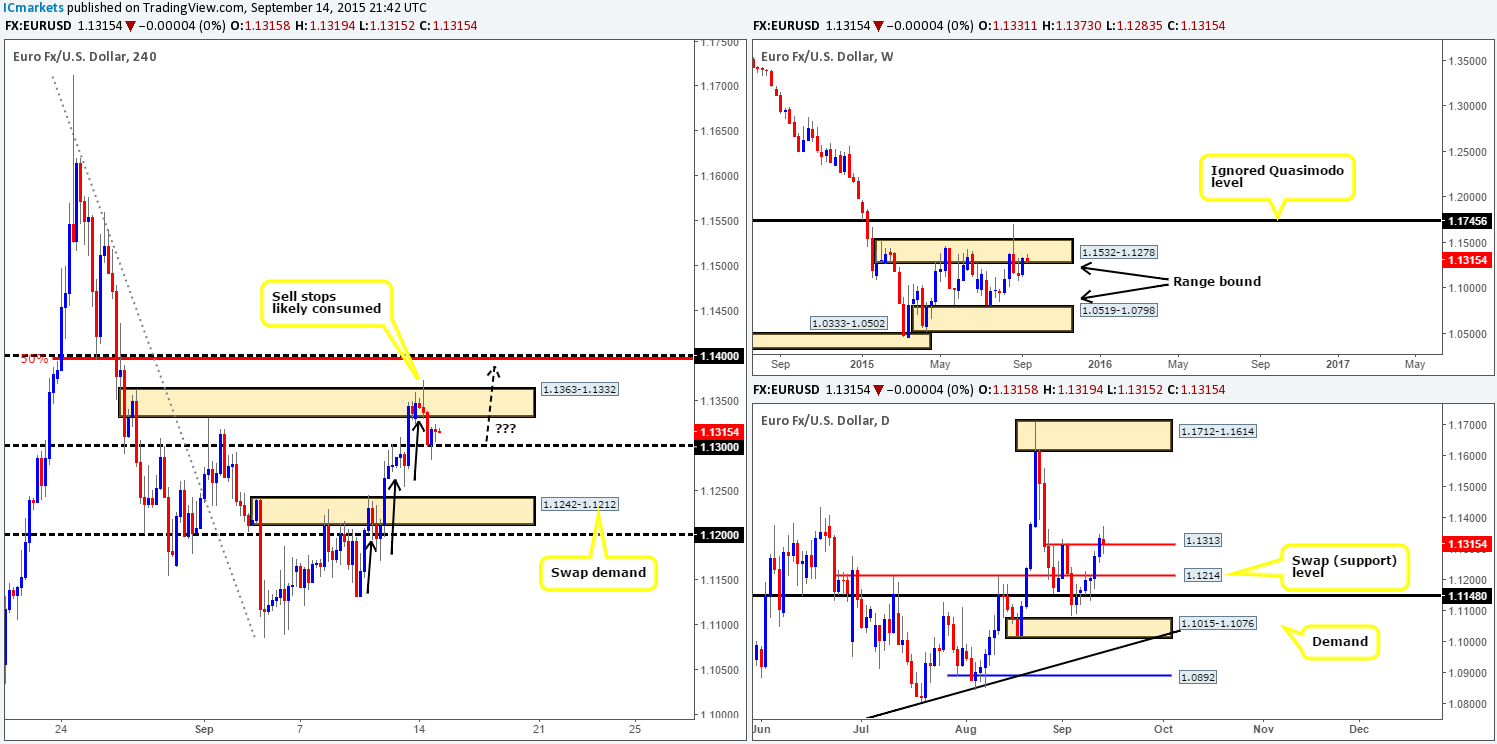

EUR/USD:

The market opened five pips lower than Friday’s close at 1.1331. As you can see, early morning trade began at a steady pace; it was only once London opened for business did we see any noteworthy action. Price faked above the current 4hr supply at 1.1363-1.1332, likely stopping out a ton of traders attempting to fade this zone in the process. Not long after this, the EUR aggressively sold off down to retest psychological support 1.1300, whichhas held firm so far.

With offers likely cleared from the aforementioned 4hr supply above, and price showing support at 1.1300, would we consider this to be a stable enough platform to consider buys from today? Well, initially, we were hoping price would drive north up to 1.1400 to complete an AB=CD pattern (see our previous reporthttp://www.icmarkets.com/blog/monday-14th-september-weekly-technical-outlook-and-review/) but with this recent movement our outlook has changed. Check out the black arrows on the 4hr chart, can you see there is somewhat of a symmetrical four-drive pattern setting up? Therefore, if price remains above 1.1300 today, we may get the chance to buy (with confirmation) the forth drive up to 1.1400…

Supporting this trade, there’s potential support forming on the daily timeframe at 1.1313. Even though an indecision candle formed here during yesterday’s trade, support still held thus making it a legit line in our opinion. Assuming that the buyers manage to maintain their position above 1.1313 this week, we see very little resistance overhead until supply at 1.1712-1.1614. The only downside to buying 1.1300 is seen on the weekly chart. Price is currently trading within supply, but with last week’s buying interest around the underside of this zone, we’re confident that a 100-pip move from 1.1300 to 1.1400 is still possible.

Levels to watch/live orders:

- Buys:1.1300 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

- Sells:Flat (Stop loss: N/A).

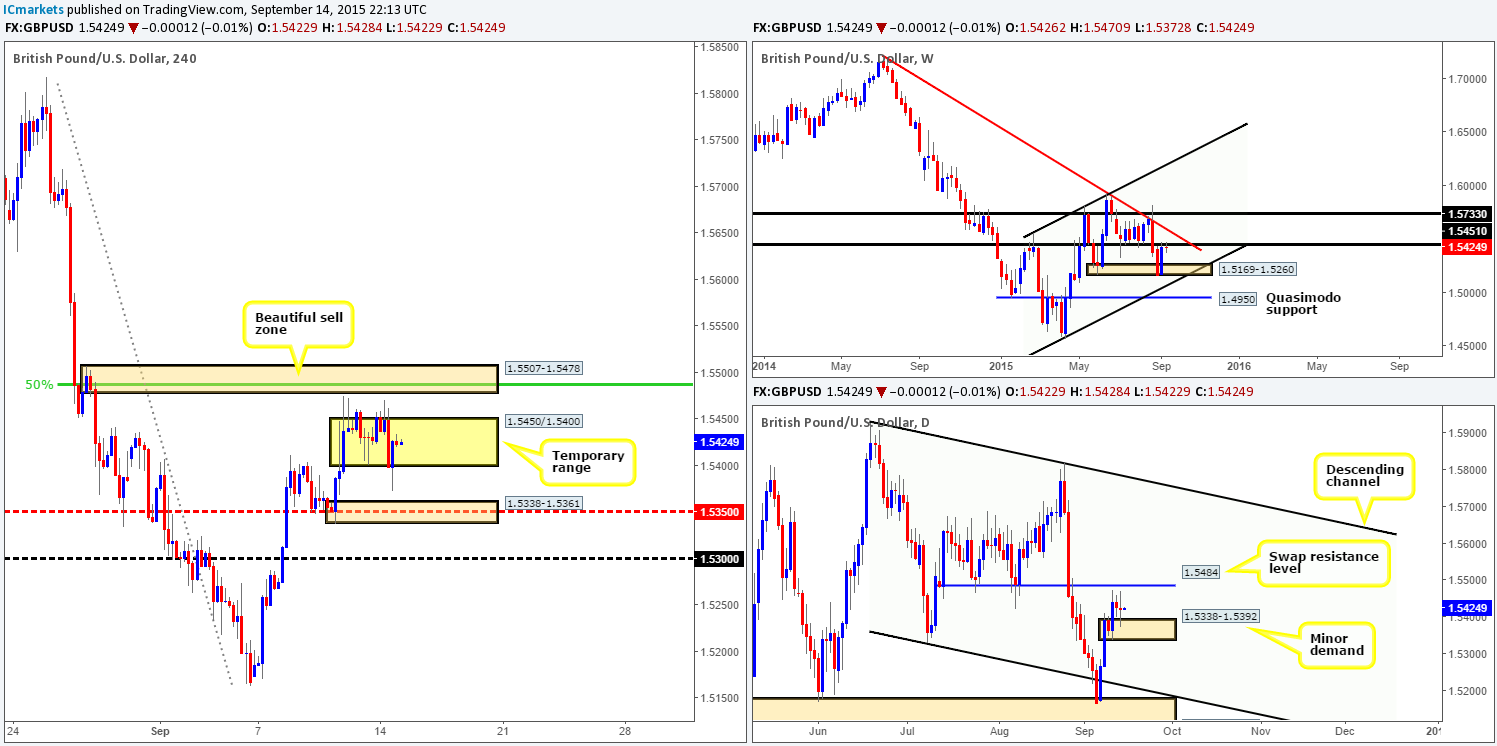

GBP/USD:

A conservative wave of bids hit the line shortly after the market opened at 1.5426 yesterday. This pushed price up to mid-level resistance at 1.5450, where a strong ceiling of offers eventually forced price back down to psychological support at 1.5400, consequently forming a temporary range on Cable’s 4hr chart.

Our team has come to an agreement that trading this temporary 4hr consolidation today is not something we’d be comfortable with. What we are interested in, however, is its surrounding barriers:

- A fresh 4hr supply zone sitting above at 1.5507-1.5478, boasting not only 50% Fibonacci resistance at 1.5485, but also psychological resistance at 1.5500.

- Just beneath the 4hr range, we also have a 4hr demand zone at 1.5338-1.5361 that has additional support from the mid-level number 1.5350.

The big question for us now is WHICH zone!? To our way of seeing things at the moment, we’d much prefer to short the aforementioned 4hr supply zone since weekly price action is currently trading around a swap resistance level at 1.5451. However, this does not mean we’re totally discounting a long trade from the 4hr demand area, as this zone also has the backing of a minor daily demand area coming in at 1.5338-1.5392.

The safest, and in our opinion, most logical way to approach the above said 4hr areas is to simply wait until price reaches either zone and ONLY enter when/if corresponding lower timeframe confirmation is seen.

Levels to watch/ live orders:

- Buys: 1.5338-1.5361 Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 1.5507-1.5478 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

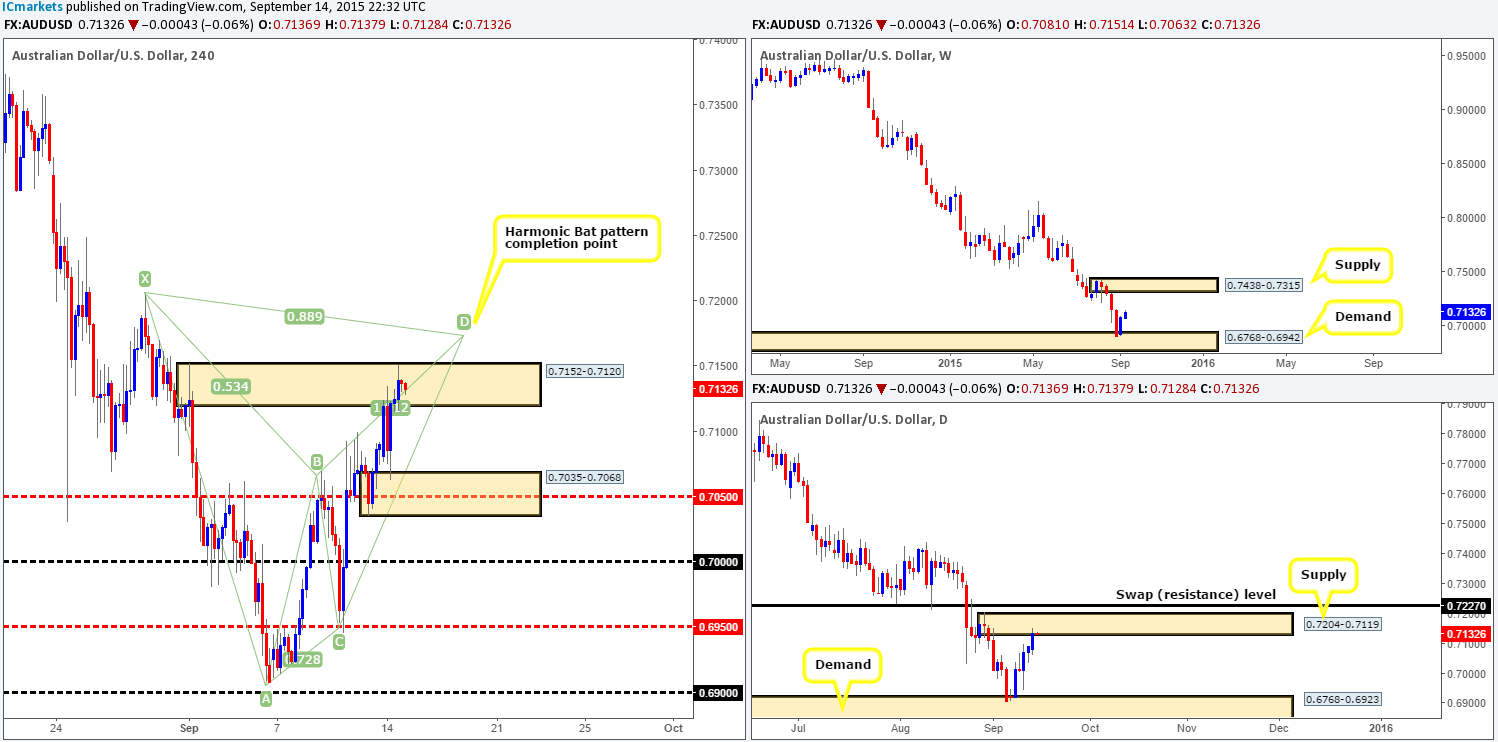

AUD/USD:

There were no big surprises during the weekend as price opened only eight pips below Friday’s close at 0.7081. Following this, however, we saw market action whipsaw between 4hr supply at 0.7152-0.7120 and 4hr demand at 0.7035-0.7068. This, as you can see, ended with price driving higher intothe above said 4hr supply zone reaching highs of 0.7151 on the day.

In the event that the Aussie remains well-bid, we believe the D-leg of a 4hr Harmonic Bat pattern terminating around the 0.7170 area may complete soon. This is certainly somewhere we’d consider selling if price reaches this high, since it sits within the current daily supply zone coming in at 0.7204-0.7119. We also like the way this Harmonic pattern completes just above the aforementioned 4hr supply area – this has fakeout written all over it!

However, even if price does reach our 4hr Harmonic zone this week, we still need to tread carefully. Let’s not forget that although price is currently trending south, we have recently seen buying pressure from weekly demand at 0.6768-0.6942. This warrants caution. Unless we are able to spot lower timeframe selling confirmation around this 4hr Harmonic sell zone, we’ll quite happily pass on the trade, since getting caught on the wrong side of weekly flow will not do your account any favors!

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.7071 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level).

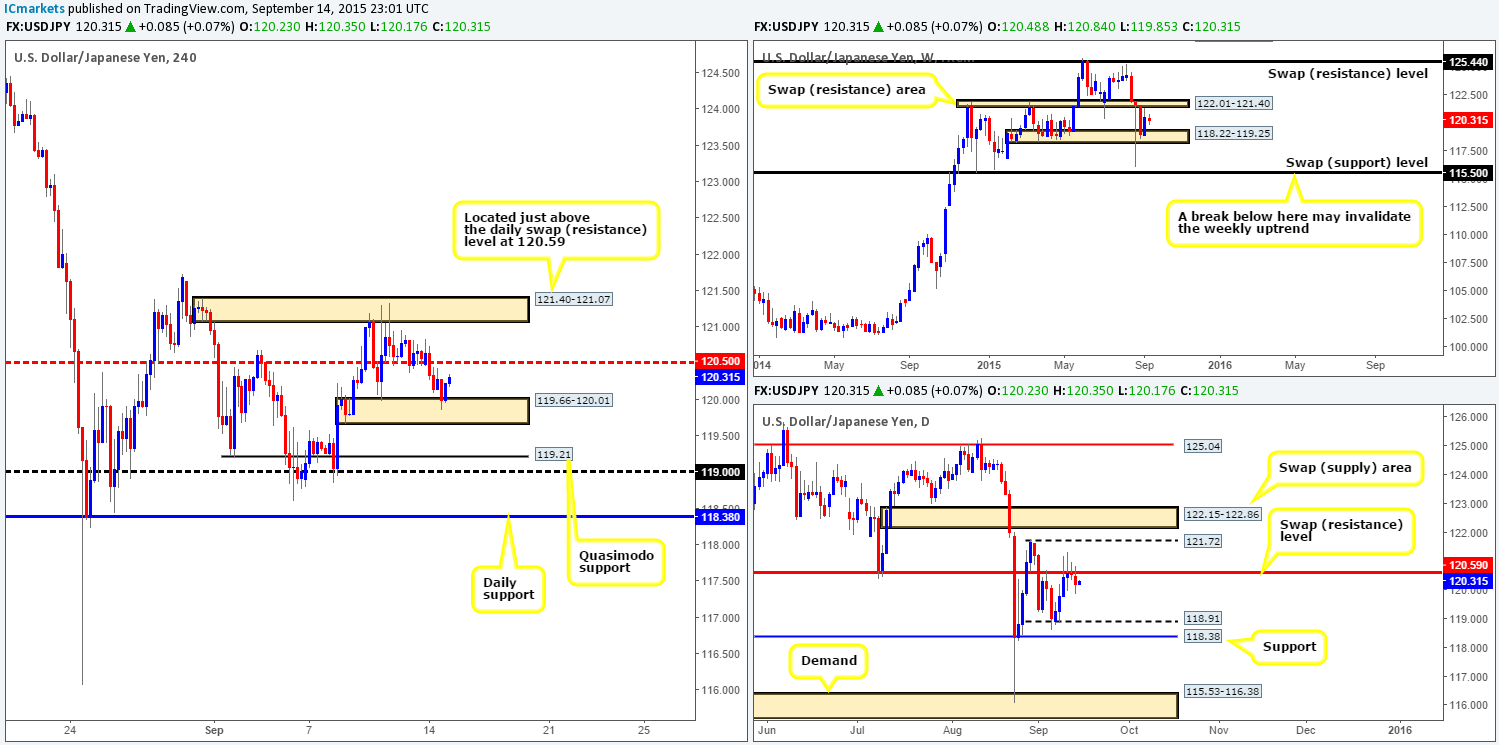

USD/JPY:

A few hours after the market opened (120.48), price chomped its way through bids sitting around the mid-level support 120.50 and headed down towards 4hr demand at 119.66-120.01, which was defended into the close 120.23.

This pair, in our opinion, is proving a difficult beast to trade at the moment. 4hr structures are so closely pinned together; it’s hard to find space for price to run. Above the current 4hr demand, we see a space of about fifty or so pips up to 120.50. We agree, this is tradable, but the risk/reward, at least for us would be skewed at current prices since we’d want our stop below the 4hr demand base itself. If price drops deep into this 4hr demand and a lower timeframe long setup is seen, we’d be ALL OVER IT!

Below 4hr demand, there is around forty pips of space down to a 4hr Quasimodo support. Again, this a tradable move, but unfortunately for us the risk/reward would not be enough unless a deep retracement was seen allowing us to place out stop above the 4hr demand (which at that point would be supply).

The only other thing we will note here is the fact that price is holding below a daily swap (resistance) level at 120.59 at the moment, which has space to run lower down to 118.91 – a daily support barrier.

With the above taken into consideration, our team has decided that it’s best to remain on the sidelines during today’s trade and wait for a setup with better risk/reward to present itself.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells:Flat (Stop loss: N/A).

USD/CAD:

Offers piled into the USD/CAD at yesterday’s open (1.3262) dragging this market down to the 1.3235 region, which, as you can see, remained well-bid throughout the London morning session. It was only once the U.S. traders joined in the party did we see any real action – the market was heavily bought, bringing price back up to the underside of the 4hr descending channel (1.3352/1.3142).

Looking at the 4hr chart this morning almost hurt our eyes! It really is quite a mess. However, even though price is currently choppy at the moment, it has still been contained very well between a 4hr ascending trendline taken from the low 1.2950, and the aforementioned 4hr channel resistance. The question is though, would we trade it?

Personally, we feel this pair is now best left alone until a breakout is seen, since we have little Intel from the weekly timeframe other than price is trading mid-range, and let’s be honest, price is not exactly showing much enthusiasm beneath daily supply (1.3352-1.3284) at the moment.

Levels to watch/ live orders:

- Buys:Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

USD/CHF:

Following the open 0.9691, price headed south and hit a line of active bids sitting around the 0.9670 region – a 4hr ignored Quasimodo level. For those who read Monday’s report http://www.icmarkets.com/blog/monday-14th-september-weekly-technical-outlook-and-review/ you may recall us mentioning to watch this area for potential long trades. Well done to any of our readers who managed to lock in some green pips from this intraday bounce.

With price shortly after rebounding from nearby 4hr resistance at 0.9711 going into U.S. trade, this pushed the Swiss pair back down to where it began – 0.9670. So, where do we go from here? Ultimately, our team is bearish. The reasons for why come from price reacting from a weekly swap (resistance) level at 0.9796 last week, and also recently closing below a daily swap (support) level at 0.9689.

Therefore, today’s spotlight will be once again focused on 0.9670. Ideally, we’re looking for price break through this level and retest it as resistance (black arrows). As long as there is some sort of lower timeframe selling confirmation alongside the retest, we’ll jump in short, targeting 0.9600, followed closely by 0.9577 – a 4hr Quasimodo support barrier.

Levels to watch/ live orders:

- Buys: Flat (Stop loss: N/A).

- Sells:Watch for bids to be consumed around 0.9670 and then look to enter on any retest seen at this number (confirmation required).

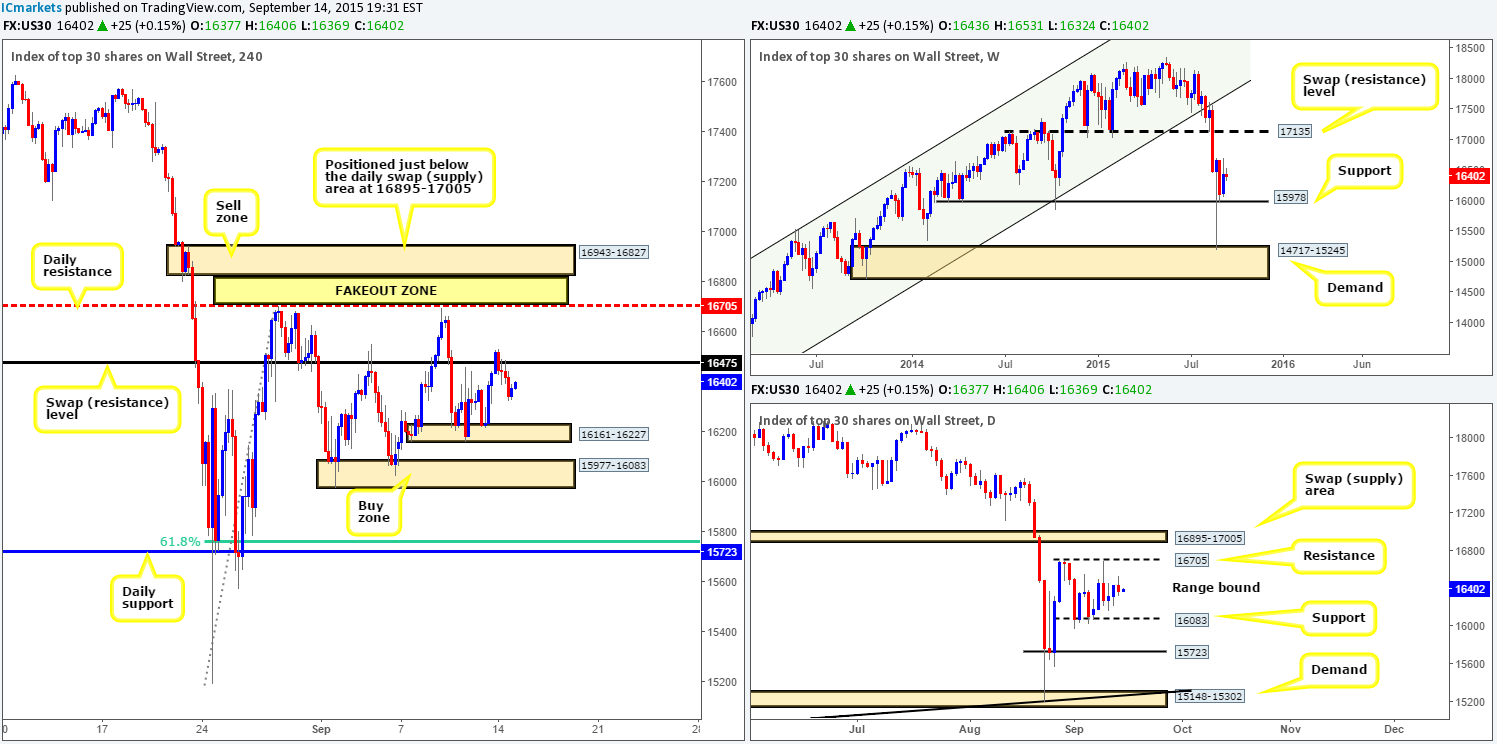

DOW 30:

Immediately after the DOW index opened (16436) price was bid north, driving into a 4hr swap resistance level at 16475. However, not long after this candle closed, price sold off (effectively forming an 8hr bearish pin candle [two 4hr candles combined]), reaching lows of 16324 on the day.

All in all, the overall structure of this market has not really changed. As such, much of the following analysis will remain similar to the previous…

Should this market continue selling off during today’s trade, we may see price connect with bids sitting around a 4hr demand base at 16161-16227. Due to the amount of times this zone has been hit though, we perceive this area to be weak, thus we’d be eyeing the 4hr demand zone below it at 15977-16083. At this point, you may be wondering why choose this area since it has also been visited (16024 – 04/09/15) and could be just as weak. We agree it could be. However, what we like about this barrier is the fact that it is collectively made up of not only a weekly support at 15978, but also a daily support seen at 16083. As such this would be an area we’d consider buying from this week.

Supposing that 16475 is attacked once again today, and this time taken out, this may not only entice further buying back up to the daily resistance level at 16705, but could also give traders the chance to go long on any retest seen. Beyond the daily resistance line, we’d also be looking at a very compact 4hr supply zone coming in just above it at 16943-16827, which is neatly placed just below a daily swap (supply) barrier at 16895-17005. This is a perfect little sell zone, since the daily resistance level is lurking just below it where the majority of traders will be looking to sell at. The big boys know this and also know there will be a ton of buy stops above this daily barrier. Therefore, do keep an eye out for a potential short within the yellow fakeout zone between these two areas this week to sell into all those stops!

Levels to watch/ live orders:

- Buys:15977-16083 [Tentative – confirmation required] (Stop loss: depends on where one confirms this area) Watch for offers at 16475 to be consumed and then look to enter on any retest seen at this number (confirmation required).

- Sells:16943-16827[Tentative – confirmation required] (Stop loss: depends on where one confirms this area)

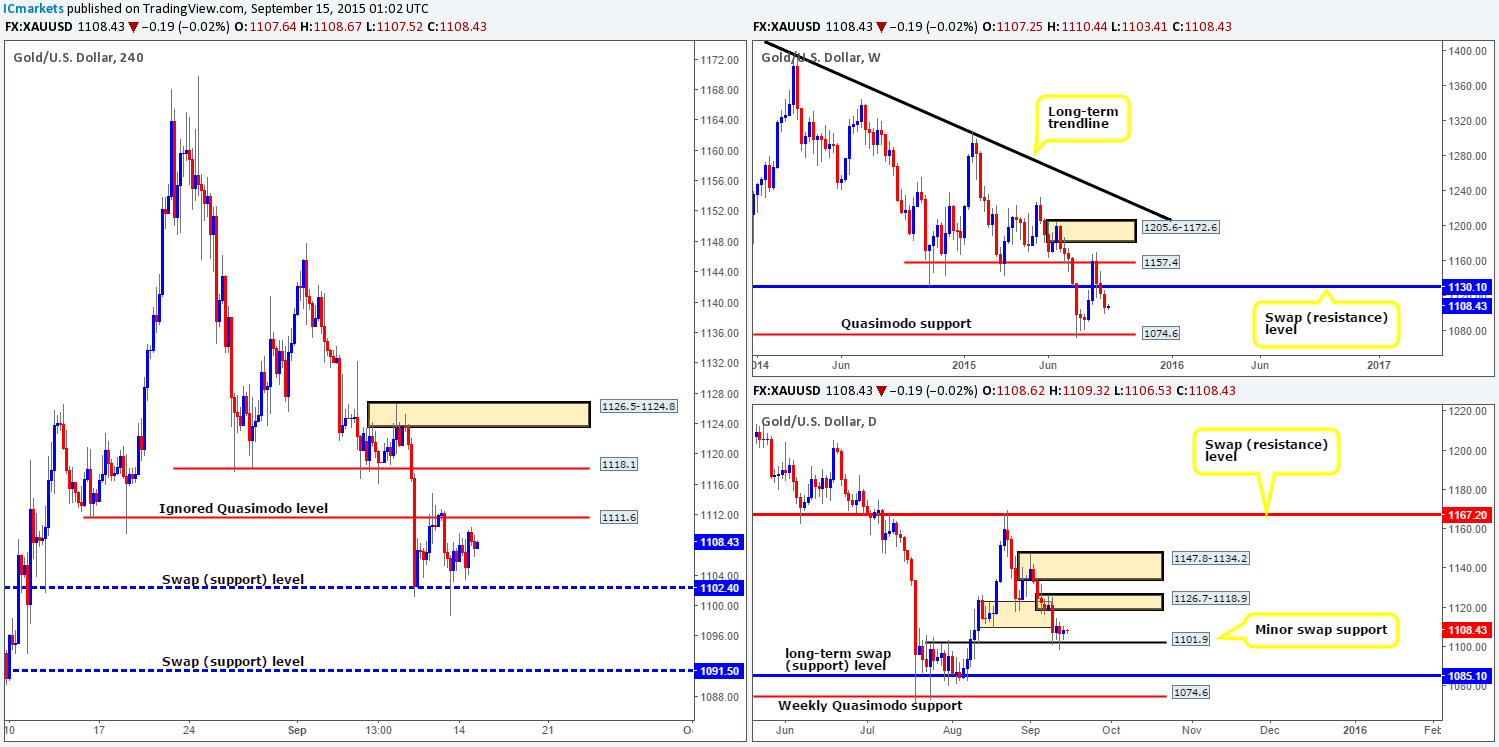

XAU/USD: (Gold)

Little action was seen after the Gold market opened at 1107.2. Session highs were recorded at 1110.4 and lows at 1103.4, which, if you look across to the daily chart you’ll see somewhat of an indecision candle formed as a result.

With weekly price showing room to continue trading lower down to at least 1074.6, and the daily chart showing supportive pressure from a minor swap support barrier at 1101.9, where do we go from here?

As you can see, there is still relatively mixed signals coming in from the higher timeframe structures and not much has changed on the 4hr timeframe since we last analyzed this instrument. Therefore, much of the following analysis will be similar to our previous report…

We are still going to be closely watching both the ignored 4hr Quasimodo level at 1111.6 and the 4hr swap support barrier at 1102.4this weekfor potential (confirmed) trades. A cut above 1111.6, nonetheless, would likely offer two things. Firstly, we believe it would set the stage for a continuation move north up to a 4hr swap resistance level at 1118.1 (located close to daily supply at 1126.7-1118.9). Secondly, it may provide an opportunity to trade long should price retest 1111.6 as support (waiting for confirmation here is highly recommended). On the flip side, in case 1102.4 is engulfed, the river south should be ‘ripple free’ down to at least the 4hr swap support at 1091.5. For us to be given the green light to short following a close lower, however, we’d need to see price retest this level as supply together with lower timeframe selling confirmation.

Levels to watch/ live orders:

- Buys: 1102.4 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) Watch for offers at 1111.6 to be consumed and then look to enter on any retest seen at this number (confirmation required).

- Sells: 1111.6 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this level) Watch for bids at 1102.4 to be consumed and then look to enter on any retest seen at this number (confirmation required).